20% of Insured Americans Struggle with Paying Medical Bills

A survey from the Henry J. Kaiser Family Foundation and The New York Times shows that one in five people who are enrolled in health insurance face difficulties with paying their healthcare bills.

- A new report from Rice University’s Baker Institute for Public Policy and the Episcopal Health Foundation (EHF) shows that 3.8 percent fewer Texans found problems paying their medical bills in September 2015 when compared to the results from September 2013.

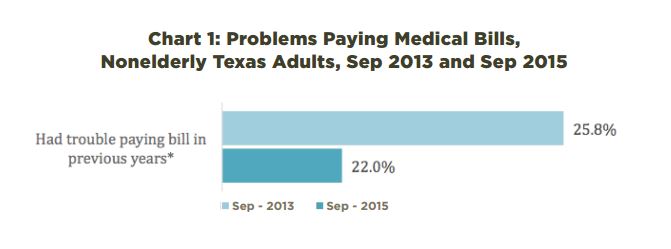

This slight drop in medical bill issues comes soon after the Affordable Care Act was implemented, according to a press release from Rice University. The study found the same results where problems paying medical bills dropped from 25.8 percent in 2013 to 22 percent in 2015 across all income levels and health insurance availability.

“The fact that Texans had fewer problems paying their medical bills in 2015 is good news,” Vivian Ho, the chair in health economics at Rice’s Baker Institute and director of the institute’s Center for Health and Biosciences, said in a public statement.

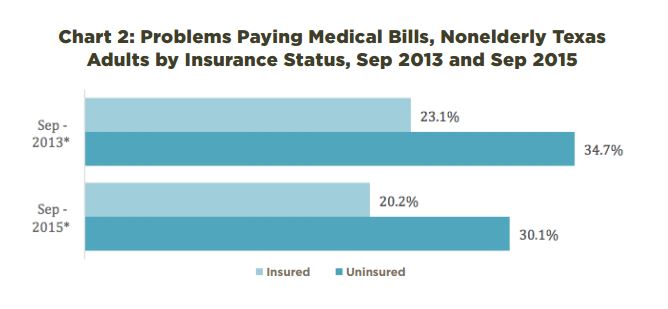

“One reason fewer Texans are having problems paying medical bills is because more Texans now have health insurance. However, one in five Texans still has problems affording health care. And it’s no surprise our data show the uninsured and those with lower incomes continue to struggle paying those bills more than anyone else.”

The Health Reform Monitoring Survey focused on healthcare coverage, access to medical care, self-reported health status, affordability of medical services, and general use of the healthcare industry throughout the state of Texas.

In 2015, 30 percent of uninsured Texans report problems with managing their healthcare costs, which is down from 35 percent in 2013. Additionally, those without health insurance were more likely to bypass most medical services including prescription drugs, specialist care, and primary care.

However, in 2015, less uninsured people missed receiving medical care than the rates from 2013. It is possible that, since more people in Texas received insurance coverage by 2015, there were additional charitable medical services available to the uninsured.

“On the whole, uninsured Texans reported fewer problems with affording health care in 2015,” Elena Marks, EHF’s president and CEO, and a nonresident health policy fellow at the Baker Institute, said in a public statement. “While our data doesn’t explain exactly why that is happening, the Texas economy improved during that time, which might have helped the uninsured pay for care.”

Currently, the state of Texas has 115 Medicaid waiver projects taking place and this may have also brought more healthcare services to individuals who lack health coverage.

However, Texans with the lowest income reported to skipping primary care, prescription drugs, and dental care in much larger numbers than those with the highest income.

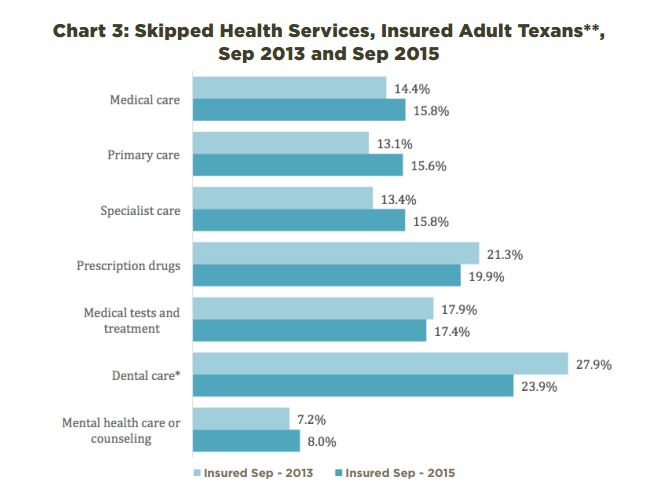

Across all socioeconomic groups, dental care was the least likely one people pursued due to its costs. In fact, nearly 24 percent of insured adults missed dental care in 2015, which was a drop from the 27.9 percent from 2013.

“The connection between oral health and overall health is well-documented, yet we often regard dental care as ‘extra’ rather than essential,” Marks clarified. “Most plans, including in the ACA marketplace, offer dental care coverage as only an ‘add on.’”

In addition to the lack of dental care usage in Texas, nearly 20 percent of those insured in 2015 are skipping prescription drugs. About 15 percent of insured individuals are missing primary care and specialist care.

Along with the results from Rice University’s Baker Institute, a survey from the Henry J. Kaiser Family Foundation and The New York Times shows that one in five people who are enrolled in health insurance face difficulties with paying their healthcare bills.

The survey found that more than half – 53 percent – of individuals without healthcare coverage find paying their medical bills challenging. Interestingly, the poll found that nearly identical numbers between those with insurance (44 percent) and those without (45 percent) claim the medical bills had a large impact on the life of their family members.

There are a wide variety of financial issues that stem from having difficulty paying medical bills, the survey shows. This includes delaying vacations or large household purchasing decisions (77 percent), spending less funds on groceries and household items (75 percent), and taking all or most of their financial savings to cover the costs of medical bills (63 percent).

The survey also uncovered that 38 percent enlarged their credit card debt to pay medical bills while 37 percent borrowed money from family or friends. Smaller proportions changed their living situation at 14 percent and even less pursued charity options (11 percent).

Out of all insured individuals with medical bill problems surveyed, 75 percent stated that the amount they had to pay for deductibles, co-pays, or co-insurance were “more than they could afford.”

While the state of Texas may be seeing better results when it comes to paying medical bills, many throughout the rest of the nation are still experiencing significant struggles with paying for their medical care.