4 Steps Toward Reforming the Medicare Program, Lowering Costs

At this moment in time, the Medicare program takes on 20 percent of healthcare spending around the country and covers the medical costs of more than 50 million beneficiaries.

- The Medicare program will need to be reformed in order to account for the rising costs of running this major public health plan.As the baby boomer population gets older and more retired Medicare beneficiaries enter the system, the costs of operating the Medicare program becomes unsustainable.

A report from the National Center for Policy Analysis (NCPA) provides four potential solutions for reforming the Medicare program, according to an NCPA press release. One solution is to increase the cost of premiums among Medicare beneficiaries in order to account for the the growth in spending.

A second option for redesigning the Medicare program is to raise the prices of deductibles and out-of-pocket costs. This would limit Medicare spending to a baseline forecast, according to the report.

A third option is for the Medicare program to offer the federal payment rates to Medicare beneficiaries for their health care services instead of directly to the providers. This would potentially lead seniors to demand lower prices for medical care, says the report.

Additionally, the NCPA suggests that, in order to restrain the cost growth within the Medicare program, it would be beneficial to ensure that premium support payments rise at the same rate as the per-capita gross domestic product. These four suggestions would bring the taxpayer burden into the same rate as the growth of the GDP.

At this moment in time, the Medicare program takes on 20 percent of healthcare spending around the country and covers the medical costs of more than 50 million beneficiaries, NCPA reports. The total spending for this program has grown significantly over the last 50 years.

As it currently operates, the Medicare program tends to increase the tax rates on each generation to cover the medical expenses of each prior generation. This payment system is clearly unsustainable.

“From the perspective of the working population, changes in the benefit structure of Medicare is a two-sided coin,” the NCPA report stated. “On one side is the fact in their future that Medicare will cover less and less of their senior healthcare. Thus, Medicare spending will be shifting to greater reliance on beneficiaries and less reliance on taxpayers. Reform is about finding feasible options to shift Medicare spending from taxpayers to beneficiaries while ensuring access to improving technology. The other side of future lower taxpayer-funded Medicare is that the tax burden for current workers will be lower.”

Additionally, the NCPA predicts that Medicare spending will rise from 3.53 percent to 6.02 percent of (GDP) over the next 75 years. Some potential reasons for the growth in Medicare spending may be due to new technological advancements that have led to a rise in cost and demand for better patient outcomes.

Ever since the Affordable Care Act was passed and other healthcare reforms were implemented, there has been a greater stress to reduce federal healthcare dollars and this new proposition is no different. There will need to be some serious changes in order to keep Medicare spending from growing exponentially over the next several decades.

“One of the goals of the Affordable Care Act and of the majority of Medicare reform proposals has been to reduce or eliminate excess cost growth as it applies to federal spending,” NCPA Senior Fellows Andrew J. Rettenmaier and Thomas R. Saving stated in the press release. “Without significant changes in the current program, it is not realistic to think that federal Medicare spending per capita can be constrained to grow at the same rate as per capita GDP.”

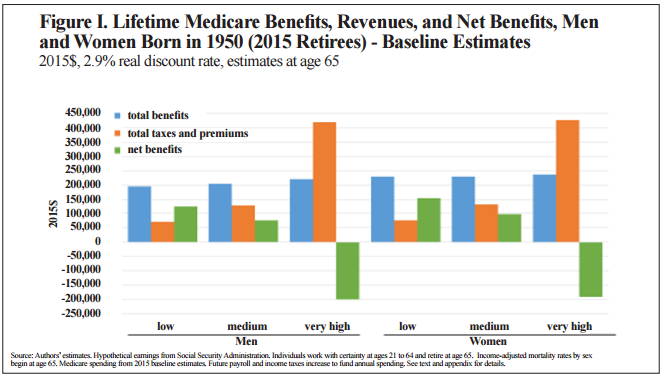

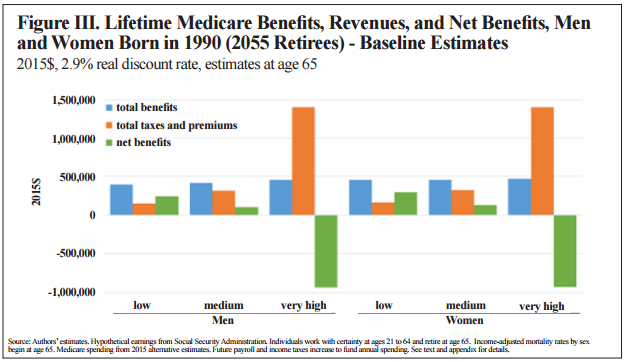

The report from NCPA looked at how the generations differed in terms of lifetime benefit within the Medicare program. Those medium-earning workers born in 1950 and retiring in 2015 have Medicare net benefits ranging from $77,000 to $98,000. For the generation born in 1990 and retiring in 2055, the costs of their tax rates rose much more quickly than the prior generation but their net benefits stayed in the green.

Essentially, the report from the NCPA argues that it is vital to keep the taxpayer-funded part of the Medicare program to the same rate as per-capita GDP in order to keep Medicare spending at reasonable standards.

Some issues found by the NCPA experts is that beneficiary cost-sharing has dropped over the last 30 years from 25 percent to little more than 10 percent. The federal government today gears toward reducing excess cost growth within the Medicare program and these propositions could be a useful step toward this goal.

The future of the healthcare industry depends upon effectively financing the costs associated with treating the elderly population. The federal government will need to develop new solutions for reforming the Medicare program.

Dig Deeper:

Did the Affordable Care Act Lower Medicare Spending?

Medicare Advantage Plans Decrease Avoidable Hospitalizations