Affordable Care Act Marketplace Consumers Face Fewer Choices

New research shows that fewer payers will be participating on the Affordable Care Act's marketplace next year.

- A hefty number of health insurance companies have been dropping out of the Affordable Care Act’s state exchanges in recent months including Humana, Aetna, and UnitedHealthcare. These actions would leave fewer health plans to choose from among low-income consumers who lack access to employer-sponsored coverage. What does the future hold for the Affordable Care Act with regard to the stability of the health insurance exchanges?

Several analyses attempt to answer that question. Stemming from the Henry J. Kaiser Family Foundation, one report found that there will be far fewer health payers participating in the exchanges in 2017 as compared to 2016.

However, the report also clarifies that there is still plenty of information lacking regarding the regions that will be affected by the more recent announcement from Aetna about its decision to leave a number of Affordable Care Act state exchanges. More information should be available when the open enrollment period for 2017 comes closer.

The number of enrollees that will have access to three or more options for health plans will drop to 62 percent in 2017, according to the Kaiser Family Foundation analysis. This would be a 23 percent drop from the 85 percent of consumers with three or more options seen in 2016.

As many as 2.3 million individuals or 19 percent of marketplace enrollees could have access to only one health plan option in 2017, the analysis predicts. The ongoing drop-out rates among payers may bring an additional 2 million consumers as compared to 2016 facing only one coverage option next year.

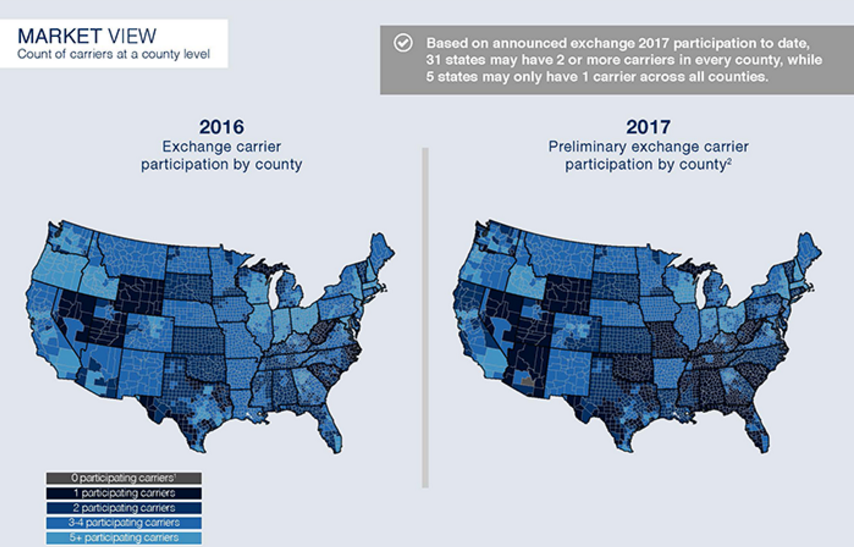

An analysis completed by the McKinsey Center for The New York Times Upshot shows a similar percentage of policyholders facing few healthcare coverage options next year. The results claim that 17 percent of Americans obtaining coverage through the Affordable Care Act marketplace will have only one health payer offering plans in their region.

“It’s important to have competition in the exchange markets, both to have consumer choice and to keep premiums competitive,” Caroline Pearson, a Senior Vice President at Avalere Health, told the news source.

There will be at least five states facing only one health payer to offer health plans to individuals and families ineligible for employer-sponsored coverage. This could create a potential monopoly on the Affordable Care Act exchanges operating in these states.

This is a major change from last year where only 2 percent of consumers faced this type of monopolized health insurance marketplace. This means that premiums and out-of-pocket costs may increase even further on the exchanges.

“HHS and other advocates have said, ‘don’t worry about the double-digit premium increases if you have premium subsidies if you’re low income and cost-sharing subsidies as well. Taxpayers will pick up the bill for those cost increases.’ In other words, if your premium was about $290 per month and you were at 200 percent of the federal poverty level, you’d only spend about $107 per month for premiums,” Joel White, President of the Council for Affordable Health Coverage, told HealthPayerIntelligence.com.

“That’s true,” White acknowledged. “Congress enacted the law to provide premium subsidies. What they’re not saying though is that those costs don’t evaporate. They don’t go away. They get shifted onto taxpayers and taxpayers then pay the costs of those subsidies. A better strategy is not cost-shifting. It’s not a good cost containment strategy. Cost reduction is a good cost containment strategy.”

However, there are still several weeks before health insurers finalize their 2017 contracts with the federal government, which means some payers may still choose to expand their coverage and thereby change the competitiveness of the Affordable Care Act’s exchanges.

“A number of steps remain before the full picture of marketplace competition and prices are known. Regardless, we remain confident that the majority of marketplace consumers will have multiple choices and will be able to select a plan for less than $75 per month when Open Enrollment begins Nov. 1,” Marjorie Connolly, a spokeswoman for the Department of Health and Human Services, told The New York Times.

While there are definitely problems on the horizon for the Affordable Care Act and the future potential of the health insurance exchanges, the benefits of the landmark healthcare law are also worth noting.

Findings from Gallup illustrate how the Affordable Care Act has brought the uninsurance rate to drop significantly over the last several years. The individual mandate requiring all Americans to have healthcare coverage or else pay a fine likely played a role in increasing the insurance rate around the country. Gallup stated that the uninsured rate hit 17.3 percent in 2013 and has dropped to 10.8 percent in 2016. This means that more than 16 million Americans gained healthcare coverage since 2013.

The Gallup findings outline that low-income Americans including minorities and young adults have seen the greatest decline in their uninsurance rate since the Affordable Care Act was implemented. Medicaid expansion has also assisted with these achievements.

New regulatory actions may need to be taken in the near future in order to minimize the effects of a monopoly in certain public health insurance exchanges. The federal government will need to decide whether investing in a public option is worthwhile or whether other modifications to the Affordable Care Act are necessary.

Image Credits: McKinsey Center