Affordable Care Act Reduced Uninsurance Rate to 8.6% in 2016

During the first three months of 2016, the uninsured rate in the country dropped to 8.6 percent due to Affordable Care Act provisions.

- The latest data from the National Center for Health Statistics shows that the uninsurance rate during the first three months of 2016 has decreased to 8.6 percent, or 27.3 million Americans, thanks to the continued impact of the Affordable Care Act.

This is a drop of half a percentage point from 2015 when the Affordable Care Act led to 9.1 percent of Americans remaining uninsured, as reported by the Centers for Disease Control and Prevention. Looking back even further, the statistics show that the uninsurance rate was 10.4 percent in 2014, according to a report from the United States Census Bureau. While the Affordable Care Act may have taken away some safeguards from health insurance companies such as requiring payers to cover those with pre-existing conditions, the health insurance industry can’t decline that the number of consumers for this field has ballooned over the last several years.

“According to this morning's news release from the Census Bureau, 29 million people in the US were uninsured in 2015, 4 million fewer than in 2014,” Helen Levy, Research Associate Professor at the Institute for Social Research, University of Michigan, said in a statement.

The uninsured rates have dropped due to both Medicaid expansion and a rise in "direct-purchase private insurance" through the health insurance exchanges, which are all key aspects of the Affordable Care Act, explained Levy.

In addition, the uninsured rate at this point is "at a historic low" when looking at data that goes back as far as the 1960s, Levy added.

“The number of uninsured in 2014 and 2015 were both far smaller than the 42 to 50 million people without health insurance in each year from 2008 to 2013,” Levy continued. “Further implementation of Affordable Care Act provisions, such as Medicaid expansion for low-income adults in the 19 states that have so far rejected this option, would reduce the number of uninsured even further.”

Actually, the number of Americans that have gained healthcare coverage since 2010 tops out at 21.3 million. Health payers will need to pay attention to the general trend of more Americans gaining healthcare coverage and the uninsurance rate dropping.

The sharp increase in insurance rates is important for health insurance companies to consider when preparing for future enrollment periods. The sheer number of people who have gained coverage brings more in premiums for payers, but health insurance companies will also need to remain vigilant in assisting these large numbers of customers with their healthcare needs, managing the costs associated with high-risk populations, and keeping benefits favorable for their incoming consumers.

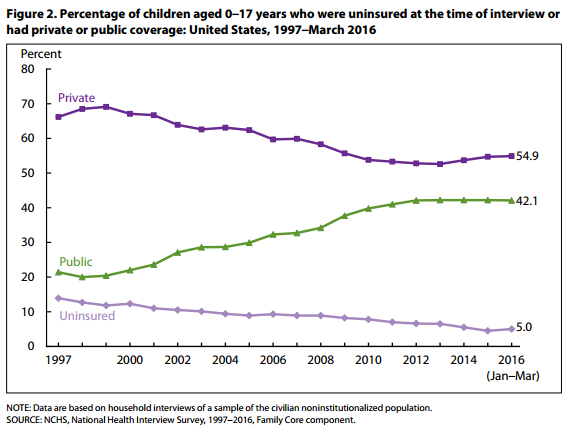

The percentage of children without health insurance under age 19 fell to 5.3 percent in 2015, which is almost a full percentage point lower than in the prior year. In the first quarter of 2016, only 5 percent of children remained uninsured.

For minority groups, the uninsured rate in 2015 was 11.1 percent among African-Americans, 7.5 percent among Asians, and 16.2 percent among Hispanics.

“In the first 3 months of 2016, 24.5 percent of Hispanic, 13.0 percent of non-Hispanic black, 8.4 percent of non-Hispanic white, and 6.7 percent of non-Hispanic Asian adults aged 18–64 lacked health insurance coverage at the time of interview,” the report from the National Center for Health Statistics stated. “Significant decreases in the percentage of uninsured adults were observed between 2013 and the first 3 months of 2016 for Hispanic, non-Hispanic black, non-Hispanic white, and non-Hispanic Asian adults. Hispanic adults had the greatest percentage point decrease in the uninsured rate between 2013 (40.6 percent) and the first 3 months of 2016 (24.5 percent).”

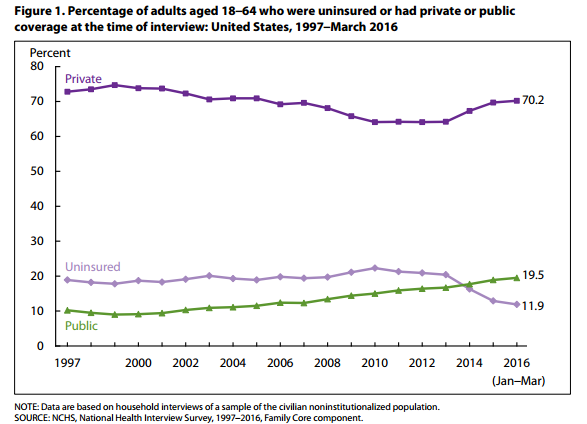

To go deeper into the latest data from the National Center for Health Statistics, 11.9 percent of adults between the ages of 18 to 64 lacked healthcare coverage.

The results also illustrate that consumers are choosing the high-deductible health plans that more payers are emphasizing. In 2010, 25.3 percent of people under 65 years of age with private insurance had purchased high-deductible health plans.

This percentage went up to 36.7 percent in 2015 and now stands at 40 percent in 2016. While these type of plans have lower premiums, consumers are left with more out-of-pocket costs when choosing this coverage option.

The Affordable Care Act requires payers to cover preventive care, eliminate pre-existing condition clauses, and allow young adults to stay on their parents’ health plans until age 26. Private payers have used high-deductible health plans to counter the financial losses from insuring patients with complex health needs and keeping young beneficiaries in lower-cost options for longer as a way to maintain higher levels of revenue.

Many consumers may be purchasing high-deductible plans through their employers. In a survey of 500 corporations conducted in early 2016, 52 percent of employers said they are now offering high-deductible health plans.

More employers are jumping on the bandwagon and sponsoring high-deductible health plans in order to offer healthier employees low-cost coverage options. The survey results showed figures similar to the National Center for Health Statistics: forty-one percent of employees polled are choosing high-deductible health plans instead of HMOs or PPOs.

Dig Deeper:

How the Affordable Care Act Changed the Face of Health Insurance

How Payers Could Succeed in ACA Health Insurance Exchanges