Bundled Payment Model, Lump Sum Insurance Plans Make Headway

The bundled payment model could be used to improve care coordination between facilities, create more efficiencies in cancer screenings, and reduce hospital readmission rates.

- As the healthcare industry especially the medical insurance space continues to seek methods for reducing ever-increasing costs, the bundled payment model shows more promise for payers and providers alike. The Centers for Medicare & Medicaid Services (CMS) were one of the first to jump on the bandwagon and are now moving forward with bundled payments for joint replacement.

In fact, CMS seeks to position 30 percent of all Medicare fee-for-service payments toward an alternative reimbursement method such as the bundled payment model in 2016 and 50 percent of these payments by 2018. Providing a lump sum for specific healthcare services offered over a limited period of time is expected to improve efficiency and quality of care for Medicare beneficiaries.

The bundled payment model could be used to improve care coordination between medical facilities, create more efficiencies in cancer screenings and treatment, reduce hospital readmission rates, prevent disease, and put an end to duplicative testing. By achieving these goals, both providers and payers will be able to cut healthcare costs across the board.

Along with the bundled payment model, a lump sum insurance policy is also becoming a more popular option for individuals who are diagnosed with a serious illness such as cancer or heart disease, according to Kaiser Health News. Employers and companies are bringing these lump sum insurance plans to their employees in order to protect them from high deductibles and extensive out-of-pocket costs.

The results show that 45 percent of employers with 500 or more employees offered these type of health insurance plans in 2015, which is a rise of 11 percent from a survey completed in 2009. Additionally, some employers are now helping their workers out with covering some of the monthly premium costs.

“What we have seen is a very clear and steady rise in the number of employers offering high-deductible plans,” Barry Schilmeister, a principal in the health and benefits practice at the consulting company Mercer, told the news source. “More employers are looking at the reality of pulling back on the value of health plans but looking to offer something else that would make people feel a little more comfortable about taking on that additional risk.”

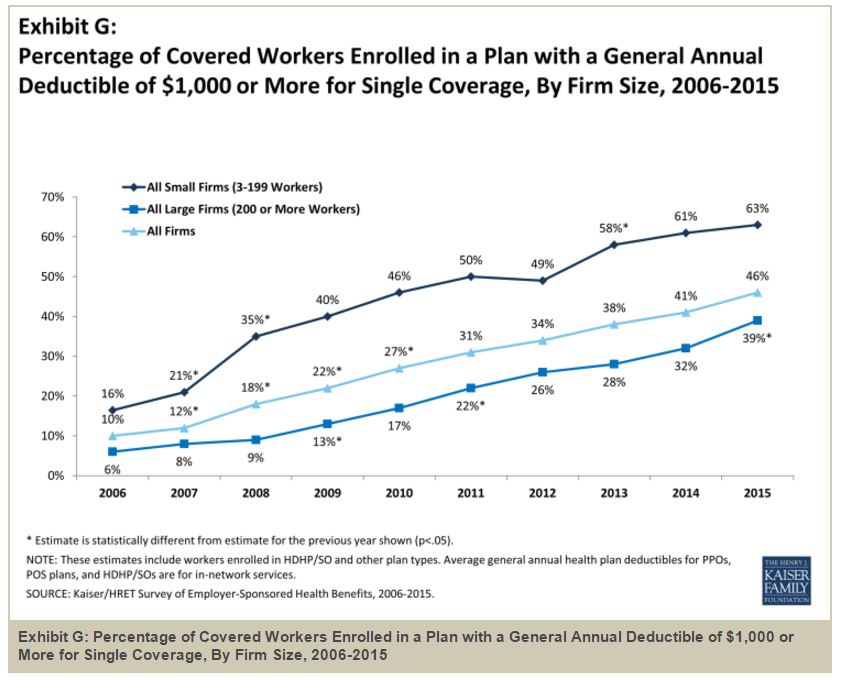

Based on results from the Kaiser Family Foundation’s annual survey of employer-sponsored health insurance, 46 percent of insured employees had a deductible of at least $1,000 last year.

“Most covered workers face additional out-of-pocket costs when they use health care services. Eighty-one percent of covered workers have a general annual deductible for single coverage that must be met before most services are paid for by the plan. Even workers without a general annual deductible often face other types of cost sharing when they use services, such as copayments or coinsurance for office visits and hospitalizations,” the survey stated.

“Among covered workers with a general annual deductible, the average deductible amount for single coverage is $1,318. The average annual deductible is similar to last year ($1,217), but has increased from $917 in 2010.”

These critical illness insurance policies offer a lump sum of funds for consumers who experience a stroke or are diagnosed with kidney failure, cancer, or heart disease as well as those in need of an organ transplant, Kaiser Health News reported.

Some employers offer a policy that covers employees only in the case of a cancer diagnosis. The amount employees receive if they become ill with one of the covered medical conditions is typically, on average, approximately $15,000.

Statistics show that the average annual premium cost for at least $25,000 worth of coverage was $283. The critical illness insurance policies can be used to cover costs besides general medical treatment and prices of prescription drugs. This may include travel costs, medical leave from work, extra costs associated with out-of-network doctors or hospitals.

However, since these plans are not primary health insurance policies, they do not abide by some of the regulations set forth in the Affordable Care Act and a consumer who has had a pre-existing condition may not be able to have that particular illness covered by the lump sum insurance plan.

Additionally, these insurance policy options may not cover every type of cancer or other disease and others may only provide partial pay-outs, Kaiser Health News mentioned. Minnesota Public Radio also reported on the benefits of lump sum insurance policies, especially due to the fact that medical bills seem to be a leading cause of personal bankruptcy. This may be a main reason for greater popularity of the critical illness insurance plans, which cover the costs of medical needs that other traditional plans do not.

“It’s just a protection while you're still alive, to kind of relieve some of that financial burden,” Ashley Ostrowski, a Woodbury insurance agent selling critical illness policies, told the news source. “What we like to refer to critical illness insurance is basically life insurance for the living.”

Many who have high deductible plans are struggling to pay out-of-pocket costs when dealing with a serious illness and this may be an option to prevent the issues associated with high medical bills.

“More employers are moving to high-deductible health plans as a way of reducing their overall employee benefit costs and as a result of that it’s putting more financial burden on employees,” Gary Harger, UnitedHealth's Vice President for Voluntary Benefits, told the source.

While the health insurance industry progresses toward adopting the bundled payment model and other value-based care payment reforms, fee-for-service remains the most common payment methodology within the field. As such, consumers are faced with high deductible plans and critical illness insurance may be a way out of paying for extensive out-of-pocket costs.

Image Credits: Henry J. Kaiser Family Foundation