Healthcare Affordability Difficult for Marketplace Consumers

Healthcare affordability is still an issue for approximately 33 percent of people who have coverage through the exchanges.

- Healthcare affordability remains a top issue throughout the United States. The Henry J. Kaiser Family Foundation released a brief discussing how many Americans still have difficulty with healthcare affordability since the price of premiums and out-of-pocket costs are continually rising.

The researchers classified healthcare affordability challenges specifically as difficulty with paying monthly health insurance premiums.The typical characteristic of individuals who could not afford their monthly premium include having income below 250 percent of the poverty level, which 60 percent of those polled exhibited.

Additionally, about half of those stating healthcare affordability challenges in the survey had dependent children. Only 16 percent of those who had no difficulty paying their medical bills polled in the study were parents with dependent children.

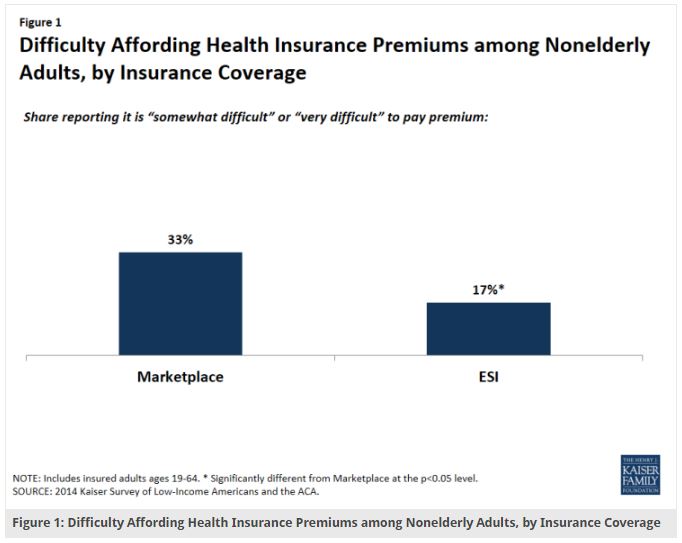

When you look at private health insurance, 25 percent of adults find it challenging to cover the cost of premiums, deductibles, and out-of-pocket spending. The Patient Protection and Affordable Care Act has brought health insurance coverage to millions of Americans through the health insurance exchanges. However, the study from the Kaiser Family Foundation shows that healthcare affordability is still an issue for approximately 33 percent of people who have coverage through the exchanges.

The results also showed that 36 percent of people with marketplace coverage are dissatisfied with their deductibles. On the side of employer-sponsored health insurance, Only 17 percent have had the same issues with the cost of their monthly premiums.

Often, those who had trouble with covering medical insurance costs were facing financial insecurity in other areas of their life. In addition to financial insecurity, those who had difficulty paying their medical bills or insurance costs were more likely to have used healthcare services recently than those who reported no healthcare affordability challenges.

About 67 percent of those who had trouble paying their medical bills had seen a doctor for a specific medical condition while more than 50 percent stated having received preventive medical services and six out of ten were assigned a prescription drug.

“While the implementation of new coverage options under the Affordable Care Act has led to unprecedented gains in health insurance coverage in the past two years, the reliance on private insurance with premiums and cost sharing means that affordability of coverage continues to be a problem for some consumers,” the Kaiser Family Foundation report stated.

“Developing strategies to address and improve the affordability of coverage for those enrolled in plans in the Marketplaces are necessary to maintaining the coverage gains achieved to date. Although the policy levers to lower costs for those in the Marketplaces beyond the premium tax credits and cost sharing reductions already available are limited, improving consumers’ health literacy around health insurance concepts and the balance between the monthly premium and the annual deductible may help to alleviate some of the problems that are contributing to the financial challenges consumers are facing.”

In the midst of the ongoing obstacles related to the Affordable Care Act and health insurance coverage, a federal district court judge has sided with House Republicans ruling that the Obama administration does not have the right to provide cost-sharing reductions to low-income families and individuals. The reasoning is due to the fact that Congress did not approve this particular funding source.

The cost-sharing reductions were given to people with incomes between 100 percent and 250 percent of the federal poverty level and enrolled in silver health plans. This court case will continue to move through an appeals process.

In the meantime, if the ruling stands, it would be a significant problem for the future of the health insurance exchanges and the Affordable Care Act, as it would limit the number of Americans who could afford health coverage as well as reduce access to medical care.

It is also key to remember that it would negatively impact health insurance companies, as a study from the Urban Institute found that payers would have to raise the cost of silver plan premiums by more than $1,000. This means that consumers would be unable to continue affording coverage and many would be forced to drop their policies. Payers would be left with fewer consumers and greater financial loss.

“Obamacare authorizes the Department of Health and Human Services (HHS) to pay health insurers, compensating them for the value of those cost-sharing reductions,” Institute for Policy Innovation (IPI) resident scholar Dr. Merrill Matthews said in a public statement. “However, the law did not provide funding for those payments and Congress has never approved that funding separately. There are no constitutionally appropriated funds to send to the health insurers.”

“By law, health insurers must still provide the cost-sharing breaks; but they won’t receive their federal reimbursements until the situation is resolved. So it is the insurers that are harmed by the decision.”

“And though the judge stayed her decision pending appeal, it’s a fair question as to how long health insurers can continue to provide the cost-sharing discounts unreimbursed,” Matthews concluded.

The federal government, health payers, and medical establishments will need to continue working together to lower costs of care for the consumer and find solutions to healthcare payment reform.

Dig Deeper:

Consumer Engagement Vital in Health Insurance Exchanges

Risk Adjustment Affects Plans on Health Insurance Exchanges