Indiana, Florida Approve Anthem, Aetna Health Insurance Mergers

Even though a significant number of states have approved these health insurance mergers, there are specific issues that stem from the acquisitions that could elongate or even harm the approval process.

- The major health insurance mergers taking place between Anthem-Cigna and Aetna-Humana have shown some progress of late. Recently, the Indiana Department of Insurance approved the acquisition between Cigna and Anthem, according to a press release from Anthem.

Indiana Department of Insurance Commissioner Stephen W. Robertson released the Final Order last month that approves this particular merger. Last year, on July 23, 2015, the two health insurance companies came to an agreement where Anthem would acquire shares of Cigna through a cash and stock purchase.

So far, the health insurance merger has received approval throughout 12 states to proceed with the agreement. Over the last eight months, Anthem has been working with state regulators to move this merger through without any issues regarding an impact on competition between payers.

The release notes that this particular health insurance merger has been approved by more than 99 percent of Cigna and Anthem shareholders. The two major health insurance mergers are truly making headway as state regulators have been in favor of moving ahead with the acquisitions.

Several months ago, the state of Florida also approved the Aetna-Humana merger, according to a news release from Aetna. So far, Aetna has gained half of the state regulatory approvals it needs. The health insurance company has gained 10 out of 20 necessary approvals.

“Florida’s evaluation was based on a thorough review of the competitive environment in the state. We are pleased that in its review, the OIR recognized how traditional Medicare competes with Medicare Advantage plans, and that consumers have robust choice in a competitive landscape,” the statement from Aetna declared.

“As we consider our future presence on the exchange, we will look for opportunities to expand into communities where we can give consumers a valuable offering at an affordable cost.”

“We continue to cooperate with the Department of Justice as it continues its review. It is possible that the Department of Justice will require divestitures in some geographies, which is a standard tool as part of its approval processes. If divestitures are required, there are competitors in good standing that are able to provide consumers with options.”

Even though a significant number of states have approved these health insurance mergers, there are specific issues that stem from the acquisitions that could elongate or even harm the approval process. For example, the Justice Department and Federal Trade Commission has in recent history opposed mergers that would create harm to competition on a national level such as the American Airlines and US Airways agreement, according to Bloomberg.

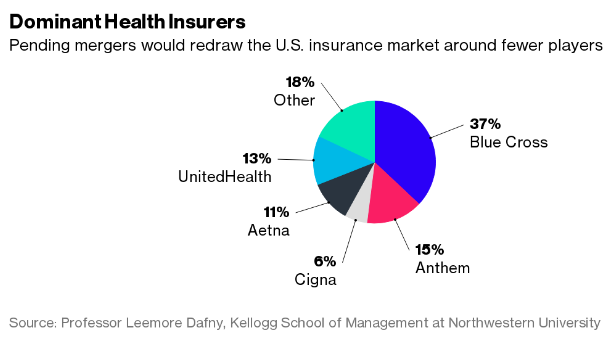

Currently, the Justice Department is looking at how these impending health insurance mergers would touch competition on both a local and a national level. By merging four of the top five payers into two companies, there would definitely be fewer insurers with regard to consumer choices.

At this point in time, all four payers are pushing the federal government to focus on local competition instead of national, which could bring regulatory and legal issues from antitrust regulators. It's possible that the antitrust division will consider the national impact of these major health insurance mergers and refuse to allow the acquisitions to take place.

“This Justice Department does not simply accept that, because in the past, in certain industries, they’ve focused on local markets that’s how all future deals should be viewed,” Mark Ryan, a lawyer at Mayer Brown in Washington, told the news source. “As industries evolve, they’re willing to ask whether there is another market, a national market that we should be evaluating.”

When it comes to the health insurance mergers, the state of Connecticut has recently come under fire, according to the International Business Times. Officials from the state have refused open record requests regarding their interviews with Cigna and Anthem. The state officials also mentioned that any information about the impending merger that wasn’t already made public will remain confidential.

There has been scrutiny over whether Democratic Governor Dannel Malloy is partaking in unfair practices by appointing Katharine Wade who had been a Cigna lobbyist and even has family ties with the insurance company. Due to the decision of Malloy’s administration to block certain documents about the merger from being made public, many have criticized the governor for lacking much-needed transparency when it comes to major health insurance mergers.

“When you start to go down the road where you have significant connections to a major issue, and there is a company with which you [were] formerly and your spouse is currently employed, now that raises a different specter, now there are some bona fide concerns,” State Senator Kevin Kelly told the news source.

“It really does raise the specter as to whose interest is really the administration is protecting through Commissioner Wade? Are we protecting the corporate interests and basically those of the 1 percent, or are we protecting everyday middle-class Connecticut citizens who are consumers of insurance products?”

As the approval process for these health insurance mergers continues making its way through state and federal regulatory agencies, the future of the health insurance industry will likely be decided based on whether or not these mergers affect competition on a national level. It is vital for regulators to focus on the impact the health insurance mergers will make on consumers, as premium costs may rise once again when the companies consolidate.

Dig Deeper:

How State Policymakers Impact the Health Insurance Mergers

Mergers in Health Insurance Market Don’t Pose ‘Pure Monopoly’