Joint Replacement Bundled Payment Cut Costs, Maintained Volume

A study found that lower joint replacement bundled payment models did not result in higher procedure volumes than non-model hospitals.

Source: Thinkstock

- A new Altarum Institute study confirmed previous research that bundled payment models for lower extremity joint replacements decreased care costs without sacrificing care quality or substantially increasing procedure volumes.

In September 2016, a study published in the Journal of the American Medical Association revealed that Medicare reimbursements for lower extremity joint replacement episodes dropped significantly more at hospitals in the Bundled Payments for Care Improvement (BPCI) initiative than non-participating hospitals.

For the first 21 months of the initiative, mean Medicare reimbursements at participating hospitals fell by $3,286. Non-participating hospitals reduced mean Medicare reimbursements by just $2,119.

In addition to claims reimbursement declines, the study also showed that care quality did not significantly change in both hospital groups. Researchers found no statistical care quality differences in some claims-based quality measures, which included 30- and 90-day unplanned readmissions, 90-day emergency department visits, and 30- and 90-day post-discharge mortality.

The September study’s results, however, were called into question by an accompanying editorial in the same journal. A Dartmouth Institute for Health Policy and Clinical Practice researcher argued that claims reimbursement savings stemming from the initiative may have actually been Medicare spending increases because of significantly higher lower joint replacement volumes at participating hospitals.

READ MORE: How to Overcome the Challenges of Bundled Payment Models

The study acknowledged that procedure volumes increased in both BPCI and non-BPCI hospitals, but stated that the rise in lower joint replacement volume at BPCI hospitals was not significantly different than the matched group.

According to the editorial, the service volume increase was substantial enough and, if taken into account, would show Medicare spending increases on the bundled payment episode. Therefore, the results showed that procedure-focused bundled payment models may promote unnecessary resource use.

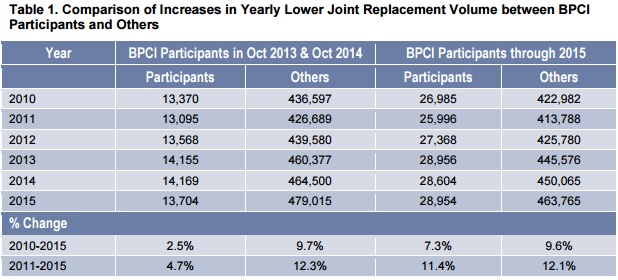

In light of the debate regarding the lower joint replacement bundled payment model, Altarum Institute researchers investigated if procedure volumes affected Medicare spending. Researchers revealed that the number of lower joint replacements performed at both BPCI and non-BPCI hospitals was not significantly higher.

Adjusted average annual volume at non-participating hospitals grew by 1.7 percent after the BPCI launch, whereas volume increases at BPCI hospitals were not much higher with a difference-in-differences estimate of 4.8 percent.

Source: Altarum Institute

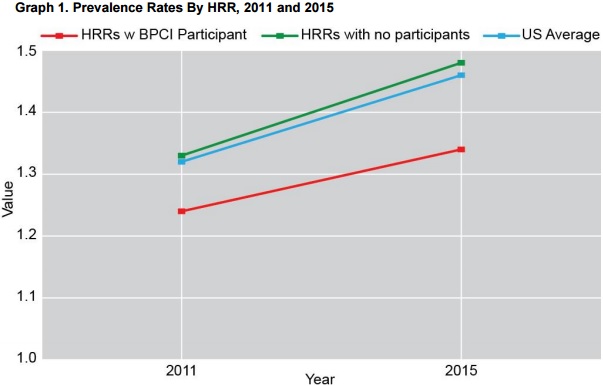

Additionally, hospital referral regions with BPCI participants maintained lower average prevalence rates for lower joint replacements compared to the national average. In 2011, before the initiative, the hospital referral regions had a 1.21 percent prevalence rate versus a 1.30 percent national rate.

READ MORE: 3 Ways Bundled Payment Models Brought Hospital Cost Savings

Twenty-one months after the BPCI initiative launch, the same regions were still below national rates with a 1.32 percent prevalence rate versus a 1.44 percent national rate.

Source: Altarum Institute

Researchers attributed procedure volume boosts after the bundled payment model’s launch to a growing Medicare fee-for-service population and the number of hospitals in the regions.

The Altarum Institute report also points out that the editorial disputing lower joint replacement bundled payment model savings “never took into account the potential for the volume of the procedures at the participating hospitals to reflect differences in the underlying count of Medicare beneficiaries in the local area, nor the differences in regional prevalence rates for these types of procedures.”

By shedding new light on the BPCI initiative, the study’s results show that some procedure-based bundled payment models do not encourage providers to boost inappropriate resource use to reap more claims reimbursement revenue.

Many payers have struggled to define their bundled payment models based on conditions or procedures. In a procedure-based model, the care episode starts with an inpatient admission or surgery. Condition-based models, on the other hand, are triggered by the detection of a disease or symptom.

READ MORE: Are Bundled Payment Models or Capitation the Better Choice?

Many condition-based bundled payment supporters contend that these initiatives can better control healthcare costs and resource use compared to procedure-based models. Condition-based models tend to focus on preventing adverse events and expensive services, rather than controlling these factors after the patient is in the hospital.

However, many large national payers are moving forward with more procedure-based bundled payment models, especially those targeting lower joint surgeries. Payers are focusing on the surgeries because they present the most opportunity for cost reductions.

For example, UnitedHealth announced in December 2016 new bundled payment models for hip, knee, and spine surgeries.

“The main reason for developing a [bundled payment] program is that, in most large companies, high spend is really associated with orthopedic procedures,” Michelle Lobe, Vice President of Network Strategy and Innovation at UnitedHealthcare, told HealthPayerIntelligence.com. “For the most part, about 17 percent of company spend is in the orthopedic arena. Hip, knee, and spine procedures constitute about 33 percent of that.”

Other major payers developing procedure-based bundled payment models include CMS with several new models targeting cardiac surgeries and hip fracture and replacement surgeries as well as Humana with their hip and knee replacement bundles.