Medicaid Expansion, State Exchanges Led to Drop in Uninsured

While there have been concerns surrounding the implementation of health insurance exchanges and Medicaid expansion, there is no arguing that the Affordable Care Act has led to a significant reduction in the number of uninsured.

- Ever since the Supreme Court ruled that one stipulation within the Patient Protection and Affordable Care Act is not fully constitutional, states around the nation have taken the court’s decision to heart and truly shown that Medicaid expansion is very much optional. While the federal government had set aside the majority of the funds necessary to expand Medicaid, some state representatives argued that the additional future costs of expanding Medicaid coverage was a barrier that prohibits its implementation.

Several years ago, The Heritage Foundation released a report that illustrated some of the concerns states may have with regard to both implementation of state-based health insurance marketplaces and Medicaid expansion.

Health insurance exchange concerns

First, when it comes to state health insurance exchanges, the issue is that no “steady flow of federal dollars” will be moving into the states to support this initiative. Starting in 2015, the states had to create their own revenue source to manage the yearly operations of these marketplaces. Additionally, the Department of Health and Human Services will be levying an administrative fee for the health insurance exchanges.

“The law specifies that starting in 2015, any state implementing a state exchange must develop its own revenue source to fund the exchange’s annual operations. That puts the long-term costs squarely on the states,” the report from The Heritage Foundation declared.

“Moreover, the recent announcement by the Department of Health and Human Services (HHS) that it will levy a 3.5 percent administrative fee on coverage sold through the federally run exchanges indicates there are significant costs if a state agrees to run its own exchange.”

Some states may find the costs associated with these marketplaces prohibitive while also realizing that there would be no greater benefit to running a state exchange as compared to a federally-subsidized health insurance exchange.

Medicaid expansion concerns

The costs associated with Medicaid expansion are the most significant concerns among states. While the majority of the costs associated with Medicaid expansion will be the federal government’s responsibility, there are certain fees that many states refuse to incorporate in their annual budgets.

For example, administrative costs will add 5 percent to the budgets and states will have to take up 10 percent of the price of Medicaid expansion in 2020 and the years afterward. Until then, the federal government has matched 100 percent of the Medicaid expansion costs.

With more focus on value-based care coming from the federal government, states may also feel “pressure from their hospitals” suffering from “federal payment cuts for uncompensated care,” the report stated.

If states choose not to increase Medicaid coverage for their population, the report stresses that it is vital to find other alternative solutions to address the healthcare needs of the population lacking health insurance.

“If your state hasn’t expanded Medicaid, your income is below the federal poverty level, and you don't qualify for Medicaid under your state's current rules, you won’t qualify for either health insurance savings program: Medicaid coverage or savings on a private health plan bought through the Marketplace,” HealthCare.gov explained the potential consequences and coverage gap that occurs when states don’t expand Medicaid.

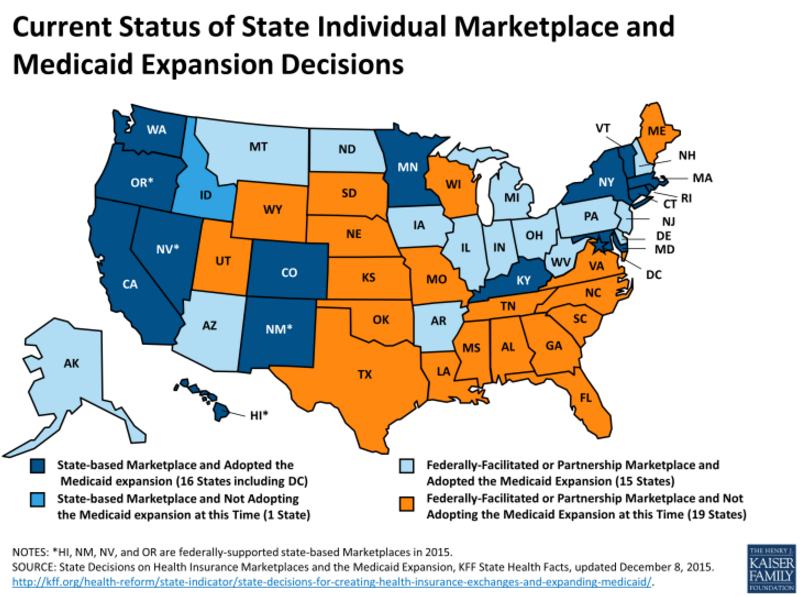

Currently, only 31 states have adopted Medicaid expansion, 16 states and Washington D.C. have established state-based health insurance exchanges, and 15 states have incorporated federally-facilitated or partnership health insurance marketplace. The figure below from the Henry J. Kaiser Family Foundation illustrates how 20 states are foregoing Medicaid expansion in their region.

Uninsured rates plummet due to Affordable Care Act

While there have been concerns surrounding the implementation of health insurance exchanges and Medicaid expansion, there is no arguing that the provisions of the Patient Protection and Affordable Care Act has led to a significant reduction in the number of uninsured individuals throughout the nation.

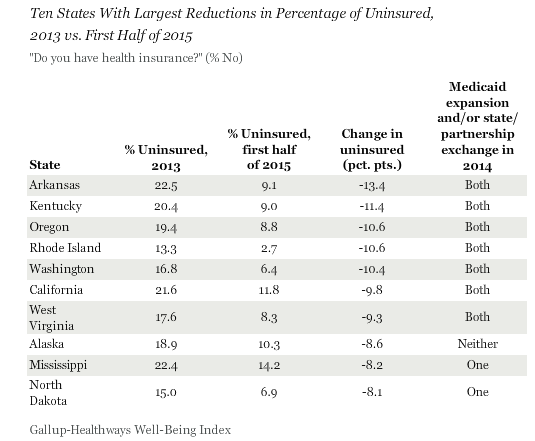

A Gallup poll shows that Arkansas and Kentucky top other states with regard to the highest drop in the number of their uninsured residents since the Affordable Care Act was implemented in 2014.

Arkansas had a 22.5 percent rate of uninsured throughout the state in 2013, but this dropped to 9.1 percent in 2015. Kentucky had a rate of 20.4 percent on uninsured two years ago and this fell to 9.0 percent during the first half of 2015. Oregon, Rhode Island, and Washington also saw a drop of at least 10 percentage points in the rate of their uninsured over the last two years.

The survey results also show that seven out of the 10 states that garnered the greatest reduction in uninsured rates across the country have implemented Medicaid expansion as well as either a state-based health insurance exchange or a state-federal partnership.

“Collectively, the uninsured rate in states that have chosen to expand Medicaid and set up their own state exchanges or partnerships in the health insurance marketplace has declined significantly more since 2013 than the rate in states that did not take these steps,” the Gallup survey found.

“The uninsured rate declined 7.1 points in the 22 states that implemented both of these measures by Dec. 31, 2014, compared with a 5.3-point drop across the 28 states that had implemented only one or neither of these actions.”

Clearly, despite the cost issues associated with some of the Affordable Care Act’s provisions, it does lead to greater healthcare coverage across the nation and increases access to medical care among low-income families.