Payers See High Financial Losses on Health Insurance Exchanges

Healthcare payers are facing financial losses on the health insurance exchanges, which is leading some to drop out of the public marketplace while other raise premium costs.

- Healthcare payers have been facing significant financial losses on the health insurance exchanges in recent years. UnitedHealth Group lost $475 million in 2015 and was predicting a loss of $650 million in 2016, according to Kaiser Health News. During the fourth quarter of 2015, net income at Humana also dropped from $145 million to $101 million.

The Henry J. Kaiser Family Foundation released a report earlier this year discussing payers’ decisions and challenges for operating on the health insurance exchanges in 2017. At this point in time, payers have garnered more experience operating through the Affordable Care Act exchanges.

Many payers are seeing a higher risk pool and more costly medical claims on the exchanges. With gaining a better understanding of their risk pool, payers are more capable of predicting future claim costs among their enrollees. With insurers finding that their member base is less healthy than previously anticipated, significant premium increases were inevitable. On the other hand, payers whose claim costs were in line with their premium revenue had fewer changes to submit for next year.

Earlier this year, the Department of Health & Human Services (HHS) released a report showing that the cost of premiums on the federal health insurance exchanges are expected to increase by an average of 25 percent in 2017. The state-based marketplaces are also expected to see a rise of 22 percent in premium costs next year. The payers who are still committed to staying on the health insurance exchanges have increased their premium costs as one solution to financial losses.

Other challenges that impacted the cost of premiums include more healthcare service use and a general upward trend of rising medical prices. Some other aspects of the Affordable Care Act such as the exit of the federal reinsurance program and the health insurance tax one-year waiver are also changing premium costs among private payers next year.

The report claims that competition and revenue on the health insurance exchanges could stabilize if payers seeing financial losses correct their premium prices for greater profitability. The increase in premium costs for 2017 are expected to be a “one-time market correction.”

“Given the highly competitive nature of the Marketplaces in much of the county, as well as the uncertainty insurance companies faced in the early years of ACA implementation, it’s not surprising that premium increases may be higher in 2017 as the market matures and more data become available to insurers,” the Kaiser Family Foundation report stated.

On the other side of this argument, premium prices have risen in prior years on the health insurance exchanges. In 2015, the average premium costs increased by 5.3 percent, according to The Heritage Foundation.

“These premium increases have resulted in, and will continue to cause, millions of Americans shifting to very high deductibles, which will push even more younger and healthier people out of the health insurance market,” Institute for Policy Innovation (IPI) Resident Scholar Merrill Matthews, Ph.D., said in a public statement.

If more low-risk enrollees drop coverage from health plans sold on the exchanges, payers will likely continue to see more financial losses.

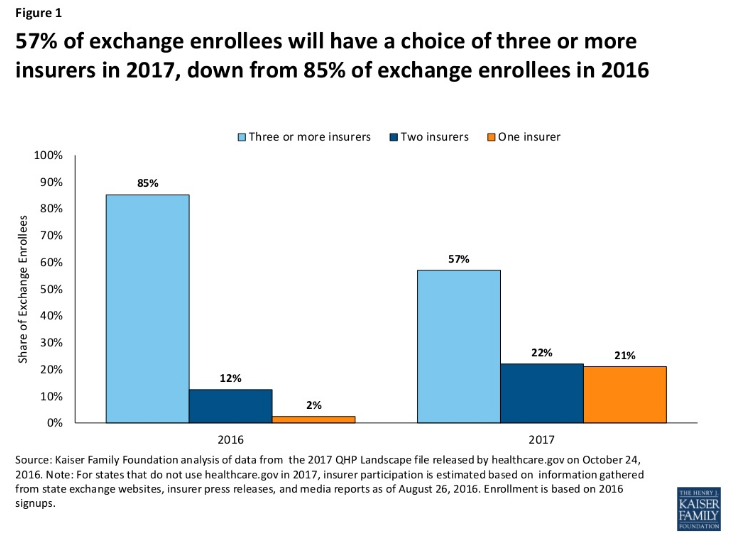

Some payers could not sustain operating through the public marketplace and chose to drop out as one solution to their financial losses. The Kaiser Family Foundation reported a drop in the number of health plan options available to enrollees next year. In 2017, 57 percent of consumers will be able to choose from three or more payers, which has dropped from the 85 percent of enrollees in 2016.

UnitedHealthcare, Aetna, Blue Cross Blue Shield of Minnesota, and Humana are some of the payers pulling back on serving customers through the health insurance exchanges. These payers have faced financial losses of millions of dollars and found it unsustainable to continue serving as many high-risk pools on the exchanges.

The biggest problem facing payers when it comes to continued operation on the health insurance exchanges is the financial losses experienced by many. The issues stem around high cost medical claims and higher risk pools in the public marketplace. Some payers went forward with increasing premium costs while others found the marketplace unsustainable and have pulled back from the exchanges.

Dig Deeper:

How Payers Could Succeed in ACA Health Insurance Exchanges

The Progress and Challenges of the Affordable Care Act