Plan Member Satisfaction Reduced in Less Competitive Markets

This report shows that competition may be key for greater health plan member satisfaction, which may present why large health insurance mergers may harm the competitive landscape.

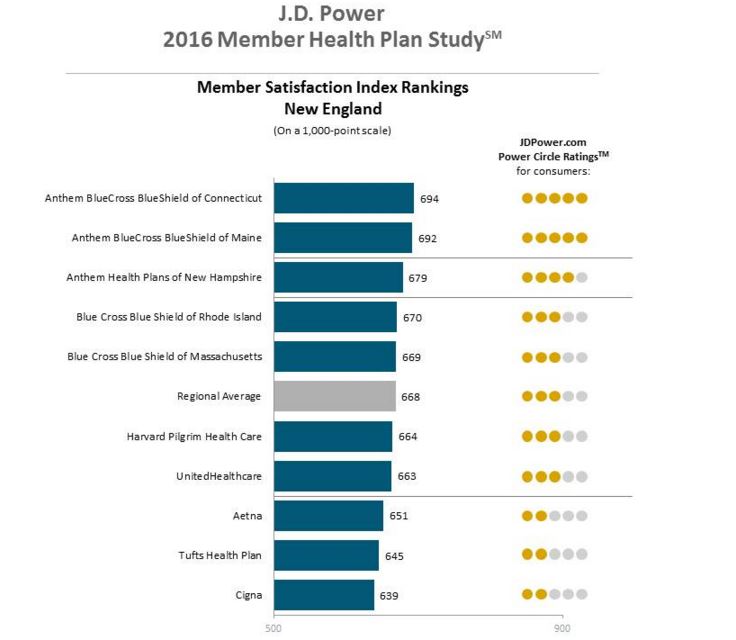

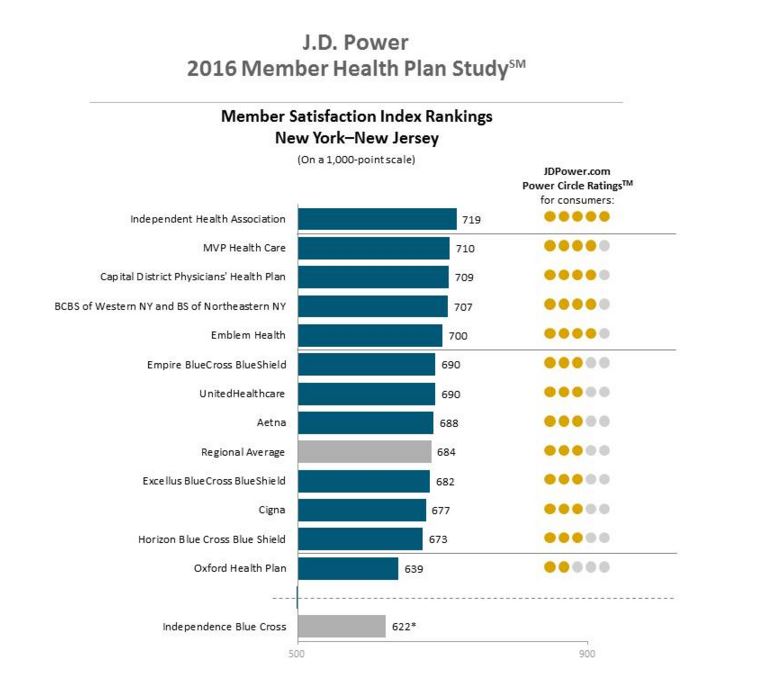

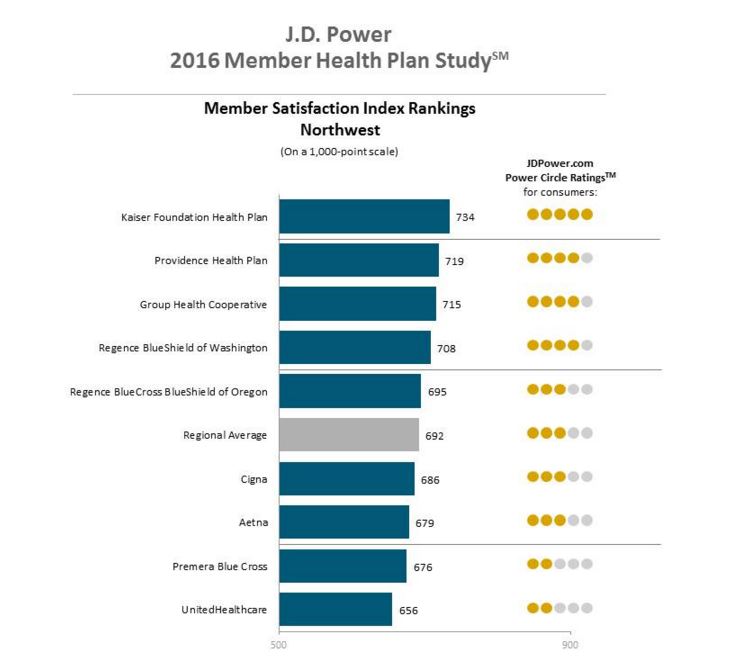

- Due to the value-based care initiatives taking place at the Centers of Medicare and Medicaid Services (CMS), patient engagement and patient satisfaction have become imperative for the health payer industry. A report from J.D. Power called the J.D. Power 2016 Member Health Plan Study outlines the essentials that health payers will need to ensure high health plan member satisfaction.

According to a company press release, greater competition between insurance companies boosts health plan member satisfaction. The results from the report shows that health plan member satisfaction grew a total of 9 index points in 2016. Additionally, last year's annual report also showed that member satisfaction increased by 10 points throughout 2015.

However, member plan satisfaction was low in 2014 when the Affordable Care Act’s health insurance exchanges were introduced. The study showed that member plan satisfaction when it comes to communication, information access, and pricing was reduced in regions where one health plan has more than 50 percent of the market share.

Essentially, it looks like health plan member satisfaction and patient engagement is higher in areas where insurers have greater competition. Insurance beneficiaries are especially looking for superior customer service, healthcare information access, better communication, and affordable prices, the report stated.

The J.D. Power study analyzes member plan satisfaction among 135 health insurance plans throughout 18 regions. Six characteristics are being analyzed in the report including provider choice, medical claims processing, pricing of health plans, customer service, communication, and information access.

This report shows an interesting finding in that competition may be key for greater patient and plan member satisfaction, which may present another reason why large health insurance mergers may harm the competitive landscape of the insurance industry.

Both the Aetna-Humana and the Cigna-Anthem health insurance mergers are experiencing a wide amount of disapproval from various medical organizations. For example, the American Medical Association and the American Hospital Association both find problems with these health insurance mergers such as their potential negative impact on premium prices due to anti-competitive stances.

“A lack of competition in health insurer markets is not in the best interests of patients or physicians,” AMA President Steven J. Stack, M.D., said in a public statement. “If a health insurer merger is likely to erode competition, employers and patients may be charged higher than competitive premiums, and physicians may be pressured to accept unfair terms that undermine their role as patient advocates and their ability to provide high-quality care.”

A report from the Harvard Business Review did predict that health insurance mergers would lead to higher premium prices for consumers. This included higher costs for employer-sponsored commercial health plans as well as insurance purchased through the federal or state marketplaces.

Along with the potential for a rise in medical costs among insurance beneficiaries, provider reimbursement and general patient care may be negatively hit due to the health insurance mergers. The American Hospital Association finds it a problem that these mergers would bring the nation's top five health insurers to become only three payers.

The J.D. Power report, however, did find that member plan satisfaction rose in markets with little competition when provider choice in health insurance plans was changed.

“Sometimes, having fewer, simpler plan choices makes it easier for the member,” Greg Hoeg, Vice President of U.S. Insurance Operations at J.D. Power, stated in the press release. “Having dozens of plan options—such as deductibles and coverage levels—to choose from can be overwhelming.”

The report outlines how the Affordable Care Act and its impact on the medical loss ratio have affected health insurance companies. More insurers are now looking to raise their market share through mergers and acquisitions.

“Carriers are paying particular attention to cost management and economies of scale, and one way to do that is to combine with other carriers,” continued Hoeg. “Competition is good for the market, but how that narrowing of the market will affect member satisfaction remains to be seen.”

Along with the Aetna-Humana and Cigna-Anthem health insurance mergers, Blue Cross Blue Shield is combining its health plans between differing Blue Cross insurers and UnitedHealthcare is looking to scale with Optum.

Various organizations have commented that these major health insurance mergers could harm consumers and negatively impact competition between payers. Premium prices in less competitive markets will not be the only factor to reduce health plan member satisfaction, as communication, access to information, and customer service were found to be key for higher consumer approval.

“Competition among health plans is good for members in that it forces carriers to fight for market share, and the best way to do that is with satisfied customers,” mentioned Greg Hoeg. “In today’s health insurance markets, with increased legal restrictions on profitability, carriers are shifting toward member satisfaction.”

The future will show whether these mergers will make a significant impact on consumers and other health insurers. Over the coming years, health payers, providers, and the patient community will need to work together to ensure that health insurance mergers do not harm the competition and member services necessary for higher satisfaction and patient engagement.

Image Credits: J.D. Power