Proposed Rule in Oklahoma Impacts Costs of Prescription Drugs

Due to the rising costs of prescription drugs, there has been some legislation proposed in Oklahoma that might not be the best option.

- In recent months, scandals associated with the costs of prescription drugs have made headlines. About seven out of 10 Americans are currently enrolled in a health insurance plan that covers costs of prescription drugs. Prescription drug plans may be in the form of Medicare Part D, employer-sponsored insurance, or insurance purchased through the federal exchange.

Additionally, many more people are currently on discount prescription drug plans, according to the National Center for Policy Analysis. Those who are enrolled in these programs are able to purchase more affordable prescription medication. However, those without healthcare coverage or consumers who haven’t met their annual deductible must cover the entire costs of their medication.

Due to the rising costs of prescription drugs, there has been some legislation proposed in Oklahoma that might not be the best option, reports Devon M. Herrick, Senior Fellow with the National Center for Policy Analysis.

In fact, new legislation could actually make access to medication more expensive for people who live in Oklahoma, explained Herrick. There is currently a large backlog of generic drug applications at the Food and Drug Administration (FDA) office. This backlog rose to almost 4,000 applications last year.

Due to the lengthy period of time it takes for the FDA to clear and approve generic drug applications, some manufacturers have hiked the costs of prescription drugs, specifically their generic medication.

The high prices of generic medicine affects consumers with prescription drug plans as well. In addition, drug stores and pharmacies can be negatively impacted by these actions when it comes to their profit margins, according to Herrick.

Due to this impact on pharmacies, a number of drug stores have begun lobbying policymakers in Oklahoma to bypass negotiated discounts and require consumers to take on the hikes in costs of prescription drugs regardless of what contracts were signed previously.

In general, Devon Herrick has argued that more healthcare payment reform is necessary to go beyond that of the Affordable Care Act and current policies.

“The Affordable Care Act did not really do anything that would cut the rising cost of healthcare spending,” Herrick told HealthPayerIntelligence.com. “I think we need to have effective reform. We need to have a system where individuals have more incentive to try to control cost and we need to find a way to encourage individuals to watch what they spend along with enabling more cost control.”

“The Affordable Care Act did not really do anything that would cut the rising cost of healthcare spending,” Herrick told HealthPayerIntelligence.com. “I think we need to have effective reform. We need to have a system where individuals have more incentive to try to control cost and we need to find a way to encourage individuals to watch what they spend along with enabling more cost control.”

In a National Center for Policy Analysis brief, Herrick detailed exactly how the prices of generic drugs are set. Prescription drug plans and other health coverage plans include maximum allowable cost (MAC) price lists for drug manufacturers to know the top level a medication’s price can be set.

These limits are important because they hold pharmacies responsible and prevent these establishments from passing the high costs down to the consumer. One law in Oklahoma, however, already allows pharmacies to contest any MAC price limits that they feel violate the financial health of their establishment.

That law was created due to the fact that the costs of prescription drugs were rising faster in some circles than the rate at which the MAC lists were being changed. However, Herrick argues that this will no longer be a problem for pharmacies and drugs stores, as the FDA has more recently streamlined its drug approval process to complete it in a much quicker fashion.

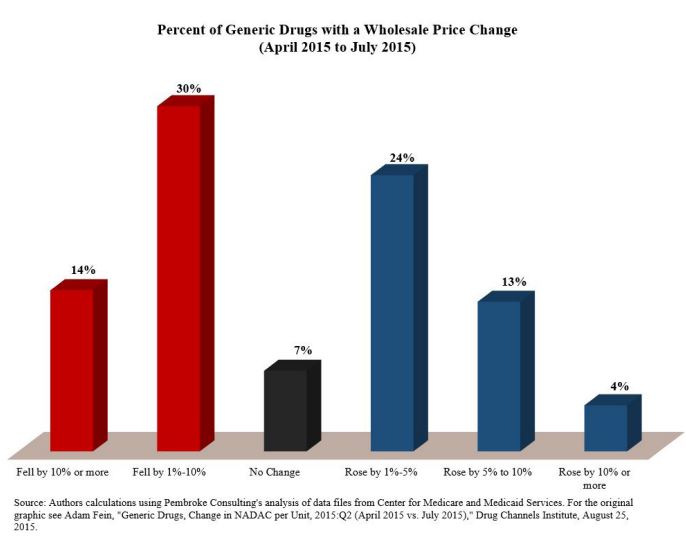

“The average acquisition cost of generic drugs was about as likely to fall as it was to rise in the second quarter of 2015,” explained Herrick in the brief.

Now the Oklahoma Senate is actually considering a proposal that was lobbied by drug stores to expand the existing law to include more vague wording that would allow pharmacies the ability to more arbitrarily raise the costs of prescription drugs.

Essentially, if the proposed law is passed, it would allow drug stores in Oklahoma to contest the prices of medication regardless of whether a contractual agreement has already been signed.

“Today, nearly all health plans include some level of prescription drug benefits,” continued Herrick. “When drug plans create pharmacy networks, they negotiate the lowest possible prices. Negotiated prices are the result of bargaining power — the ability of the drug plan to steer business to a firm that offers the most favorable bid. As a result of drug plans and competition among pharmacies, relatively few patients are unable to afford their medications. Indeed, three-fourths of retail prescriptions cost the patient $10 or less.”

“But this could all change if new laws allow drugstores to renege on negotiated contractual arrangements prior to the expiration of contracts. Consumers, employers and taxpayers will be the ultimate losers in that deal. SB 1150 as amended is a bad deal for Oklahoma consumers, employers and taxpayers,” Herrick concluded.

This legislation could negatively impact consumers who would be the ones to cover the costs of prescription drugs when price hikes are implemented. As the healthcare industry continues to reform its payment practices, it would be beneficial to take a harder look at the prices set by the pharmaceutical industry and the legislation being proposed in Oklahoma.