Top 4 Predictions for Healthcare Payer Industry in 2016

“After more than a decade of identifying the top health industry trends, we are finally starting to see the creation of a New Health Economy – a health system that is more connected, transparent and patient-centric.”

- As the year comes to a close, while many are off to celebrate the holidays, those within the healthcare payer industry would be wise to look ahead to the New Year and prepare for the coming trends and challenges of 2016. Below we outline four specific avenues that the health payer field is predicted to move toward over the next 12 months.

Health insurance mergers will rise

First and foremost, the healthcare payer industry is expected to continue consolidating and experiencing a rise in mergers, especially due to the Aetna-Humana and Anthem-Cigna consolidations. A report from PwC shows that 2016 will be a year of mergers and acquisitions throughout the healthcare payer industry because the insurance market will be dominated by only three major payers and more establishments are expected to focus on consolidation.

“After more than a decade of identifying the top health industry trends, we are finally starting to see the creation of a New Health Economy – a health system that is more connected, transparent and patient-centric,” Kelly Barnes, PwC's US health industries leader, said in a public statement.

“2016 will be marked by how well the sector balances greater demand with rising costs, and handles trends such as industry consolidation and the increase of consumer technology in healthcare. But there is much more work that needs to be done in forging new ways of receiving, paying for and delivering care, and it will be businesses that prioritize addressing consumer needs and increasing value that should succeed.”

While there are many opponents to the mergers proposed by Aetna-Humana and Anthem-Cigna, these consolidations may very well take effect next year and transform the healthcare payer industry. There is a possibility that these mergers will not have a major impact on monopolizing the market, according to Patrick Pilch, Managing Director and National Healthcare Advisory Leader of The BDO Center for Healthcare Excellence & Innovation.

“I don’t envision seeing monopolies, possibly oligolopic organizations. There certainly will be market concentrations,” Pilch began. “One could make the argument that these payer mergers will lead to single payer or maybe a utility so that it becomes regulated. I believe that this will be a long way away. Through the FTC, regulators are looking at where the measures of concentration are and how they play there.”

“As far as a pure monopoly, I don’t see it as I do believe there will be considerable pushback by the FTC,” Pilch concluded.

New innovative payment models will emerge

The PwC report further explains that innovative financing options are likely to come about in the healthcare space, as consumers consider how to treat their healthcare costs in a similar way to retirement savings. This could lead to bundled payment systems in which consumers’ demands are met to reduce wasteful spending on unnecessary medical services.

As previously reported, value-based care reimbursement and bundled payment models will gain popularity in 2016. Alternative reimbursement models are becoming a mainstay of the healthcare payer industry, as more insurers and providers move away from the fee-for-service payment model.

Specifically, the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) has brought more focus on value-based care and performance quality measures. The Centers for Medicare & Medicaid Services (CMS) are also promoting bundled payments particularly within joint replacement surgery procedures.

Premiums will rise on health insurance exchange

New data from the Robert Wood Johnson Foundation shows that premium prices are expected to skyrocket around the nation for those plans purchased on the health insurance exchange.

Gold Plan premium prices will rise by nearly 14 percent in 2016 while Silver plan premiums will rise by 11.3 percent and bronze plans will see a 12.6 percent jump in their costs. Some states like Alaska, Alabama, Hawaii, and North Carolina will have their premium prices increase dramatically with most seeing more than a 20 percent hike.

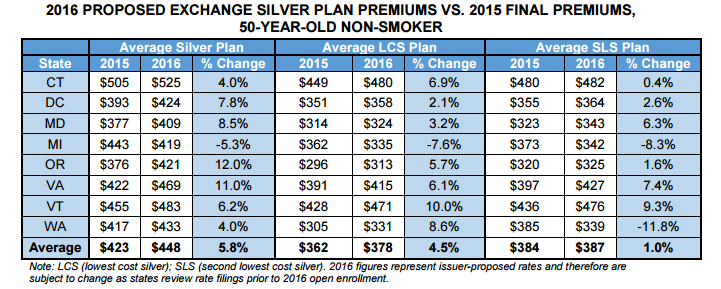

Despite this, an Avalere analysis shows that premiums for silver plans may yet compete effectively in the market, as the rise may not be as dramatic as previously assumed. When looking across eight states, the analysis finds that there will only be a 5.8 percent rise in premium coverage costs on average.

For example, in Michigan the rise is only 5.3 percent. Additionally, about two-thirds of beneficiaries purchasing coverage through the health insurance exchanges chose silver plans in 2015.

“While recent public attention has focused on a subset of plans that filed for premium increases of 10 percent or more, these data reveal that most plans are proposing more modest increases,” Caroline Pearson, senior vice president at Avalere, said in the release. “Notably, final premiums could be even lower than those proposed.”

The CMS Innovation Center will bring more transformations

Many common developments in the healthcare payer industry come directly from the CMS Innovation Center and the Patient Protection and Affordable Care Act. In fact, it was the Affordable Care Act that led to the creation of the CMS Innovation Center.

One transformation that the CMS Innovation Center brought forward is the Home Health Value-based Purchasing Model. Beginning on the 1st of January in 2016, a number of states will begin participating in the Home Health Value-based Purchasing Model, which consists of linking home health reimbursement to quality performance measures in order to boost population health outcomes. The states that will take part in the program include Massachusetts, Maryland, North Carolina, Florida, Washington, Arizona, Iowa, Nebraska, and Tennessee.

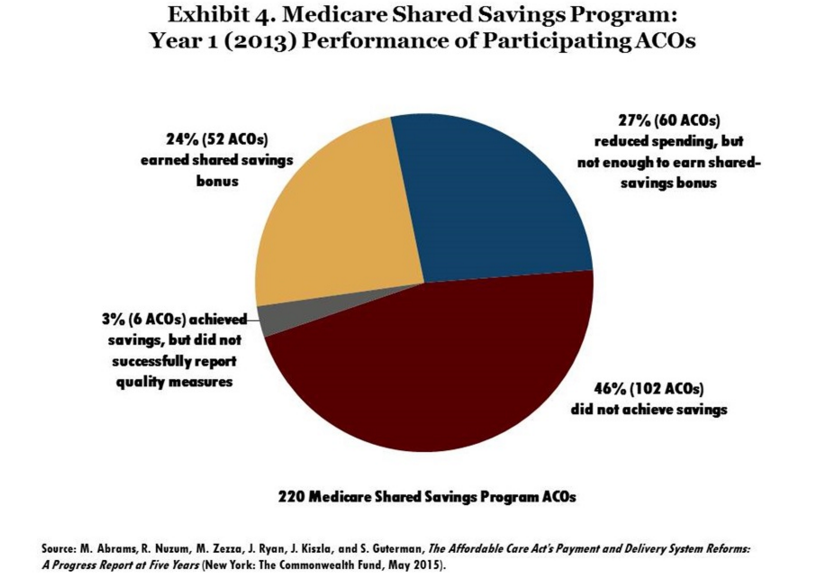

Additionally, the CMS Innovation Center has worked to strengthen Accountable Care Organizations (ACOs) around the nation. This year, the Department of Health and Human Services reported that the Pioneer ACO Model brought in $384 million in savings over the last two years. The graph below offers more information about the number of ACOs that earned shared savings from the Medicare Shared Savings Program in 2013.

“This is a crucial milestone in our efforts to build a health care system that delivers better care, spends our health care dollars more wisely, and results in healthier people,” HHS Secretary Sylvia M. Burwell said in a public statement. “The Affordable Care Act gave us powerful new tools to test better ways to improve patient care and keep communities healthier. The Pioneer ACO Model has demonstrated that patients can get high quality and coordinated care at the right time, and we can generate savings for Medicare and the health care system at large.”