What the Health Insurance Marketplace Should Expect in 2016

In 2016, the health insurance marketplace should expect a modest rise in the number of individuals enrolling in the exchanges as well as a general rise in premium costs around the nation.

- With January 1, 2016 only days away, it is useful to review next year’s predictions for the healthcare insurance industry. Both the costs of monthly premiums and the health insurance marketplace set up by the Patient Protection and Affordable Care Act will experience some changes starting in 2016.

Health insurance marketplace enrollment

For starters, the Department of Health & Human Services (HHS) suspects that there will be anywhere from 11 to 14.1 million people purchasing health coverage plans through Obamacare’s health insurance marketplace by the end of the 2016 open enrollment period, according to the Health Affairs publication.

These numbers estimate that approximately 1 million people who are currently receiving coverage through commercial insurers or the individual market will move over to purchasing coverage through the health insurance marketplace in 2016.

These figures were determined by the Health and Human Services Assistant Secretary for Planning and Evaluation (ASPE) and are based on information from the first two open enrollment periods. It is expected that HHS will meet its goal of ensuring that 10 million beneficiaries are enrolled in coverage through the health insurance marketplace by the end of 2016.

While the Congressional Budget Office expected more individuals to move from employer-sponsored health plans to coverage through the health insurance marketplace, the opposite seems to have occurred. Last year, the number of employer-sponsored health plan beneficiaries rose from 2013 and jumped as high 175 million Americans.

Regardless of where individuals obtain their healthcare coverage, the number of insured people have risen by 17.6 million, the ASPE estimates. Nonetheless, there is still a percentage of Americans who remain uninsured possibly due to the Medicaid coverage gap.

Some of the characteristics and findings of the uninsured population from ASPE includes that about 80 percent of these individuals have less than $1,000 in savings with about one out of two containing only $100 or less in savings.

Additionally, about 50 percent of the uninsured have difficulty with food and housing affordability. As such, the uninsured population is much less likely to visit their primary care doctor, obtain preventive care, or be able to afford prescription drugs. The Centers for Medicare & Medicaid Services (CMS) are bringing forward further attempts to reach the uninsured population and emphasize financial assistance programs for health coverage.

“CMS is using its understanding of the remaining uninsured population and of their attitudes and experience to better target enrollment efforts for 2016,” Health Affairs reports.

“This includes greater use of electronic and social media to reach young adults and greater use of in-person assistance for individuals who are hard to reach through conventional channels. CMS will emphasize the availability of financial assistance and the potential penalties of going uninsured. It will focus its efforts on particular parts of the country where the level of uninsurance is high.”

Monthly premium costs predicted to rise

The Henry J. Kaiser Family Foundation announced that monthly premiums in the health insurance marketplace is expected to increase by more than 10 percent, in some cases, next year.

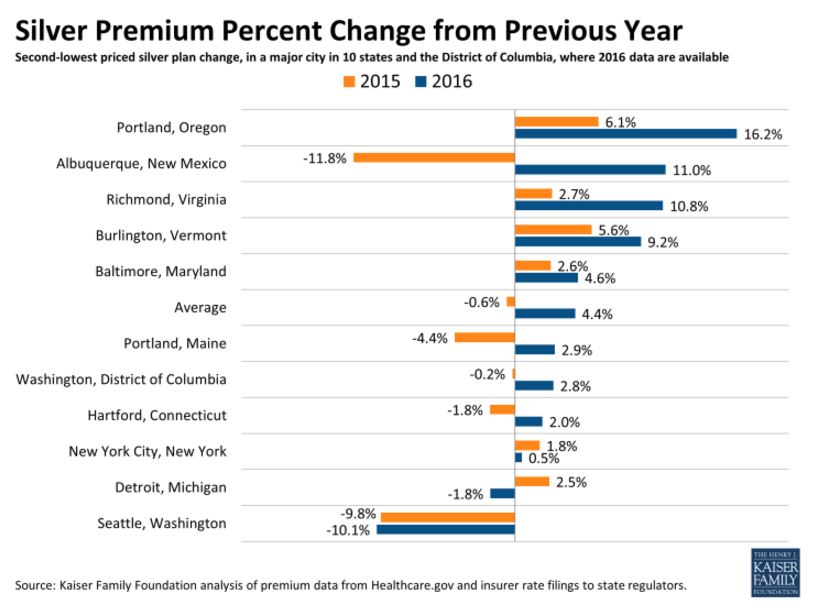

The brief from the Kaiser Family Foundation looked at silver plans in the health insurance exchanges throughout 10 separate states. The increases for premium prices next year are larger than those seen in 2015, but modestly so. The rise is, on average, 4.4 percent higher than in 2015.

The number of insurers in the exchanges has either stayed the same or rose in number across nine of the states analyzed. Additionally, premium price caps are expected to move upwards in 2016.

The lowest-cost silver plan will increase by 4.5 percent on average in 2016 when compared to 2015. However, in certain areas like Richmond, Virginia the monthly premium for the silver plan will jump 19 percent next year. Other regions like Seattle, Washington will see a decrease of 4.2 percent.

“As a result of the ACA’s rate review provision, data has become public on rate increases over 10 percent, with some insurers requesting average increases well into the double digits,” the brief from the Kaiser Family Foundation stated.

“However, the patterns in these 10 states and DC, where more complete information is available, suggest that the premiums for the two lowest-cost silver plans – where the bulk of enrollees tend to migrate – are not necessarily increasing, and where they are increasing, the growth has generally been moderate.”

The American Academy of Actuaries issued a brief that explains some of the reasons monthly premium prices may be going up in 2016. For instance, the composition of the risk pool or the beneficiary population reflects the cost of premiums. The way health insurance works is by having the healthy individuals subsidize the care of the sick. Essentially, the costs of premiums reflect the health status of the risk pool.

“Premiums for 2016 will reflect insurer expectations regarding the composition of the enrollee risk pool, including the distribution of enrollees by age, gender, and health status. How 2016 premiums change from 2015 will depend on how assumptions regarding the composition of the 2016 risk pool differ from those assumed for 2015,” according to the American Academy of Actuaries.

Additionally, premium costs reflect projected medical claims or the price of healthcare services. Premiums also cover the costs of administration including claims processing, sales and enrollment, regulatory compliance, and insurance product creation.

In 2016, the health insurance marketplace should expect a modest rise in the number of individuals enrolling in the exchanges as well as a general rise in premium costs around the nation.