2016 Premiums on Health Insurance Exchanges Expected to Soar

With the jump in demand among health insurance exchanges and the market as a whole, it is understandable to see premium costs going up.

- Health payers managing plans through the state health insurance exchanges will need to work toward maintaining superior customer relations due to the rise in premium costs expected in 2016. The Robert Wood Johnson Foundation released datasets that show premium prices rising significantly next year.

For the Silver Plan premium rates, an 11.3 percent rise across the nation is expected while the Gold Plan premium costs are expected to increase by a total of 13.8 percent around the country. Those purchasing insurance through the Bronze Plan will see a 12.6 percent hike in their monthly premiums. Alaska, Alabama, Hawaii, and North Carolina are some of the states that will have their premium costs hardest hit on the health insurance exchange.

The gold level plans saw deductible prices drop slightly more than 1 percent while the premiums grew significantly. Beneficiaries using state health insurance exchanges and not receiving subsidies from the federal government will have to pay higher monthly fees to keep their coverage next year, according to the Robert Wood Johnson Foundation.

“A lot of the insurers talked about how they priced too low and claims exceeded premiums for a lot of them, so there’s been an adjustment,” Katherine Hempstead, RWJF's director of insurance coverage, told USA Today. “Going forward you really would expect to see the market stabilize.”

The Obama administration had outlined predictions that fell below this increase in premium costs. Additionally, the price of deductibles skyrocketed in the state of Washington, Mississippi, and South Carolina.

Some of the potential reasons for the high costs of healthcare coverage through the state health insurance exchanges after the Patient Protection and Affordable Care Act took effect relate to the extra benefits such as preventive screenings that are offered within the plans.

Additionally, those with pre-existing conditions are now covered fully by health insurers due to the provisions of the Affordable Care Act. Young adults under 26 years old are also allowed to stay onto their parents’ insurance plans due to the ACA stipulations. These extra individuals in the health insurance market bring more demand and, thereby, a rise in costs.

An infographic from the McKinsey Center for US Health System Reform also outlined the premium price increases expected across the states in 2016. When it comes to the Silver Plan premium costs, Hawaii is expected to see a rise in 25 percent while Alaska sees a 15 percent jump, Oklahoma experiences 26 percent growth, and Montana sees a 22 percent increase.

The infographic also shows that the percentage of consumers enrolling in Medicaid coverage will rise by 29 percent next year and general national coverage will increase a total of 18 percent in 2016. With the jump in demand among health insurance exchanges and the market as a whole, it is understandable to see premium costs going up. Some other potential reasons for the expected increase in healthcare coverage costs is associated with continual rise in prescription drug fees and general medical inflation rates.

Perspectives on future of healthcare

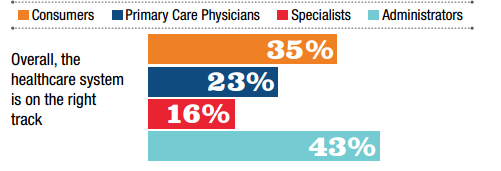

The healthcare industry clearly has a long way to go before making a real dent in stabilizing costs and ensuring quality care at reasonable prices. According to a consumer and provider perspective report from Ipsos Public Affairs and Booz Allen, only 35 percent of consumers and 24 percent of primary care physicians believe that “the healthcare system is on the right track.”

“In 2015, anxiety over healthcare and its costs are still in evidence among consumers and providers, and satisfaction with numerous factors dropped,” the report stated. “In fact, the majority of respondents across all groups still believe the US healthcare system is not on the right track. Yet, within several groups, this perception is showing improvement. Thirty-five percent of consumers (up from 33 percent in 2014) believe that the healthcare system is headed in the right direction.”

“Just 23 percent of PCPs share this view (unchanged from 2014), but 16 percent of specialists now feel that way compared to just 10 percent in 2014. Among administrators, 43 percent believe the healthcare system is on the right track compared to 34 percent in 2014.”

Consumers and providers also agree that early detection screenings and greater care coordination will benefit the patient community. An interesting finding is that younger adults between age 18 and 35 place more value on preventive interventions within the healthcare industry.

Some models of care meant to stabilize healthcare costs such as the patient-centered medical home is bringing more hope among providers for the future of healthcare. For example, providers of patient-centered medical homes are more optimistic about the future when compared to other medical professionals, according to the report.

Penalty tax for lacking health coverage

While the costs of premiums are expected to rise, the tax penalties associated with the Affordable Care Act for failure to have healthcare coverage is still expected to keep most individuals enrolled in a health plan. NPR reported Tuesday that a family of four making $250,000 per year could be facing a $10,000 tax penalty in 2016 if they lack medical coverage.

Additionally, any individual who does not have health insurance in 2016 will be responsible for paying the federal government at least an extra $695 in taxes. Despite the rise in premiums expected for next year, it is likely that most families will continue investing in the health insurance market due to the individual mandate tax penalty.

“People understand generally that there’s a penalty,” Katie Nicol, Senior Manager of Public Benefits and Insurance Navigation at Whitman-Walker Health, told the news source. “But the majority of the time they don’t know what that means — definitely not the amount of money that it is. There is a bit of shock of realizing, ‘Wow, if I don’t do this, I will likely be responsible for over $600 in penalties.’”

Image Credit: Ipsos Public Affairs and Booz Allen