ACA Risk Adjustment, Reinsurance Improved Payer Financials

Over the first two years of ACA risk-adjustment and reinsurance were well targeted and improved financial performance for payers with high risk enrollees.

Source: Thinkstock

- A new study published in Health Affairs found risk adjustment and reinsurance provisions of the Affordable Care Act improved financial outcomes for certain payers with higher risk enrollees.

Researchers from AHRQ and CMS found that before ACA implementation, 30 percent of insurers with the highest claims cost lost between $90-$397 per enrollee per month.

After the first two years under the ACA, this trend shifted to produce positive revenues for these payers. The revenues exceeded the cost of claims by$49 per month per enrollee or more.

Risk-adjustment has long been a part of the payer market, but has recently been debated by many payers following required adoption of higher risk enrollees under the ACA.

“Because insurers can no longer vary their offers of coverage based on applicants’ health status, the ACA established a risk adjustment program to equalize health-related cost differences across plans,” the study explained. “The ACA also established a temporary reinsurance program to subsidize high-cost claims.”

READ MORE: The Progress and Challenges of the Affordable Care Act

“Based on the experience within the structure of the Marketplaces, our results suggest that the risk adjustment and reinsurance programs were relatively well targeted in the first two years.”

The researchers focused their analysis on the individual markets, since the potential for risk selection is much greater when risk isn’t pooled across employer groups.

Results of the study found that payers who paid less in claims per enrollee ended up owed funds, losing money per enrollees. Payers that spent more on claims per enrollee received funds, netting profits instead of losses.

Payers that paid less in claims, ended up owed $48 per enrollee. Inversely, payers that spent more on their payments received $56 per enrollee due to ACA risk adjustments.

Reinsurance, or a partnership between payers to lower costs by sharing risk, improved the bottom line for many payers following ACA implementation.

READ MORE: Why Payers Should Reduce Cost Sharing for High-Value Care

Reinsurance payments were always positive, the researchers noted, and payers who had paid more enrollee claims saw their reinsurance revenues double over payers that neglected claims payments.

The study further elaborated on the before and after effects of risk-adjustment and reinsurance under the ACA.

For payers that had the lowest claims costs, or less than 47 percent of the state average, revenues exceeded claims $171 per enrollee per month on average. The reverse was true for payers with higher claims costs, or 193 percent of the state average, as claims exceeded revenues by $397 per enrollee per month.

After the revenues from ACA compliant risk-adjustment and reinsurance were factored in, the payers who had the higher claims costs started to experience positive revenue-to-claims ratios instead of negative ones.

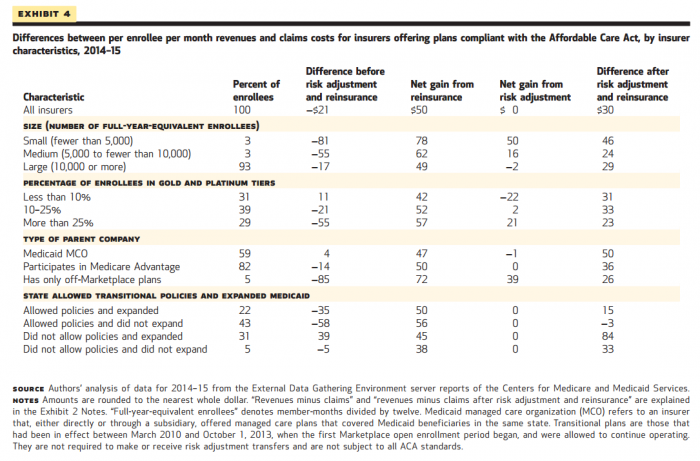

Payer attributes also played a role in determining revenues before and after ACA compliance. The team found that payers fewer than 5,000 full-year enrollees benefited the most from the ACA.

Source: Health Affairs

READ MORE: Joint Replacement Bundled Payment Cut Costs, Maintained Volume

Previously, this category of payers experienced losses of $81 per enrollee per month. Once ACA risk adjustment and reinsurance were implemented, these small payers saw positive revenues of $41 per enrollee.

Under the federal marketplace individuals can enroll in “gold” or “platinum” plans which offer the highest amount of coverage, no deductibles, and no cost-sharing subsidies, but also have the highest premiums. These plans had a significant effect on payer revenues.

Payers who had more gold and platinum enrollees in their programs experienced higher losses than payers who had less than 10 percent of their enrollees in gold or platinum plans.

The result of ACA risk adjustment and reinsurance provided payer groups positive revenues-to-claims ratios, ranging from $23 to $33 per enrollee, regardless of how many of the enrollees had gold or platinum plans.

“Before risk adjustment and reinsurance program revenues were incorporated, revenue claims differences varied from −$85 to $4 per enrollee per month depending on the insurer’s type of parent company,” the research team said.

“After those revenues were included, average revenue-claims differences were positive for all insurers, regardless of their type of parent company, and ranged only from $26 to $50. Furthermore, the rank ordering of revenue-claims differences did not change for the types of parent companies.”

Based on the findings of the study the researchers noted that healthcare policy makers, along with payer strategies, will have to adopt best practices for compensating risk-based payments.

“In the near term, health care costs, state policies, and enrollment patterns across plans will also change in ways that will likely necessitate continued scrutiny to ensure that costs related to health risk are being sufficiently compensated,” the researchers said.

“For example, CMS has finalized changes to the 2017 risk adjustment methodology, updating it to better reflect the costs of emerging treatments. CMS has also finalized changes to the 2018 methodology, such as incorporating additional information about health risk from prescription drug use, partially compensating insurers for very high claims costs, and accounting for enrollees’ duration of enrollment.”