AMA, AHA Find Health Insurance Mergers Harmful to Consumers

The AMA has determined that the health insurance mergers could both limit consumer access to healthcare coverage as well as the affordability of health plans.

- Many stakeholders are concerned about the potential implications of the Aetna and Humana acquisition along with the Anthem and Cigna merger. Having the top five major health insurers merge into only three payers could block access to affordable health insurance plans among American citizens. Even the American Medical Association (AMA) opposes the problems associated with these health insurance mergers.

The AMA’s stance on payer mergers

According to an AMA press release, the organization is working toward ensuring consumers have access to more affordable healthcare coverage plans. Consolidation with the health payer market is expected to lead to anticompetitive strongholds and the AMA has passed a policy opposing the health insurance mergers.

The Department of Justice has received letters from a number of organizations including the AMA stating their contention with the Aetna acquisition of Humana as well as the Anthem’s proposed acquisition over Cigna. In particular, the AMA is concerned about the negative impact on patient care and provider reimbursement that these acquisitions could hold, as it may potentially increase costs for the consumer.

“A lack of competition in health insurer markets is not in the best interests of patients or physicians,” AMA President Steven J. Stack, M.D., said in a public statement. “If a health insurer merger is likely to erode competition, employers and patients may be charged higher than competitive premiums, and physicians may be pressured to accept unfair terms that undermine their role as patient advocates and their ability to provide high-quality care. Given these factors, AMA is urging federal and state regulators to carefully review the proposed mergers and use enforcement tools to preserve competition.”

The AMA has analyzed data from peer-reviewed studies and experts’ statements and determined that the health insurance mergers could both limit consumer access to healthcare coverage as well as the affordability of health plans.

In particular, the AMA states that these health insurance mergers will break federal antitrust guidelines and lead to anticompetitive stances for the insurance market across 17 states and could reduce competition in “154 metropolitan areas within 23 states.”

“The AMA strongly opposes mergers that would erode competition and result in patients and employers paying higher premiums, and force physicians to accept unfair terms,” AMA Immediate Past Chair Barbara A. McAneny, M.D., stated in the press release. “We urge the federal government to prohibit any mergers that would limit patient choice in selecting health insurance plans to meet their care needs, or impede physicians from providing their patients with the quality care they deserve.”

The AHA opposes Anthem and Cigna merger

The American Hospital Association (AHA) sent a letter to William Baer, the Assistant Attorney General for the United States Department of Justice Antitrust Division, describing the organization’s stance on the health insurance mergers particularly the one between Anthem and Cigna.

The AHA letter explains that these health insurance mergers move far beyond that of any consolidation between two hospitals, as it would lead four out of five top insurers to merge into only three individual payers. This would cause significant barriers for other insurers attempting to enter the market, the letter states. The mergers would impact competition in the market as well.

“While some are comparing these acquisitions to those in the hospital sector, we submit that the antitrust issues for these transactions are fundamentally different. The size, scope and enduring impact of the announced deals far surpass any hospital merger. These transactions will combine four of the five national health insurance companies, with effectively no possibility that existing firms could replicate their size and scope,” the letter states.

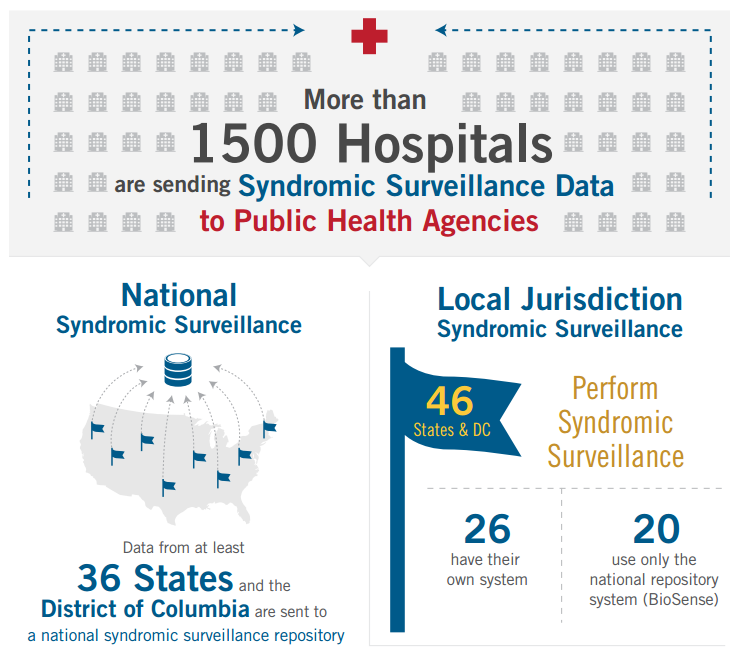

Additionally, there are very different reasons for attempting hospital mergers, the AHA mentions. Many hospitals and healthcare systems are moving toward mergers due to the reforms behind medical care including the embrace of value-based care and population health management. The infographic below from the Office of the National Coordinator for Health IT illustrates the hospital movement toward public health improvement.

The decline of fee-for-service models as well as the need for helping financially-constrained medical facilities better serve their communities are also driving hospital mergers. The health insurance mergers, on the other hand, may be more based on increasing revenue and profit, the AHA stated.

Essentially, the AHA letter asks the federal government agency to scrutinize the transaction as well as any remedy proposals in order to ensure that consumer rights are protected and antitrust laws are followed. Protecting competition within the health insurance marketplace is key, according to the American Hospital Association.

“A competitive commercial health insurance market is essential for access, affordability and innovation in the health care sector,” the AHA letter concludes. “Anthem’s proposed acquisition of Cigna presents a substantial risk to such competition on an unprecedented national scope. The AHA is confident that the Department will work to protect consumers by vigorously investigating the transaction.”

As previously reported, various political figures such as former Secretary of State Hillary Clinton find the health insurance mergers troublesome. Many fear these mergers will increase premium costs among consumers and impact access to healthcare coverage within more remote regions. Additionally, it is likely to decrease competition within the health insurance market.

The Department of Justice will need to inspect the details of these health insurance mergers in order to determine whether any antitrust laws are being broken or not. The Coalition to Protect Patient Choice has also stated its stance on the mergers and acquisitions taking place within the health insurance marketplace.

In particular, the Coalition to Protect Patient Choice believe these mergers will hurt consumers’ choice in selecting certain coverage plans, impact affordability of health insurance, and may even become a barrier for healthcare access. Many fear that the mergers will lead to higher premiums without any cost savings passed down to the consumer.

“These mergers should be challenged or patient choice will suffer. In fact, studies have shown previous health insurance mergers resulted in increases ranging from 7 percent to nearly 14 percent,” according to a press release from The Coalition to Protect Patient Choice. “The argument that health insurers drive down health costs has no impact on consumers – historically, no savings are passed along to consumers. Instead, insurance costs rise for employers, individuals and families.”