Can Healthcare Payers Inspire ACOs to Take on Two-Sided Risk?

Two-sided risk is difficult for most accountable care organizations (ACOs), but support from payers may help providers rise to the challenge.

Source: Thinkstock

- While two-sided risk arrangements are attractive for healthcare payers, even experienced accountable care organizations (ACOs) are wary of jumping into contracts which make them financially responsible for falling short of their quality benchmarks.

Two-sided risk, also known as downside risk, does tend to bring greater opportunities for rewards alongside the specter of failure, but private payers and the Medicare Shared Savings Program (MSSP) alike have had difficulty convincing their ACOs to make the leap.

While the number of upside-only accountable care organizations has grown 261 percent since 2012, according to the National Association of ACOs in 2016, two-sided risk arrangements have only increased by 62 percent over the same time frame.

At the start of 2017, more than 90 percent of MSSP ACOs were participating in upside-only tracks, although that was before the availability of the Track 1+ model, which includes limited downside risk but allows providers to attest as an Advanced Alternative Payment Model (APM).

But the pervasive reluctance to expose reimbursement streams to pay-for-performance risks may be a mistake, argues a new analysis by Avalere.

READ MORE: Two-Sided Financial Risk Model Reduces Socioeconomic Disparities

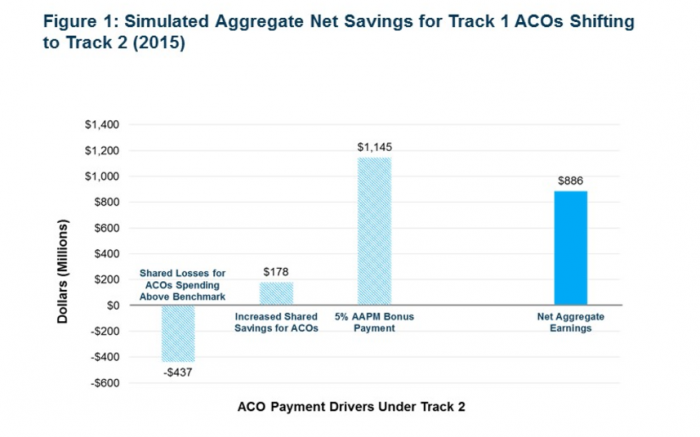

The study asserts that if all the MSSP ACOs participating in Track 1 during 2015 had joined the risk-bearing Track 2 instead – and qualified for the 5 percent bonus payment now available for successful Advanced APMs – they would have earned an additional $886 million in incentives.

Seventy-nine percent of Track 1 ACOs would have benefitted financial from the switch, says the report, while just 21 percent would have generated overall net losses.

Source: Avalere Health LLC

And under new CMS guidelines implemented in June of 2016, even more two-sided risk participants would have gained from taking the plunge.

“CMS’ new value-based payment incentives really tip the scales for doctors to assume greater financial risk,” said Josh Seidman, Senior Vice President at Avalere. “For those physicians who were dipping their toes in the water with low-risk ACO models, the incentives now make it advantageous for a majority of them to move more aggressively into greater accountability for population health.”

For commercial payers, the data hints at future possibilities for sharing risk more equally while still reducing overall care costs and improving quality.

READ MORE: The Role Risk Plays in Value-Based Care Reimbursement Models

Significant two-sided risk sharing is a relatively new development for modern accountable care organizations, and few providers are willing to stake their revenue and their reputations on perilous financial undertakings without solid proof that bonuses and incentives are truly within their grasp if they meet their clinical care goals.

As the ACO environment matures, shored up by strong regulatory frameworks like the Quality Payment Program and the continued evolution of the Medicare environment, providers will have access to more evidence that accountable care can work – and more industry best practices about how to make that happen.

Payers may be able to nudge ACOs along by fully equipping them with the data and resources they need to engage in population health management, preventive care, and internal performance benchmarking – without overwhelming organizations with a slew of burdensome reporting requirements.

“The first step [for ACO success] is for governmental and private payers to stop constantly piling new requirements upon the old,” stated a team of authors from Harvard Medical School and Northwestern University in a December 2016 perspective piece published in the American Journal of Managed Care.

“Then, together, payers and providers need to examine far more closely what works in the frontlines of care.”

READ MORE: Population Health, Risk-sharing Vital for Accountable Care

A collaborative approach to accountable care begins with sharing data, such as patient risk scores, satisfaction scores, and utilization rates, which can help providers pinpoint opportunities for improvement.

Claims data, typically held on the payer side of the equation, can help providers understand hidden areas of inefficiency, like unfilled prescriptions or a provider with a propensity for ordering too many expensive imaging tests, which may not be obvious from the electronic health record alone.

“Data is the lifeblood of the value-based payment environment,” former National Coordinator Vindell Washington, MD, and former CMS Acting Administrator Andy Slavitt, wrote in a recent blog post.

“Working together across the healthcare landscape, the nation can move towards a truly 21st century data infrastructure that frees clinicians to confidently transition to value-based payment and realize better care, smarter spending, and healthier people.”

Partnering on patient outreach and messaging, especially for chronic disease patients, is another way providers and payers can turn data to their financial advantage. If patients do not understand what resources are available or why they should access them, they are less likely to make informed, positive decisions about their care.

High patient satisfaction scores, which reflect consumers’ ability to receive the care that meets their needs, are a critical indicator of an ACO that is thriving in the risk-based environment.

Payers may be able to help providers collect key data about waiting times, communication and compassionate staff, shared decision-making, and other satisfaction metrics that can translate into actionable suggestions for how to improve the patient experience.

A supportive, accessible, and transparent payer relationship, along with growing industry evidence that risk-bearing can lead to success, may be just what providers need to move more deeply into two-sided risk arrangements.

While the industry is still some way away from embracing a fully-involved risk environment, slow but steady positive pressure on the health system, led by payers, is likely to be an important driver for bringing increased financial accountability to more provider groups.