CBO: Alexander-Murray Healthcare Bill Could Save $3.8B

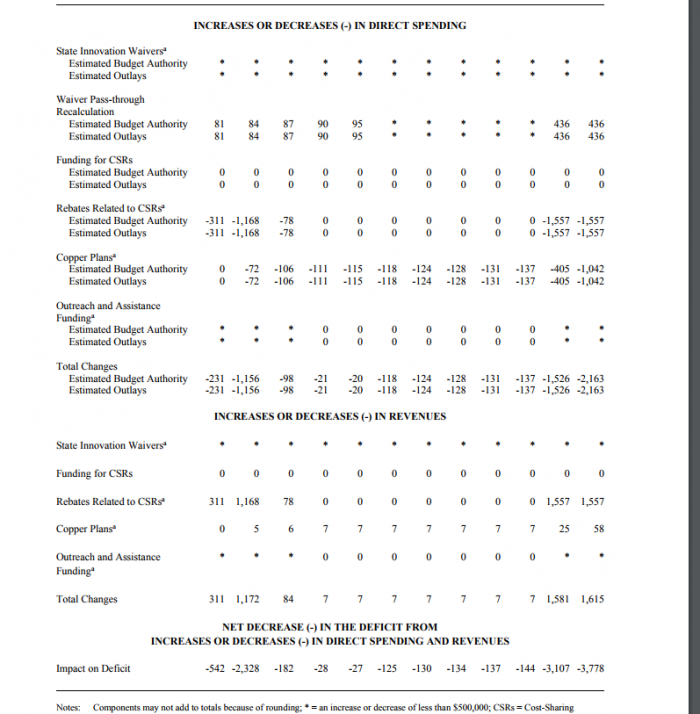

The Bipartisan Health Care Stabilization Act is estimated by the CBO to save the federal government $3.8 billion on spending.

Source: Thinkstock

- The Bipartisan Health Care Stabilization Act of 2017, also known as the Alexander-Murray compromise bill, would save the federal government $3.8 billion without drastically changing the number of individuals with health insurance, the Congressional Budget Office (CBO) estimates.

Provisions in the bill, such as funding cost-sharing reductions that subsidize the cost of low-income individuals on public health exchanges and increasing access to copper-tier plans, would decrease direct federal spending.

Conversely, the bill would allow states to receive 1332 waivers more easily, which would likely increase spending.

The CBO and the Joint Committee on Taxation (JCT) found the savings generated from keeping the CSRs in place, as well as the rebates earned from the CSRs, would offset other expected spending. The net result would be billions in reduced federal spending starting in 2018.

Source: Congressional Budget Office

Continuing to fund the CSRs is expected to reduce federal spending by $1.5 billion from 2018 to 2027 in the form of rebates from state governments and private payers. However, the CBO’s estimate determined that funding the CSRs again wouldn’t help lower premiums until 2019.

CBO estimates that the CSRs will be responsible for the largest reductions in federal spending among the provisions included in the Bipartisan Health Care Act.

The CBO score also determined that because the bill would increase copper plan offerings starting in 2018, and would place plan members as part of the single risk pool in the nongroup insurance market, premiums would decrease federal subsidies and lower spending by $1.1 billion from 2018-2027.

The estimate on copper-tier plans is based on the possibility that younger and healthier individuals will balance the single risk pool and stabilize premiums and healthcare costs.

CBO and JCT also estimate that the legislation would require state governments and private payers to follow an intergovernmental mandate and provide a certified health plan in order to receive CSR payments. The total cost of the mandates would fall under Unfunded Mandates Reform Act (UMRA) limits of $78 million for states and $158 million for private payers.

Decreasing the length of time involved for states to receive 1332 waivers is expected to raise spending by $436 million from 2018 to 2022. CBO generated this estimate based on potential faster waiver approvals of 90 days and 45 days in specialty instances where states could receive millions to create their own stabilization programs.