Consumer-Directed Care, High Deductibles Popular for Employees

Consumer-directed care and high deductibles have grown in popularity among members of employer-sponsored insurance plans.

Source: Thinkstock

- Consumer-directed care, high-deductible health plans (HDHPs), and financial benefits related to healthcare spending have increased in popularity and demand by employees from 2017 to 2018, according to a new report from Benefitfocus.

The State of Employee Benefits Report found that 70 percent of employers offered their employees at least one HDHP and have increased other financial benefits that support cost-effective healthcare decision making.

The authors of the report believe that employers feel an urgency to combat rising care costs through consumer-directed health plan features that put cost-effective healthcare decision making into employees’ hands.

“When it comes to employee benefits, today’s employers are tasked with balancing their need to rein in health care spending with their ability to attract, engage and retain top talent,” the report said.

“As the job market becomes more competitive and the workforce becomes more diverse, focusing on plan fit – the degree to which employees’ benefits align with their unique health and financial needs – is crucial to controlling costs without compromising coverage.”

READ MORE: How Payer Philanthropy Can Address Social Determinants of Health

HDHPs were an extremely popular choice among employees of all generation.

HDHPs were offered as either as a full plan replacement (5 percent of employers) or a supplement to a traditional health plan (65 percent of employers).

The average employer had 48 percent of employees enrolled in a PPO plan, 35 percent enrolled in a HDHP, 7 percent enrolled in an HMO, and 6 percent enrolled in another type of traditional health plan. Four percent of employees elected not to respond to the question.

HDHPs were more popular among Millennials (40 percent enrolled in an HDHP), followed by Gen-Xers (34 percent), Baby Boomer (29 percent), and traditionalists, who are employees born before 1948 (17 percent). This finding supports other data that indicates younger beneficiaries are more accepting of high deductibles and appreciate a financing design that uses lower premiums.

Employees with higher salaries in each generational category were more likely to enroll in an HDHP than employees with lower salaries, which may be a counterintuitive decision made by higher earners.

READ MORE: Health Insurance Costs Placing Stress on Majority of Americans

“In 2018, employees who elected an HDHP will earn a salary roughly $4,700, or 7 percent, higher on average than that of employees enrolled in a PPO,” the report said. “That gap is over two times wider than it was last year, as higher earners appear to increasingly favor HDHPs, while lower-wage workers identify PPOs—and their lower out-of-pocket exposure—as better suited to their needs.”

Higher earners may have more financial security, which could allow them to afford unexpected healthcare costs, or they may feel comfortable pairing their plan with a health reimbursement account (HRA) that allows them to save for healthcare costs overtime.

The average salary of an Baby Boomer enrolled in a HDHP was $100,000 per year. Baby Boomers enrolled in PPOs earned about $70,00 per year.

Employees are expected to pay lower premium contributions to employer-sponsored HDHPs and PPO offerings during plan year 2018, the report found.

HDHP enrollees are paying 42 percent less for their premiums than employees enrolled in a PPO. In 2018, the average annual employee premium contribution for individual HDHP insurance was $1,085.

READ MORE: High Care Costs Driving Employer-Sponsored Insurance Spending

For PPO-enrolled employees, the annual contribution was $1,544. The average annual employee premium contribution for HDHP family plans was $3,136. Annual PPO family premiums averaged $4,375 per year.

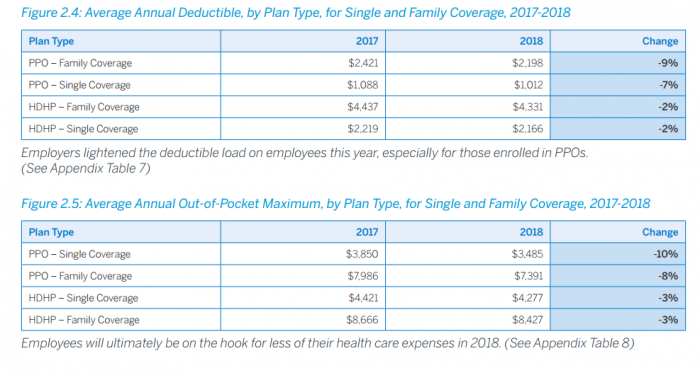

HDHPs have nearly double the deductible amount of PPO plans, but deductibles and out-of-pocket maximums dropped overall from 2016 to 2017.

Source: Benefitfocus State of Employee Benefits Survey

The average HDHP deductible amounts for 2018 plans were $4,133 per year for family coverage and $2,166 for single coverage, which were 2 percent decreases in each category from previous years. Out-of-pocket maximums for 2018 HDHPs were $8,427 for family coverage and $4,227 for single coverage, which were 3 percent decreases from prior years.

PPO deductibles for 2018 plans were $2,198 per year for family coverage and $4,227 for single coverage, which were 9 and 7 percent decreases from prior plan years. PPO out-of-pocket maximums were $7,319 for family coverage and $3,485 for single coverage, which were 10 and 8 percent decreases from 2016 totals.

A larger percentage of employees participated in the use of a health savings account (HSA) or a flexible savings account (FSA) from previous years says the report.

HDHP enrollee participation in HSAs jumped from 50 percent in 2017 to roughly 81 percent in 2018. Older generations were more likely to use an HSA and the average financial contribution made to an HSA increased from 2017.

Eighty-five percent of Gen-Xers in an HDHP participated in an HSA pairing, followed by 84 percent of Baby Boomers and 76 percent of Millennials. The average employee contribution to a single HDHP HSA is $1,419 per year, which was a 4 percent increase from last year. Average employee HSA contribution to a family HDHP is $2,881 per year, which was a 3 percent increase.

Total FSA participation is much lower than HSA participation, as 29 percent of eligible employees opened an FSA for plan year 2018. However, FSA participation increased from last year as only 17 percent of eligible employees opened an FSA account.

Employees also increased their participation in voluntary benefit offerings such as accident, critical illness, and hospital indemnity insurance.

Forty-two percent of employers offered one of these three voluntary benefits that help protect employees from unexpected health events.

Eight percent of all employers surveyed offered just one product, 16 percent offered two, and 18 percent offered all three types of voluntary benefits. The percentage of employers offering all three doubled from last year. Twenty-five percent of employees choose at least one of these benefits when offered by their employer.

The trends outlined in the report indicate that payers participating in the employer-sponsored market may want to support related health plan products with a high-deductible financing design, financial health reimbursement accounts like HSAs and FSAs, and other benefits that offer financial protections to employees.