Consumer-Driven Health Plans Reduce Medical Care Utilization

Research shows that consumer-driven health plans lead individuals to use fewer medical services while spending 1.5 times more on out-of-pocket costs.

- The Health Care Cost Institute released new findings that show consumer-driven health plans are leading individuals to utilize less medical care as well as spending more on out-of-pocket costs. Among consumer-driven health plans, enrollees spend 1.5 times more on out-of-pocket expenses than policyholders of other types of plans, according to a press release from the Health Care Cost Institute.

When looking at the specifics, enrollees of consumer-driven health plans paid $50 more on emergency room visits and $58 more out-of-pocket for primary care or specialist visits. Study results also show that these individuals used about 8 to 10 percent fewer healthcare services.

“As the costs of health care increase, consumer-driven health plans try to balance lower premiums with higher deductibles and higher limits on out-of-pocket spending,” HCCI Senior Researcher Amanda Frost said in a public statement. “As these types of plans grow in prevalence, it is important to look beyond premium dollars and also consider dollars spent directly on health care services.”

According to the study Consumer-Driven Health Plans: A Cost and Utilization Analysis, these type of health plans involve a high deductible along with a health savings account or a health reimbursement arrangement. The way these plans compare to more traditional commercial health plans is lower monthly premium costs in exchange for higher deductibles and maximum out-of-pocket limits.

Only when the deductible is met will health payers take responsibility for the extra medical costs that a patient incurs when on this health plan. The way health payers have positioned these type of plans is by creating more incentive among consumers to reduce unnecessary medical care utilization and reduce spending. Consumers are more likely to take part in these goals when they have more cost share of healthcare services.

The researchers from the Health Care Cost Institute looked at claims from more than 40 million people for privately insured people under age 65. Aetna, Humana, and UnitedHealthcare provided this claims data.

“By using actual payments from HCCI’s commercial claims data, we are able to put numbers on commonly held beliefs to better understand out-of-pocket spending and also the trends in health care use for consumers enrolled in consumer-driven health plans,” HCCI Executive Director David Newman stated in the press release. “As more employers offer consumer-driven health plans, it is critical to examine how they compare in practice to other types of health plans.”

The study looked at patients’ spending habits from the years 2010 to 2014 analyzing those with employer-sponsored health insurance versus those with consumer-driven health plans. In 2010, only about 15 percent of those studied had consumer-driven health plans but this number rose to more than 25 percent by 2014.

Due to the mere fact that people with consumer-driven health plans used medical care less frequently, the costs associated with these plans were lower as a whole. However, these consumers also faced higher deductibles, copays, and coinsurance.

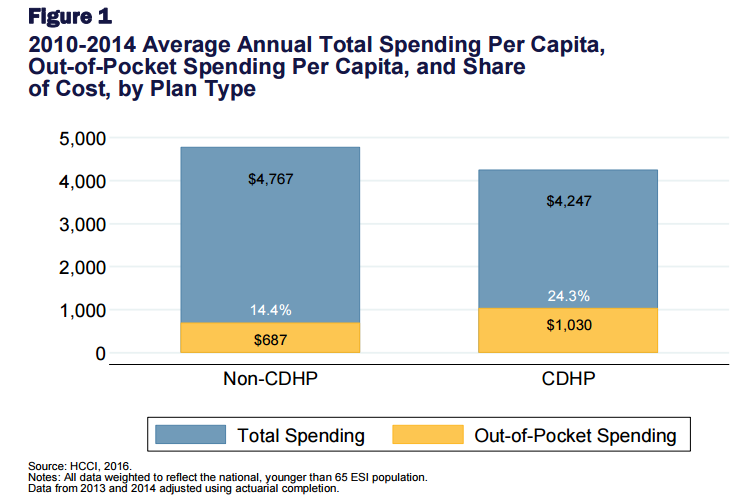

Enrollees of employer-sponsored health insurance were required to cover about 14 percent of their total healthcare costs while those with consumer-driven health plans covered as much as 24 percent.

Nonetheless, the results stated that those with consumer-driven health plans spent an average of $520 less per year while using about 10 percent fewer medical services than those with employer-sponsored coverage. Prescription drug use was also seen to be decreased among those with consumer-driven insurance.

“Across the study period, the CDHP [consumer-driven health plan] population had lower total per capita spending, as compared to that of the non-CDHP population. The CDHP population had, on average, annual per capita spending that was $520 less than that of the non-CDHP population,” the study stated. “That pattern of comparatively higher total spending for the non-CDHP population was observed for all health service categories and nearly all demographic groups. Those differences in total per capita spending arose in part from differences in utilization across the populations.”

Interestingly, the study also found that the population between 19 to 25 years old and had consumer-driven health plans actually used more medical services and had higher overall healthcare spending.

Healthcare payers can use this data to learn more about how consumers act when having different insurance options. By learning how certain health plans affect consumer behavior, health payers could work toward reducing medical spending along with unnecessary, wasteful services such as redundant testing.

Dig Deeper:

Top 3 Ways Payers and Providers Can Reduce Claim Denials

New York, California Enact Rulings Against Surprise Medical Bills