Enrollment through Health Insurance Exchange Continues to Rise

Currently, there is clearly high demand for coverage through the health insurance exchange and the automatic renewal process aids in simplifying continual enrollment.

- The deadline to apply for healthcare coverage through the federal health insurance exchange – healthcare.gov – is this Sunday, January 31. Currently, approximately 8.9 million people have either enrolled in a health insurance plan or had their insurance automatically renewed through the exchanges, according to the Centers for Medicare & Medicaid Services (CMS).

This past week, the amount of insurance plans selected totaled 103,172 while net new plan selections hit 144,971. However, the enrollment numbers and amount of plan selections may vary as time goes on due to cancellations and changes in insurance plans. Throughout the year, life events like getting a new job or getting legally married could also impact what type of coverage individuals choose.

For the 2016 open enrollment period, there has been a rise of at least 2.5 million people that have signed up for healthcare coverage through the health insurance exchange since last year only around 6.4 million people were signed up for health plans through the marketplace. For those who have not yet ensured medical insurance coverage for the coming year, there are still three days left to sign up.

“The clock is ticking with just four days left before January 31, the final enrollment deadline for 2016 health coverage,” U.S. Secretary for Health and Human Services, Sylvia Burwell, said in a public statement yesterday. “We are focused on making sure people know that financial help is available, the deadline is fast approaching and that we’re here to help them enroll – so that they don't risk having to pay a penalty of $695 or more for not having health insurance.”

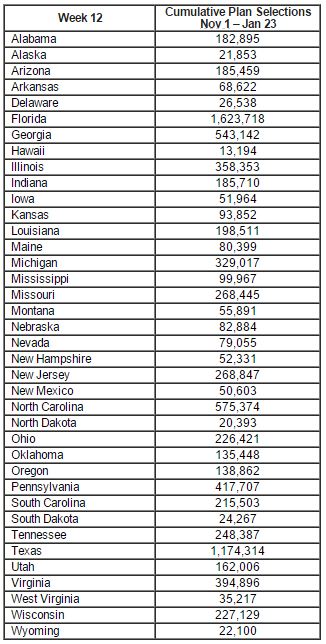

The states with the highest enrollment numbers or cumulative plan selections include Florida, Georgia, Illinois, New Jersey, Ohio, North Carolina, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, and Wisconsin.

Currently, there is clearly high demand for coverage through the health insurance exchange and the automatic renewal process also aids in simplifying continual enrollment. At this point, more than seven out of ten people who were signed up for coverage through the health insurance exchange last year have renewed their plans.

The Las Vegas Review Journal also reported the enrollment numbers in Nevada, which is at approximately 80,000 beneficiaries. Automatic renewals are also part of the numbers enrolled and Nevada Health Link seems to have surpassed last year’s enrollment numbers of about 72,000.

Any nonexempt individuals in the United States who don’t have health insurance coverage as of January 31 will face a tax penalty of $695 per adult, $347.50 per child, and a household maximum of $2,085, the publication mentioned.

“It’s hard to believe that less than 6 years ago, Americans could be denied health coverage due to a preexisting condition, women were often charged more than men for their insurance premiums simply because of their gender, and preventive care, including annual wellness visits and personalized prevention plans, was not free. By enacting the Affordable Care Act in March of 2010, President Obama put an end to these, and many other practices, ushering in a new era for our nation’s health care system,” a release from the White House stated.

“As we approach the sixth anniversary of the law’s enactment, nearly 18 million Americans have gained health care coverage and this third Open Enrollment is record-breaking. The uninsured rate has also dropped by 45 percent, making this our nation’s lowest uninsured level ever. This figure reflects, in large part, the hard work and leadership on part of state and local elected officials across the country in getting their communities informed and enrolled.”

While the number of people who are obtaining coverage through the federal health insurance exchange is rising, the rates are nowhere near where federal agencies predicted in past years. The Congressional Budget Office, for example, decreased its estimate significantly earlier this week regarding the number of people that would receive coverage through the public marketplaces over the coming year, according to The New York Times.

The prediction fell from 21 million to the lower 13 million in the annual budget report from CBO. Additionally, the agency decreased the number of people expected to receive federal subsidies on the health insurance exchange, which cover the cost of premiums for plans obtained through the marketplace.

The Congressional Budget Office anticipates that 11 million people per month will receive subsidies in 2016, which is a drop from the prior prediction of 15 million individuals. The reasons that these numbers are not as high as initially predicted is due to the expectation that forming the health insurance exchange would have led employers to drop insurance plans only leaving employees to purchase coverage through the marketplaces.

However, this has not occurred in any significant quantities, so there may be more people remaining on company health plans instead. Other reasons for the enrollment expectations not panning out is due to people finding coverage through other means and some failing to keep up with their cost of premiums.

“Most of the unsubsidized people who are no longer expected to purchase insurance through an exchange are expected to purchase insurance directly from an insurer instead,” according to the CBO report.

The Secretary of the Department of Health and Human Services Sylvia Mathews Burwell stated her expectations of about 10 million people enrolling through the health insurance exchange over the coming year. Those who have not enrolled in health insurance coverage for 2016 should do so within the next few days or else risk a tax penalty.

“Millions of Americans will start 2016 with the quality and affordable health coverage they want and need to keep their families healthy and financially secure,” HHS Secretary Sylvia Burwell said in a public statement.

“We are encouraged by the strong start we experienced in the first half of Open Enrollment for 2016 coverage, and know we have ongoing work to do. We are focused on making sure families looking for coverage understand their options through the Marketplace, know about the financial assistance available, and have access to the support they need to enroll.”