Health Plan Solutions: Do Employers Choose Private Exchanges?

With the costs of health insurance premiums and deductibles rising in recent years due to the ACA, more employers are searching for health plan solutions that would reduce their overall spend.

- Today employers are searching for multiple solutions to meet their health plan needs in order to reduce costs and provide the optimal benefits to their employees. The multitude of healthcare regulations hitting the market today is making quite an impact on employers when it comes to picking the right health plan solutions.

For instance, businesses have been affected by the Affordable Care Act especially when it comes to the employer mandate and the Cadillac Tax. With the costs of health insurance premiums and deductibles rising in recent years due to the ACA, more employers are searching for health plan solutions that would reduce their overall spend.

Some potential methods that employers have been using including adopting narrow network plans, investing in accountable care organizations, and considering the private insurance exchanges, said Jenny Kerr, Senior Analyst at Decision Resources Group, in an exclusive interview.

“[The Affordable Care Act is] definitely all driving them towards cost-cutting measures of some sort including narrow-network plans, the private exchange, ACOs, reference-based pricing, and bundled payment arrangements that some large employers have where they specify a hospital for a surgery. All of these are basically the way they’re driving towards lowering those costs,” Kerr stated.

“Benefit plan design changes is the first one that most employers are doing as well as looking at a narrow network. In some cases, there are a lot of large employers who never would have considered this – a narrow network was totally not something they would have been interested in.”

“Narrow networks and high-deductible plans are definitely what a lot of employers in 2015 were pursuing. Consumer-driven plans and HRA health savings account plans are also being sought,” continued Kerr.

“If you get to the more innovative and larger employers who are really studying this and looking at different strategies they can implement, then you see more innovative things that they’re doing. Some of them are contracting directly with a health system for an ACO.”

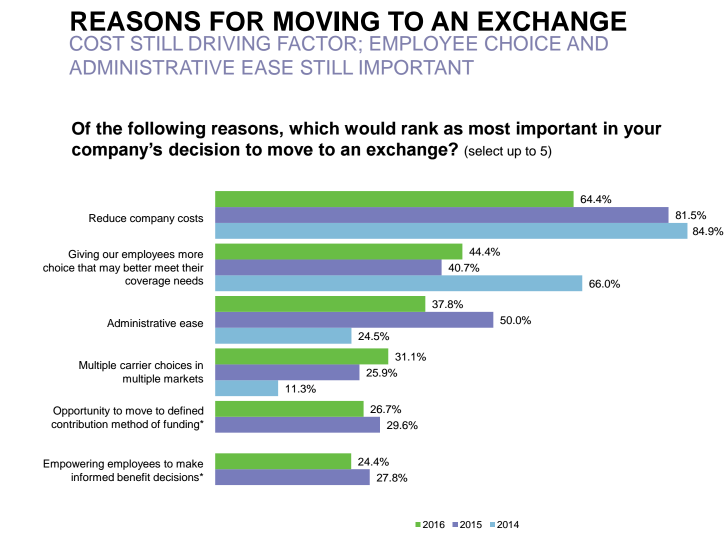

Along with narrow network plans, Pacific Resources released a survey exhibiting how some employers are moving toward private insurance exchanges. The results show that, in 2016, about 65 percent of respondents indicated that reducing company costs is the top reason to consider moving to an exchange.

Additionally, nearly 45 percent of respondents indicated that providing employees with more choices and health plan solutions is another top reason to consider moving to an exchange. When it comes to active employee decisions, however, more than 70 percent of surveyed employers stated having no interest in evaluating private exchanges or pursuing exchanges upon evaluation.

The survey also uncovered that, in 2016, many employers - 57 percent - are not at all confident that private insurance exchanges will offer a worthwhile option to their current method of covering the health insurance needs of their active employees.

Out of all surveyed respondents who decided not to move forward with private insurance exchanges, about 85 percent stated “unproven cost savings” as their reasoning. Also, 54 percent said that employee disruption was a prime reason for not pursuing private exchanges.

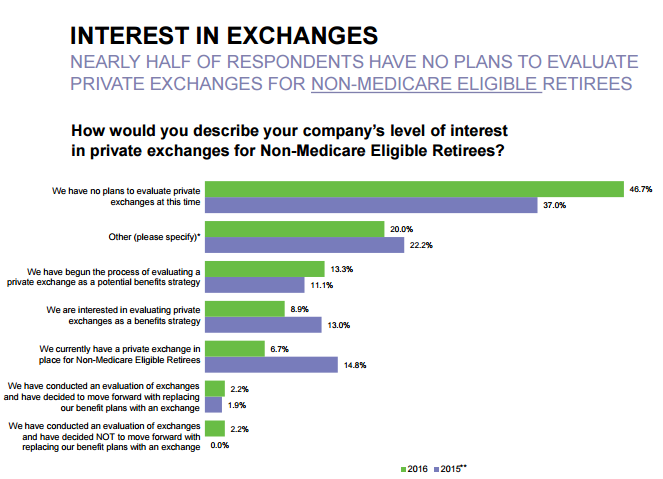

Out of all active employees, only 2 percent of this population is using a private exchange while 11 percent of Medicare eligible retirees have acquired health plan solutions on private insurance exchanges. In terms of non-Medicare eligible retirees, only about 27 percent of surveyed employers have stated that they are either in the process of evaluating private exchanges or have invested their resources in operating through an exchange.

It seems that most employers are looking to remain with their current health plans. The private exchanges are not the only ones without its troubles. The health insurance exchanges sponsored by the Affordable Care Act also seem to be experiencing issues among health payers.

For instance, the major insurer UnitedHealthcare is looking to drop out of the majority of state-based insurance exchanges starting next year. This is due to the monetary losses it has experienced selling policies on the exchanges.

The Brookings Institution stated that policymakers will need to use the provisions under the Affordable Care Act to strengthen the health insurance exchanges by diversifying risk pools and boosting market competition. Payers themselves will need to innovate in health plan design, network management, and improve the risk profiles of their members in order to remain successful in the market and especially when selling plans through the exchanges.

In order to ensure that more employers find a real benefit to pursuing private exchanges, health payers and policymakers will need to invest their time and resources in making these health plan solutions more cost-effective for businesses.

Image Credits: Pacific Resources

Dig Deeper:

Insurer Participation in Health Insurance Exchange Decreases