Hospitals Lagging Behind in Population Health Management

A study released by the healthcare consulting company Numerof & Associates illustrates that the majority of medical providers are still behind in integrating population health management.

- As most health payers know, population health management and value-based care payments go hand-in-hand. When it comes to effective population health management, data storage and analysis plays an integral role among payers and providers.

As payers continue to strive to meet the goals of the Affordable Care Act, they find themselves partnering with healthcare providers to develop value-based care reimbursement and population health management strategies.

IDC Health Insights Research Director Deanne Primozic Kasim told EHRIntelligence.com that, along with Medicare, various commercial payers are now forming their own accountable care models and using data analysis to determine value-based payments for each provider.

The fact that more payers and providers have been partnering to form ACOs and utilize population health management strategies has led to a significant growth for the population health market. Markets and Markets predicts that the population health management space will hit $31.36 billion by 2020 with an annual growth rate of 23.2 percent.

Nonetheless, a study released by the healthcare consulting company Numerof & Associates illustrates that the majority of medical providers are still behind in integrating population health management within their practice, according to a company press release.

“U.S. healthcare organizations are entering a period of greater change and disruption than any industry this side of taxicabs,” Dr. Rita Numerof, the firm’s President, said in a public statement. “However, our study finds that most providers are still just testing the waters with these models and to date there’s still far more talk than action when it comes to population health management.”

Responses from more than 300 healthcare executives does show general agreement regarding the necessity of population health management for overall success within the industry. The survey shows how health payers are transitioning from fee-for-service payment arrangements toward a more value-based care reimbursement model.

Numerof & Associates partnered with the Jefferson College of Population Health to conduct this study. Out of all polled executives, 54 percent stated that population health management is “critically important” for the effectiveness of their organization in the coming years. Additionally, almost all – 97 percent – claimed that population health was at least “somewhat important” for their medical facility.

Nonetheless, most answered that 20 percent or less of their reimbursement aligns with population health measures. This shows that value-based care, while increasing in popularity among payers, may not be as prevalent among hospitals and clinics as of yet.

“The traditional players in the payer, provider and manufacturer spaces are wrestling simultaneously with not just the question of how to change – but how fast,” Michael Abrams, Managing Partner of Numerof, stated in the press release. “A select set of leaders are making real progress, but overall we’re still a long way from where we need to be.”

For example, the survey found that 58 percent of respondents feel payers are more than “somewhat willing” to partner through cost/quality risk contracts. However, about 67 percent of respondents stated that their organization is average or worse at managing “variation in cost.”

The news release also mentions how transformation and reform in the arena of population health comes down to the culture and drive of a medical organization. Facilities with a more “focused approach” and strong physician leadership were further along in implementing population health management within their organization.

“We expect the push to value will only continue to accelerate, while the ‘wait and see’ approach that many organizations have adopted is highly risky,” Numerof concluded.

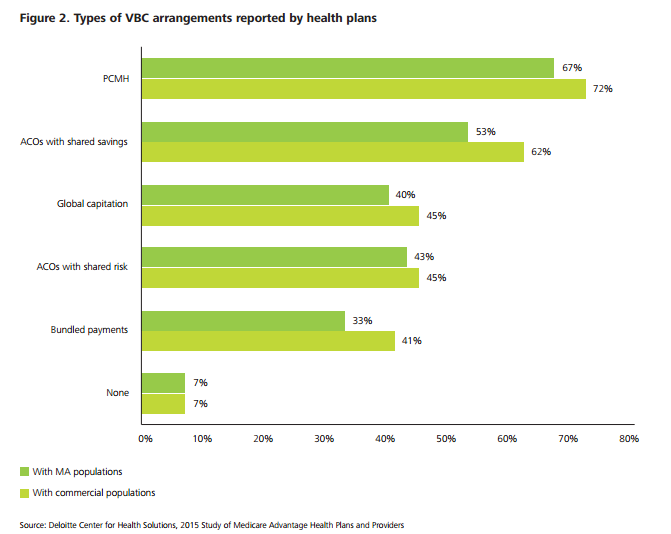

In addition to a lag found within population health management, value-based care arrangements are still not progressing as quickly as hoped among Medicare Advantage health plans, according to a study from Deloitte.

Deloitte’s 2015 Study of MA Health Plans and Providers shows that there is untapped potential for value-based care in the Medicare Advantage market. The real issue at hand is that value-based care arrangements are conducted on a much smaller scale. Most Medicare Advantage health plans do participate in some type of value-based care initiative such as the patient-centered medical home.

“The PCMH [patient-centered medical home] model strengthens health plans’ relationships with physicians and enables better coordination around care management and closing gaps in care,” the report from Deloitte stated.

“These benefits are, perhaps, why health plans have high PCMH adoption rates. PCMH arrangements allow health plans to work with physicians to capture member conditions and acuity and drive Medicare Star ratings. Required health risk assessments have a dual purpose of helping health plans to identify newly enrolled members or those due for an annual wellness visit and to encourage members to see their primary care provider (PCP). Health plans actively encourage PCPs to carefully evaluate and document members’ conditions during these visits.”

However, traditional Medicare plans report more value-based care opportunities than that of Medicare Advantage plans. However, due to the “disease burden” seen in this population, utilizing value-based care payment models could lead to quality improvements and reductions in healthcare spending.

The report from Deloitte also found that regulations and incentives from the federal government such as the Medicare Star Ratings bonuses will drive payers to incorporate value-based care payment models. Pushing forward value-based care will lead to quality improvements across the healthcare delivery system as well as achieve stronger provider-payer collaboration.

The results show that providers are wary of value-based care arrangements in terms of costs and clinician satisfaction. Due to this, many have not pursued risk-based contracts with payers. As this moment in time, it looks like health insurers have not effectively convinced providers to pursue value-based care for Medicare Advantage beneficiaries.

The future will show whether population health management and value-based care will gain greater adoption among payers and providers alike.