How Payers Can Improve Websites of Health Insurance Exchanges

“What we’ve seen over the past several years is that, while the exchanges have made considerable upgrades to their websites since the initial 2014 roll-out, there’s still substantial room for improvement.”

- In order to better serve their customer base, state health insurance exchanges along with the federal website HealthCare.gov could take a number of steps to improve their web pages and expedite the purchasing of health insurance plans.

The Clear Choices Campaign released a white paper today called 2016 Health Insurance Exchanges: The Good, the Bad, and the Ugly, which details methods that experts can incorporate when updating the websites of the health insurance exchanges.

Currently, nearly 10 million people around the United States, most of whom receive subsidies, purchase health coverage through state-based and federally-facilitated health insurance exchanges. As such, it is vital for the best available plans for each individual to be clearly spelled out and user-friendly options to be incorporated within website design.

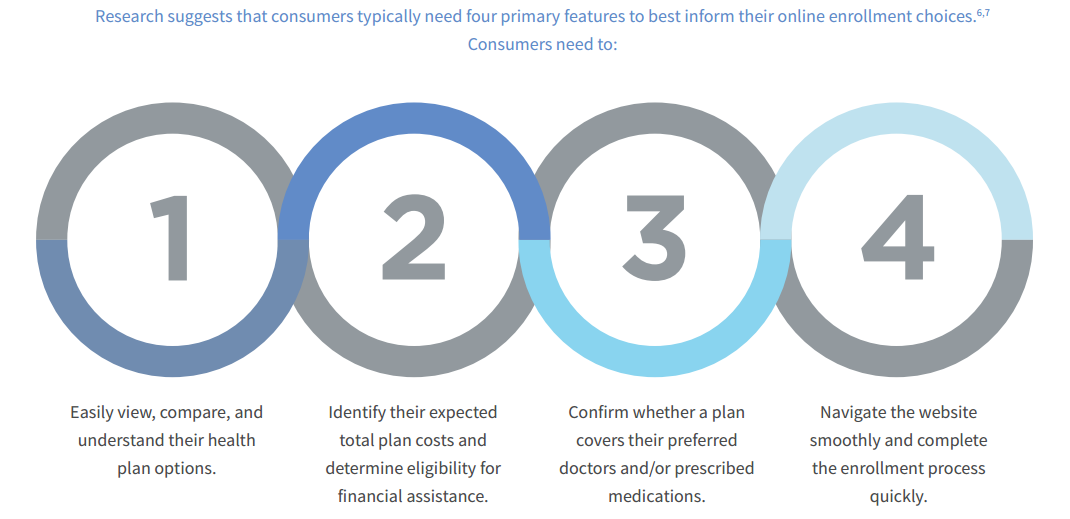

There are four steps that consumers need when purchasing healthcare coverage, the white paper suggests. These include: (1) a simple way to view and compare health plan offerings, (2) system for identifying total plan costs and any financial assistance options, (3) shows information on coverage for consumers’ preferred physicians and prescribed drugs, and (4) a quick and user-friendly enrollment process.

“While the exchanges have made considerable upgrades to their websites since the initial 2014 rollout, there is still substantial room for improvement,” Clear Choices President Joel White said in a public statement. “Despite the existence and use of private sector technologies like integrated provider network and drug formulary directories, consumer decisions are hampered – needlessly – by websites that do not go far enough to help them make the best possible coverage decisions.”

One piece of advice that could bring consumers more benefit is developing a customized window-shopping tool in which the customer can look at separate health plans and compare their options before having to create a user account and offer personal information. This is different from the current system in which the first step that consumers are forced to take is to create a user account before even seeing health plan costs.

Additionally, the white paper suggests the creation of a comparative plan display page within the online-based health insurance exchanges. Often the current sites only rank health plans based on premium costs and do not factor in deductibles, cost sharing, or coverage networks – some key pieces of information for patients with chronic diseases as well as the standard consumer.

It is more useful for the display page to incorporate total out-of-pocket costs for each health plan as well as allow consumers to customize the display page based on their preferences like deductibles or physician and prescribed medication coverage information.

The white paper also suggests developing a superior out-of-pocket cost calculator to be used on the websites of the health insurance exchanges. These calculators would be used to determine the value of deductibles, premiums, cost sharing, and other health plan costs. A vital point the white paper also mentions is the need to integrate user-friendly website language and navigation system.

During a media conference call, Amit Rao, the white paper author and Senior Policy Analyst and Manager of Government Affairs at the Clear Choices Campaign, spoke about policy recommendations that would improve the consumer experience when enrolling in new health plans via the health insurance exchanges.

Other panelists included Joel White, President of Clear Choices Campaign, Jeff Smedsrud, Chief Executive Officer and Founder, HealthCare.com, and Andrew Schwab, Senior Legislative Representative of the AARP.

“[We attempt] to provide better tools for consumer to empower them to make informed decisions, get better data and more data out in the system to power those tools, and to create more competitive markets to use those tools in,” White began. “Matching consumers to plans that fit their financial, medical, and geographic circumstances will create a stable and value-driven marketplace.”

“The Affordable Care Act’s insurance exchanges are tasked with providing the tools that consumers need to maximize the value of their insurance choices,” White continued. “What we’ve seen over the past several years is that, while the exchanges have made considerable upgrades to their websites since the initial 2014 roll-out, there’s still substantial room for improvement.”

“Most of the websites did a lot better this year than last year… We see better tools around streamlined navigation, faster websites with reduced technical errors, and enhanced window-shopping tools,” the Clear Choices President mentioned. “The downside is that the websites continue to display plans in ways that don’t make sense for consumers particularly financially.”

“In addition, cautionary reductions are not always emphasized. A low-income individual might actually get information that leads them to a bad decision financially and lines up a plan for them that may not make sense compared to a silver option,” White clarified.

Mentioning the white paper, Rao explains, “We designed scorecards and criteria to mirror our key areas of policy focus and recommendations. We outline seven principled areas such as the window-shopping tool, smart comparative plan display page, and the out-of-pocket.”

“We tried to line up our recommendations with each of the exchanges [when creating the scorecards],” Rao stated.

“HealthCare.gov, unfortunately, is still default ordering to premiums, which means you’re not getting an accurate picture of total out-of-pocket costs,” White lamented. “You can’t put in granulized consumer preferences such as this aspect of a plan – say an HMO versus a PPO – is more important to me. It doesn’t allow you to sort based on plan type. This needs to be an aspect of HealthCare.gov.”

Currently, the insurance exchanges’ websites do not offer customizable options relating to an individual’s medical conditions whether that be coverage for a particular prescribed medication or monthly visits to a mental health professional.

“On the provider directory, HealthCare.gov does not allow you to filter to see plans who don’t cover your doctor,” White continued. “Some of the other exchanges absolutely allow you to do that. On the drug directory side, it provides the information but it doesn’t provide coverage or tier information.”

It will tell me perhaps my drug is on the formulary, but it doesn’t tell me whether it’s $5 out-of-pocket or $1,000 out-of-pocket. For consumers that’s a significant difference.”

“In general, the key takeaway is that healthcare is highly individualistic. What’s going on with you is going to be very different from what’s going on with me. The websites that did very well allowed people to enter in very specific information related to their individual circumstance,” White concluded.