How the Affordable Care Act Impacts First Quarter Earnings

Despite some growth seen during the first quarter of 2016, the insurer UnitedHealthcare is looking to leave the health insurance exchange established by the Affordable Care Act.

- The health insurance industry has had a topsy turvy time learning how to function effectively in the new landscape the Affordable Care Act has brought to the medical field. When it comes to the financial well-being of top payers, the Affordable Care Act’s health insurance exchange has definitely had an impact. Recently, the major insurance companies UnitedHealth Group, Aetna, and Anthem reported their first quarter earnings for 2016.

UnitedHealth Group

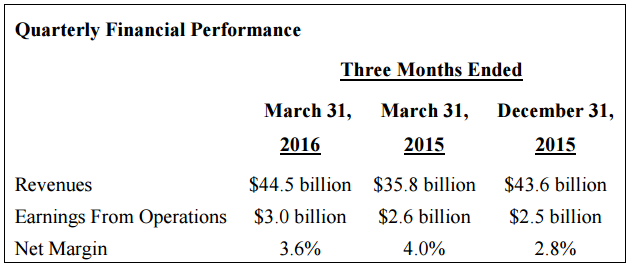

The first quarter results from UnitedHealth Group have led the company to predict its total 2016 revenue to be about $182 billion, according to a news release. The first quarter 2016 earnings totaled $44.5 billion for UnitedHealth Group.

The news release reports that the first quarter revenue rose 25 percent year-over-year. Another important finding is that the health insurance company has hired two million additional workers domestically over the last annual cycle. For 2016, adjusted net earnings are expected to be anywhere from $7.75 to $7.95 per share.

The 2016 first quarter results show that UnitedHealthcare’s earnings did grow 10 percent. When compared to the first quarter results of 2015, UnitedHealth Group’s revenue rose from $35.8 billion to $44.5 billion. Despite some growth seen during the first quarter of 2016, the insurer UnitedHealthcare is looking to leave the health insurance exchange established by the Affordable Care Act since selling health plans through the exchange has led to profit losses.

Aetna

The health payer Aetna reported in a news release that its 2016 first quarter operating revenue totaled $15.7 billion. Operating revenue for each share was around $2.30 during the first quarter as well. Additionally, first quarter operating earnings for 2016 ended up being $810.8 million.

“We started the year on a positive note, carrying over momentum from 2015 where we generated record annual operating earnings and revenues,” Mark T. Bertolini, Aetna Chairman and CEO, stated in the news release. “Based on first quarter results, we increased our full-year 2016 operating earnings per share projection to a range of $7.90 to $8.10.”

“We believe we remain on track to close our acquisition of Humana in the second half of 2016, which will help enable us to offer consumers a broader choice of products, access to higher quality and more affordable care, and a better overall experience. We have obtained approximately two-thirds of the necessary state change of control approvals required to close the transaction, and we continue to cooperate with the Department of Justice as we move toward a combined organization that will accelerate our efforts to build a healthier world.”

The results also show that operating expenses hit $2.8 billion during the first three months of 2016. More importantly, net income for Aetna was $726.6 million for the first quarter of 2016, which is a reduction from 2015’s first quarter net income of $777.5 million.

“We are encouraged by our first quarter results and our improved 2016 outlook, particularly at this early stage in the year,” said Shawn M. Guertin, Aetna executive vice president and chief financial officer. “Our operating results reflect the ongoing execution of our growth strategy, and our financial position, capital structure and liquidity all continue to be very strong.”

However, for the large case pensions segment, there was an operating loss seen at Aetna during the first three months of this year. The operating loss for large case pensions was around $300,000. This is in stark contrast from the first quarter of 2015, which saw operating earnings of $2.1 million in this particular segment.

Anthem

The major health insurer Anthem also reports its 2016 first quarter results. First quarter net income for Anthem was $703 million or $2.63 per share, according to a company press release.

An extra one million members enrolled in health plans offered through Anthem. Medical enrollment has been rising for this company and is expected to continue growing.

“Our solid first quarter results represent a strong start to 2016 with higher than expected enrollment growth in both Commercial and Government business segments. We remain firmly focused on advancing affordability and quality on behalf of our members, which will be enhanced by the pending Cigna acquisition,” Joseph Swedish, President and Chief Executive Officer at Anthem, said in a public statement.

Operating revenue for Anthem reached about $20.3 billion in the first three months of this year while operating cash flow hit $1.3 billion. Anthem also paid a quarterly dividend of $0.65 per share during the first quarter.

“We are pleased with our financial performance in the first quarter and believe it positions us well for the remainder of the year. Our results reflect continued execution across our business segments as the industry continues to evolve,” Wayne DeVeydt, Executive Vice President and Chief Financial Officer, stated in the press release.

As the health insurance industry continues to adjust to the influx of regulations from the Affordable Care Act, payers are likely to keep seeing various spikes and downfalls in their earnings over the coming years.

Image Credits: UnitedHealth Group