Insurance Coverage Rates Dip by 12% Due to High Premium Costs

A growing number of consumers ineligible for premium subsidies are experiencing high premium costs, which is leading to declines in individual health plan enrollment.

Source: Thinkstock

- Individual health plan enrollment between 2017 and 2018 fell by 12 percent as high premiums and a scarcity of subsidy assistance force consumers out of the market, according to an analysis from the Kaiser Family Foundation (KFF).

Health plan disenrollment was more apparent in the off-exchange market, where individuals do not receive advance premium tax credits (APTCs) to help subsidize health plan premiums. Since 2016, the off-exchange market has been the largest contributor to individual plan disenrollment rates.

“Total individual market enrollment began to decline in 2017 and has continued to fall in the first quarter of 2018,” KFF said. “Total individual market enrollment declined by 2 million people from the first quarter of 2017 to the first quarter of 2018. All of this decline was in the off-exchange market, which fell by 2.3 million people (38 percent).”

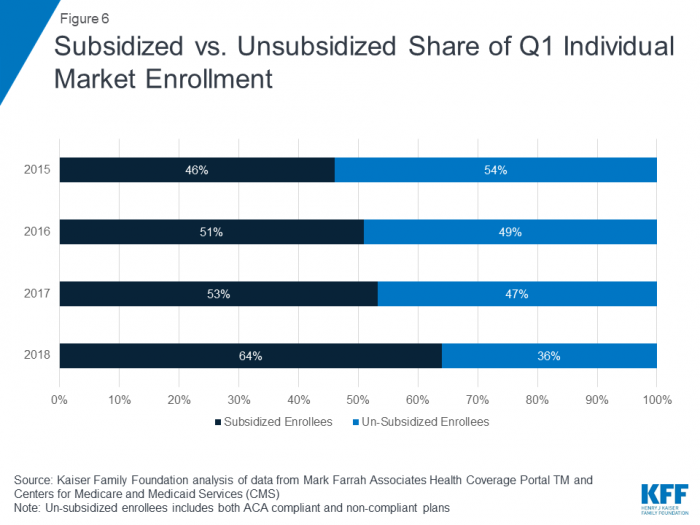

Currently, the individual insurance market primarily consists of on-exchange consumers that receive subsidies. In 2018, 64 percent of the individual health plan market receives premium subsidies while 36 percent does not.

Source: Kaiser Family Foundation

Rising individual premiums are also driving off-exchange health plan customers to disenroll from their plans, KFF found.

In 2018, the average monthly premium is about $490 per beneficiary. Since 2011, premiums have doubled as the individual health plan risk pool has become less healthy and more expensive to treat.

“The decline in individual market enrollment coincides with significant premium increases in 2017 and 2018,” KFF said. “In the early years of the ACA exchanges, insurers underestimated how sick the new risk pool would be and set premiums too low to cover their claims. A number of insurers then exited the market and the remaining insurers raised premiums substantially on average to match their costs.”

KFF expects that the individual market will continue to enroll a stable amount of low-income enrollees because these members will still be able to earn APTCs.

“The availability of premium subsidies – which rise along with premiums – is likely sufficient to keep the individual insurance market financially sustainable in the face of policy changes and enrollment declines,” KFF said. “However, based on the current trajectory, the market is likely to be increasingly dominated by lower-income people and those with pre-existing conditions.”

The individual health plan market will likely develop an overwhelming majority of low-income, high-risk enrollees, while healthier or higher income beneficiaries will not be able to afford premiums, KFF concluded.

“While the majority of people on the exchanges receive subsidies and will be protected from premium increases, middle-class people who do not qualify for subsidies will feel the brunt of future premium increases,” KFF said. “This is especially true of people with pre-existing conditions who likely would not qualify for short-term plans that base eligibility and premiums on people’s health.”

Subsidies can help state insurance markets drive individual plan enrollment, but policymakers at the state and federal level may need to consider other efforts to help consumers in the off-exchange markets to afford health plans.

Commercial payers offering individual health plans may experience other challenges in providing affordable insurance to all beneficiaries, based on current policy actions. Federal efforts to remove cost-sharing reduction payments and the individual mandate may increase consumer costs and payer expenses when offering individual plans.