Large Variations Seen in Consumer Healthcare Spending

Out-of-pocket healthcare spending is highly varied between different groups and provides stakeholders detailed insight on consumer healthcare costs.

Source: Thinkstock

- As healthcare costs rise, beneficiaries will be more responsible for out-of-pocket healthcare expenses not covered by their health plans. But those costs drastically vary by state, family size and income, and other variables, according to a report from JPMorgan Chase.

Rising out-of-pocket costs can create financial hardship for potential healthcare consumers. To counteract this trend, payers, policymakers and other healthcare stakeholders must focus efforts on managing the growing costs of healthcare. Out-of-pocket spending data from 2016 can provide payers context on the groups that spend the most on healthcare services.

“For every dollar spent on healthcare, families paid 11 cents out-of-pocket and 28 cents after including insurance costs,” the JPMorgan Chase Institute reported.

“While the Centers for Medicare and Medicaid Services projects health spending to continue to grow faster than GDP through 2025, the future of family-paid healthcare costs also rests with policy choices currently being debated. Out-of-pocket costs are a key piece of that picture,” the organization continued.

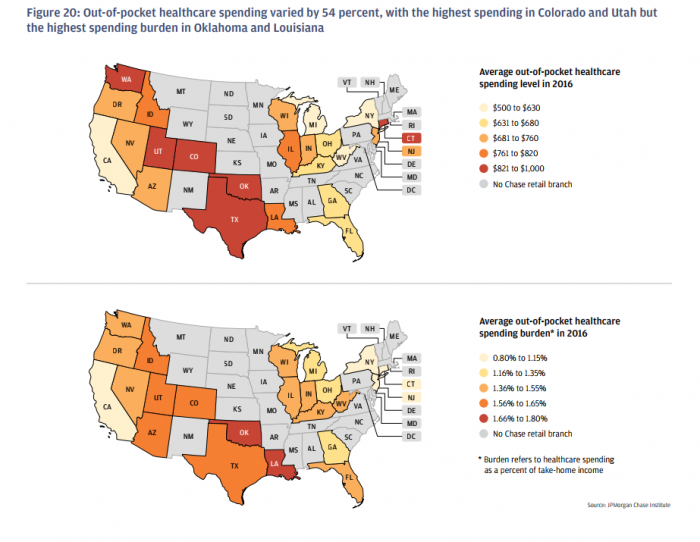

Out-of-pocket healthcare spending varied greatly between states. In Colorado, average out-of-pocket healthcare expenses reached as high as $916 a year, compared to families in California that spend an average of $596 a year.

Even though families in Colorado spent more on out-of-pocket expenses per year than any other state, families in other states spent more of their income on healthcare services but at lower overall prices. For example, in Oklahoma families spent 1.7 percent of their annual income on out-of-pocket expenses (1.6 percent in Colorado), but spent an average of $854 per year on these expenses.

Source: JP Morgan Chase

Families with greater financial resources available also spent more on healthcare services, as monthly out-of-pocket healthcare spending was highly correlated to monthly take-home income.

The correlation between monthly take-home income and out-of-pocket spending also explains how income inequality plays a role into healthcare spending, with some families either having the ability to spend significant amount on healthcare or lacking any financial flexibility to do so.

“Out-of-pocket healthcare spending was highly concentrated among a small segment of the population,” JPMorgan Chase Institute said. “The top 10 percent of healthcare spenders contributed 49 percent of total out-of-pocket spending in 2016. Seventeen percent of families had no healthcare spending in 2016.”

Financial burden for out-of-pocket costs were highest among older, lower-income, and female patients. Individuals with annual incomes over $92,000 paid roughly 1 percent of their income on out-of-pocket healthcare expenses and individuals with incomes under $24,000 a year paid upwards of 2.8 percent of their earnings on healthcare.

Women paid 1.8 percent of their annual income on out-of-pocket healthcare costs compared to 1.4 to 1.5 percent for men. Individuals over the age of 55 paid 1.9 percent of incomes on healthcare in comparison to individuals between 18 and 25 year olds who paid 1.2 percent.

Out-of-pocket healthcare costs in 2016 were the highest for spending on hospital, doctor, and dental services. These three categories accounted for 55 percent of total out-of-pocket healthcare expenses with doctor costs totaling 22 percent, dental services at 21 percent of expenses, and hospital costs at 12 percent.

While families paid less frequently for hospital and dental services, the costs of those services were much larger in scale as the average out-of-pocket cost for family dental services was $465 and $325 for hospital services.

As high out-of-pocket healthcare expenses grow alongside high healthcare costs, payers can learn from the disparities in out-of-pocket spending and empower consumers to make better healthcare decisions. Policymakers and legislators can take these insights as well and turn it into actionable policy adjustments.

“Consumers would benefit from more transparent pricing and payment options to better manage healthcare expenses,” JP Morgan Chase Institute concluded.

“Cost containment measures, including value-based care, could have meaningful impacts on costs borne by families, not just by insurers and healthcare providers. Wide variation in levels and burden of healthcare spending across geographies underscores the importance of healthcare as a state and local policy issue.”