Medical Loss Ratio Provision Led to $2.4 Billion in Rebates

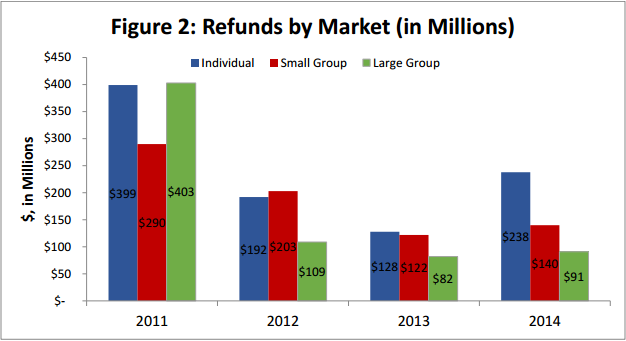

The Medical Loss Ratio provision under the Affordable Care Act was first instituted in 2011 and has since brought in more than $2.4 billion in refunds.

- A new report shows that consumers have received more than $2.4 billion in premium rebates since 2011 because of the passage of the Patient Protection and Affordable Care Act. The Medical Loss Ratio provision under the Affordable Care Act gives consumers some basic protections once they purchase coverage either through their employer or the health insurance exchange, according to the Centers for Medicare & Medicaid Services (CMS).

The Medical Loss Ratio provision or the 80/20 Rule mandates that health insurance companies report all of their earnings and financial information as well as reveal their spending on healthcare. The rule also requires that health insurers spend at least 80 percent of the premiums they receive from consumers on healthcare services or projects that improve the quality of care. Among the large group market, this rule applies to 85 percent of the premium funds.

Any health insurers that do not reach the 80 percent or 85 percent requirement of the Medical Loss Ratio provision must then offer a refund to their consumers. This refund or rebate can be offered in multiple ways such as a decrease in future premiums, a check in the mail, or a reimbursement to the consumer’s account.

“Thanks to the Affordable Care Act, there are now programs in place to give consumers maximum value for their premium dollar,” Kevin Counihan, CEO of the Health Insurance Marketplace, said in a public statement. “We are pleased that the tools created under the health care law are working as intended to give consumers access to high-quality health insurance coverage and keep cost affordable.”

If a consumer purchased their insurance coverage through an employer, the employer will then receive the rebates and distribute the funds in one of the three ways already mentioned. The Medical Loss Ratio provision under the Affordable Care Act was first instituted in 2011 and has since brought in more than $2.4 billion in refunds.

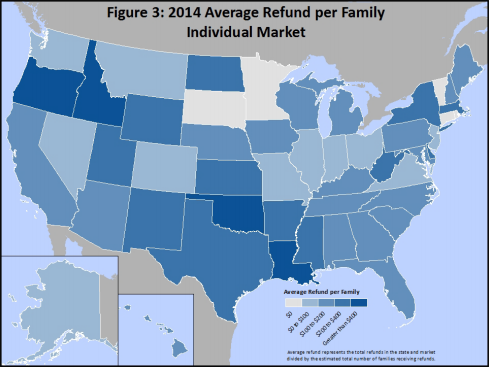

In 2014, 3.7 million families or 5.5 million consumers have received $470 million in rebates due to the Medical Loss Ratio provision. On average, each family is receiving more than $100 in refunds. When it comes to the individual market, the small group market, and the large group market, the average refund per family varies depending on the state they reside in.

While this benefits consumers, it is also advantageous for insurers when it comes to gaining more experience in setting competitive premium prices in the health insurance exchange.

The reason the Medical Loss Ratio provision came into existence is because many insurers spend their funds and premiums on administrative costs such as executive salaries, overhead, and marketing, CMS reports. Now health insurers are required to report data on the spending of their premiums including the amount spent on clinical activities and quality improvement.

Also, more strict reviews for increases to health insurance premium rates are becoming more standard throughout the health payer space. If insurers aren’t able to meet the 80 or 85 percent rates, rebates are issued to their consumer base.

“Thanks to the Affordable Care Act, consumers will receive more value for their premium dollar because insurance companies will be required to spend 80 to 85 percent of premium dollars on medical care and health care quality improvement, rather than on administrative costs, starting in 2011. If they don’t, the insurance companies will be required to provide a rebate to their customers starting in 2012,” CMS stated on its website.

“Beginning in 2011, the law requires that insurance companies publicly report how they spend premium dollars. This information will provide consumers with meaningful information on how their premium dollars are spent, clearly accounting for how much money goes toward actual medical care and activities to improve health care quality versus how much money is spent on administrative expenses like marketing, advertising, underwriting, executive salaries and bonuses.”

The Henry J. Kaiser Family Foundation released a report detailing some of the expectations of the Medical Loss Ratio provision under the Affordable Care Act. First, it is important for insurers to only spend 20 percent of their premium income on marketing, administration, and profits. Otherwise, any funds outside of the 80/20 Rule will need to be administered back to the consumers in the form of a rebate.

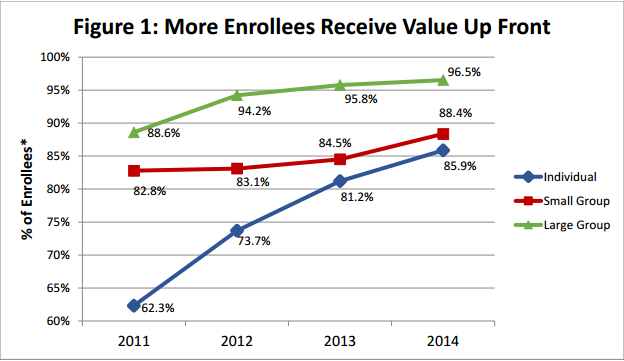

When looking at 2010, the Government Accountability Office found that less than half of insurers in the individual market met the MLR standard while 70 percent in the small groups market and 77 percent in the large groups market met this requirement.

Prior to the passage of the Affordable Care Act, insurers had similar settings requiring a certain amount of the premiums to be spent on clinical care and quality improvement. However, these percentages varied significantly across the states. The Medical Loss Ratio provision sets a more standard and uniform set of requirements for all insurers throughout the US to meet.

The report from the Henry J. Kaiser Family Foundation reveals the definition of the quality improvement aspect within the MLR standards. When 80 percent of premium funds are spent on clinical services and quality improvement, there must be measurable enhancements regarding patient safety, hospital readmission rates, the use of health IT systems tied to patient outcomes, or overall wellness of the patient population.

“Beginning in 2012, insurers failing to meet the applicable MLR standard for the prior year must issue rebates to consumers proportionate to the amount in premiums paid by each consumer,” the report stated.

“As medical loss ratios are calculated using aggregate data, rebates are not based on the experience of an individual enrollee or group. Instead, MLR rebates are based on an insurers’ overall compliance with applicable MLR standards in each state it operates. Over time, rebates will be based on cumulative data over three-year periods. All rebates must be issued to consumers by August 1st of the year following the applicable MLR reporting period.”