Most High-Deductible Health Plan Consumers Lack Financial Management

Less than half of high-deductible health plan (HDHP) consumers engage in positive financial management behaviors like saving for health expenses.

Source: Thinkstock

- Less than half of high-deductible health plan (HDHP) consumers engage in positive financial management tasks such as negotiating costs for healthcare services or saving for future healthcare expenses, says a research letter published in JAMA this month.

A University of Michigan research team found that many HDHP beneficiaries may not be maximizing the value of their health plans and may need additional education about how to achieve good outcomes with high deductible benefit plans.

The research studied a sample of 1637 HDHP beneficiaries and found that 42 percent of beneficiaries had a chronic condition. Fifty-eight percent had a health savings account (HSA), or similar bank account dedicated to healthcare expenses.

However, only 40 percent of these individuals reported saving for healthcare utilization in the future, even though more than half had a bank account designed for saving for healthcare spending.

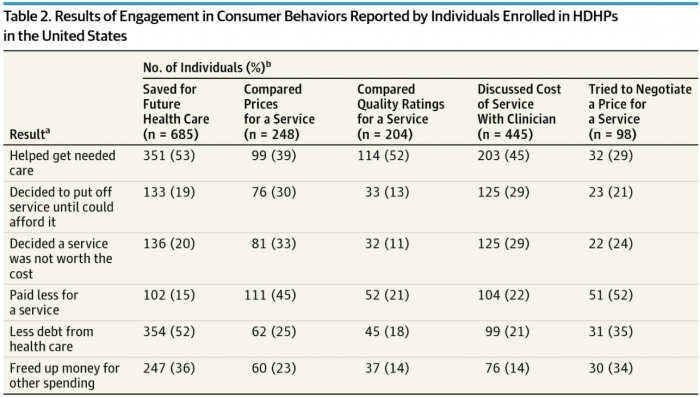

Just a quarter of HDHP beneficiaries consulted a provider about the cost of a healthcare service, and only 14 percent of plan beneficiaries compared provider prices and provider quality. Only 6 percent of HDHP holders tried to negotiate a price for a service.

Generally, HDHP holders were most likely to engage in consumer behaviors when they required prescription drug treatment (61 percent of HDHP beneficiaries using price comparison) or outpatient visits (71 percent of beneficiaries that used quality comparison tools).

HDHP beneficiaries that engaged in positive consumer behaviors were more likely to direct cost-effective purchasing into positive healthcare utilization.

Source: JAMA

About 53 percent of HDHP beneficiaries that saved for future health services did so in order to help pay for a specific necessary service. Nineteen percent of HDHP savers decided to put off healthcare utilization until they could afford it, and 20 percent of determined that a service was not worth the cost.

Fifty-two percent of HDHP beneficiaries engaged in provider quality comparison, and 45 percent of beneficiaries discussed costs with providers, did so in order to help receive a healthcare service. About 13 percent of HDHP beneficiaries that compared provider quality decided to put off care until they could afford it the visit, and 11 percent of HDHP determined that a provider visit was not worth it.

“We found that few individuals enrolled in HDHPs in the United States are engaging in consumer behaviors, and those that are could be realizing more benefits,” the team said.

Payers that want to improve the financial management and consumer engagement skills of HDHP beneficiaries can focus on providing education to beneficiaries and communicating about the benefits of fiscally responsible behaviors.

By providing case-studies and educational resources, payers can teach HDHP enrollees about what services are free and how the benefits of an HDHP promotes cost-saving care.

Enterprise strategies such as supporting health-positive behaviors, connected care models, and optimized buying experiences, make it easier for HDHP members to find the best possible care services at the lowest possible cost.

Payers have the means to improve HDHP consumer decision-making, and may be inclined to rely on those strategies, as healthcare policy may create additional financial strains on HDHP enrollees.

“Such efforts will become increasingly important as enrollment in HDHPs continues to increase and could become essential if modifications to the structure or implementation of the Affordable Care Act accelerate patient's’ exposure to high-cost sharing,” the team concluded.