Narrow Network Health Plans Continue to Dominate ACA Exchanges

Seventy-two percent of health plans on the ACA exchanges feature narrow networks.

Source: Thinkstock

- New analysis of available health plans on ACA exchanges in 2019 shows that narrow networks remain a dominant force.

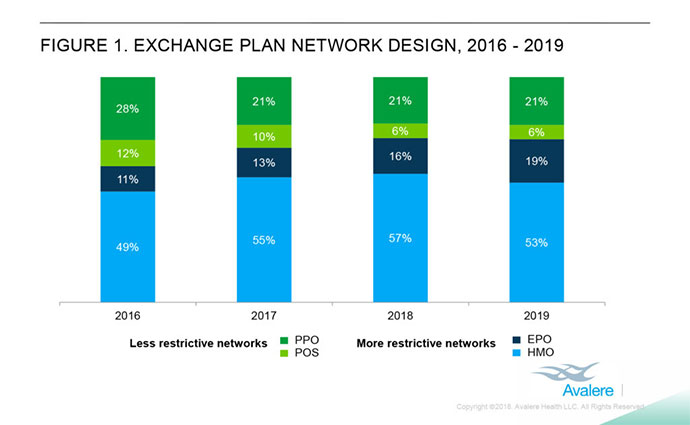

Avalere researchers found that more restrictive networks own nearly three-quarters of all health plans on health insurance exchanges. These plans include health maintenance organizations and exclusive provider organizations. HMOs hold the majority of the ACA marketplace in 2019 at 53 percent, down 4 percentage points from 2018; meanwhile, EPOs grew from 16 to 19 percent over the same period.

“Provider networks are getting narrower, which means it is more important than ever that patients understand what kind of plans they are buying,” said Director Chris Sloan. “Unknowingly enrolling in a narrow network plan could lead to patients being unable to see their preferred doctor or go to their most convenient hospital.”

Conversely, the market share for preferred provider organizations (PPO) and point of service (POS) — that is, less restrictive networks — remain unchanged at 21 and 6 percent, respectively.

Source: Avalere

According to the healthcare consulting firm, the push for more restrictive networks comes represents an attempt on the side of health payers to reduce monthly premiums and care costs at the expense of beneficiary choice.

“Network design is one tool plans use to keep premiums low,” said Senior Vice President Elizabeth Carpenter. “However, in addition to monthly costs, consumers need to consider whether a plan covers their preferred doctor or hospital before choosing an insurance plan.”

In 2016, HMOs and EPOs comprised 60 percent of the market. The following year witnessed an increase to 68 percent.

While these plans offer fewer options from a consumer’s perspective, they are rife with opportunity for payers, providers, and employers working to provide better quality of care and a more manageable price based on research from the PricewaterhouseCoopers (PwC) Health Research Institute published in June.

“Medical costs continue to grow, yet the workforce’s health and performance aren’t improving,” the institute reported. “Average labor productivity growth of 1.1 percent over the last 10 years falls far below the 2.3 percent average of the last seven decades. Efforts by employers to cut utilization have mostly run their course.”

The number of employers implementing narrow networks increased by 247 percent since 2014 and a sizeable percentage of consumers (44%) is willing to sacrifice choice in the name of quality.

An important component of implementing narrow networks remains effectively educating beneficiaries about the benefits of this approach.

“The biggest challenge for employers with advocacy services is engagement—how do employers encourage employees to take advantage of this resource?” National Business Group on Health President & CEO Brian Marcotte told the institute. “Once they are engaged, health advocacy services do a good job of helping employees understand their benefits and treatment options, navigate the health system and steer to more efficient, quality providers. But most people don’t touch the healthcare system often. When they do, they forget the health advocates are there to help.”

Writing in the New England Journal of Medicine, Hoangmai Pham, MD, MPH, and Paul B. Ginsburg, PhD, of Anthem and the Brookings echoed that sentiment:

Payers could build enticements — such as digital or other services that make care more convenient and responsive to patients’ daily realities, to address not just clinical needs but also expectations for customized care — into the capabilities that they expect providers to develop in order to participate in the network, and adjust them over time in collaboration with providers, purchasers, and patients as their collective vision of care delivery evolves. Payers could also directly invest in or otherwise promote the entry of new, disruptive providers who offer innovative patient-centered care to help jolt other providers into action.

Patient experience is a critical component of value-based care, but beneficiaries are likely unaware of the driving forces seemingly limiting their freedom of choice.