Nearly 20% of Employees Have Inpatient Out-of-Network Claims

About twenty percent of beneficiaries with employer-sponsored insurance have out-of-network claims for inpatient care that increase employees’ financial stress.

Source: Thinkstock

- Approximately twenty percent of employees with insurance had at least one out-of-network claim for inpatient care, according to a Peterson-Kaiser Tracker analysis. Employees with out-of-network provider bills may experience increased stress due to the cost of healthcare because they are largely responsible for out-of-network costs.

In 2016, 15.5 percent of all inpatient admissions claims that took place within in-network facilities included services from an out-of-network provider, indicating that choosing an in-network care site is not necessarily a predictor of what costs a payer will cover.

Overall, 17.6 percent of claims related to inpatient admissions involved out-of-network services.

The research team inferred that the high prevalence of out-of-network billing may stoke employee concerns about the affordability of medical services. In recent years, employees have experienced an increase in their cost sharing commitments for employer-sponsored coverage, leading to concerns over affordability.

Employees enrolled in limited network employer plans, such as an HMO or exclusive provider organization (EPO) plan, typically experience high-cost out-of-network bills, according to KFF researchers. HMOs and EPOs typically do not cover any form of out-of-network care.

READ MORE: About 90% of Large, Mid-Size Employers Offer Medical Benefits

Even employees in PPO plans, which are benefit packages that may provide coverage for out-of-network care, also face significant out-of-network costs.

“The [PPO] plan may have somewhat higher cost-sharing amounts (for example, it may have a separate or higher deductible) for services from out-of-network providers,” KFF explained. “Second, and more importantly, the providers they use may ask them to pay any difference between what the plan reimburses and the amount that the provider charges for its services.”

KFF found that employees sometimes face surprise medical bills when an in-network provider refers the employee to an unknown out-of-network provider for services.

“Other instances of out-of-network service use may be inadvertent, such as where an enrollee encounters an out-of-network provider (maybe an anesthesiologist) in the course of treatment at an in-network hospital or surgical center, or when their in-network provider refers them to an out-of-network provider for services such as laboratory testing or radiology,” KFF explained.

Surprise medical bills can create significant financial challenges for employees. A separate KFF survey found that seven out of ten with unaffordable medical bills did not realize the bills were for out-of-network care.

READ MORE: High Dollar Claims Rise by 87% in Employer-Sponsored Stop-Loss Insurance

The team explained that the practice of balance billing can also make employees vulnerable to out-of-network costs.

Balance billing is when the provider asks the patient to pay the difference between the costs covered by their insurance plan and the out-of-network costs. Employer health plans rarely have cost-sharing policies that protect employees from balance billing, the team added.

The Peterson-Kaiser Tracker found that ED claims are the most likely to result in an out-of-network provider bill. The team estimated that 27.2 percent of all inpatient admissions with an ED claim were from out-of-network providers.

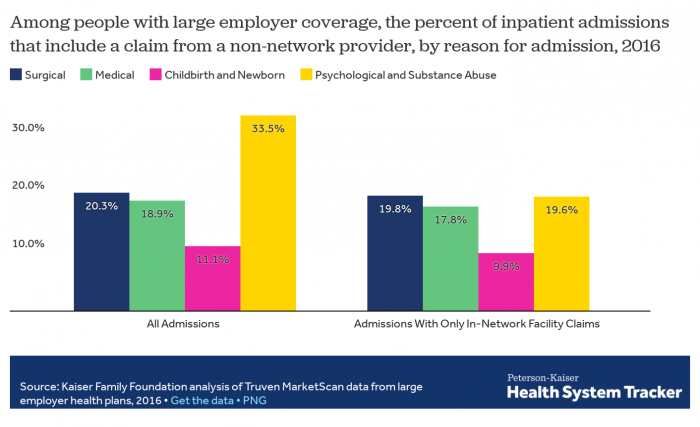

Patients that receive inpatient mental health treatment are the more likely to receive out-of-network bills from providers than patients using other inpatient services outside of emergency care.

Source: Peterson-Kaiser Tracker

In 2016, a third of all inpatient mental health services were billed by out-of-network providers. Twenty percent of inpatient surgical services and 18.9 percent of inpatient medical services were also billed by out-of-network providers or facilities.

READ MORE: How Payer Philanthropy Can Address Social Determinants of Health

Outpatient service claims (7.7 percent of claims) and outpatient facility charges for emergency and surgical care (9.2 percent of claims) were less frequently billed by out-of-network providers.

The Kaiser Family Foundation explained that many employees may seek out-of-network services because they prefer a specific provider outside their network due to the provider’s reputation, familiarity, or convenience. Employees also are likely to seek out-of-network care when services like mental healthcare are not offered by in-network providers.

Employers may want to design benefits that address mental health to keep employees from using in-network services that are cheaper than out-of-network services. Employers may also want to explore new contracting options with providers to ensure beneficiaries are able to use more affordable healthcare services.

“In many instances, it is doubtful that enrollees could reasonably anticipate or control their use of out-of-network providers,” KFF said. “For inpatient admissions, enrollees using only in-network facilities still have at least one claim from an out-of-network provider in over 15 percent of admissions. For both inpatient and outpatient services, enrollees using emergency rooms have a much higher likelihood of having an out-of-network claim, even when they use in-network facilities.”

High out-of-network costs can add onto an employee’s other stressful cost commitment including premiums and deductibles. Employers offering benefits may want to reduce their employees’ financial burdens by redesigning cost sharing or by assessing providers to develop high performance networks that lead to lower care costs in general.