Patients Need More Guidance on Medicare Prescription Drug Plans

A Walgreens survey shows that Medicare beneficiaries may need more assistance with choosing the right prescription drug plans.

- Among Medicare beneficiaries, 34 percent are not taking the time to review their Medicare Advantage prescription drug plan before renewing during the open enrollment period, according to a Walgreens survey. Nearly one in five or 19 percent stated not having an adequate understanding of their Medicare Advantage prescription drug plans.

This shows that the Centers for Medicare & Medicaid Services (CMS) will need to work toward improving patient education and understanding of prescription drug plans. Commercial health payers can also look at these survey results and work to ensure their members have adequate understanding of tier networks and how much their health plans cover prescription drugs. This would go a long way to reducing out-of-pocket costs and healthcare spending as a whole.

“This latest survey reinforces the need to educate beneficiaries about how plans and coverage can and do change from year to year, as can a person’s health and prescription needs,” said John Lee, senior director of Medicare for Walgreens. “It’s critical for people to be able to get the medications they need, at prices they can afford. One of the ways we’re helping to address this need is through participation in preferred pharmacy networks with most of the leading, national Part D plan sponsors. Our pharmacists are also a valuable community resource to help people understand Part D information and their coverage options.”

The survey also showed that 22 percent of polled Medicare beneficiaries looked at only one part of their prescription drug plan and did not consider other important factors. Also, 21 percent of those polled thought that all pharmacies bill the same copay for their prescription medication, which is false. One-third of surveyed beneficiaries were unaware that they can switch pharmacies outside of the open enrollment period.

As many as 1,000 Medicare beneficiaries were surveyed about their prescription drug plans. CMS and private payers should also pay attention to the factors that influenced decision-making for Medicare beneficiaries. For instance, 30 percent of beneficiaries cited copays as the main factor they consider when choosing Medicare drug prescription plans.

Also, 18 percent stated that pharmacy location is their primary factor while an additional 18 percent relied on the ability to conduct one-stop shopping. The cost of medical care and prescription drugs remained a key concern for Medicare beneficiaries.

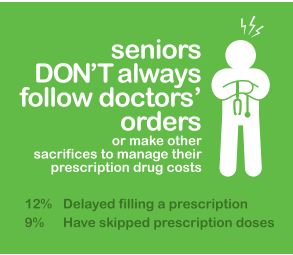

“Any time individuals aren’t remaining adherent to medications it’s a concern, as it can pose significant health risks, and can also lead to more healthcare expenditures in the long run,” Lee concluded.

This shows how vital it is for CMS as well as commercial health insurance companies to work with their members in finding health plans that cover as much of their out-of-pocket costs as possible so that these patients stick to their medications. Working with provider networks to improve prescription drug management among the patient population is also vital since it would prevent worsening conditions and higher medical costs.

Yesterday, CMS announced in a press release the premiums for 2017’s Medicare Part A and Part B programs. In Medicare Part B, the average premium cost next year will be $109, which has grown $4.10 when compared to the past four years. Also, 30 percent of Medicare beneficiaries will see a premium of $134.00 for Medicare Part B.

“CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016). Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement,” the CMS press release states. “Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B monthly premiums. These income-related monthly premium rates affect roughly five percent of people with Medicare.”

For Medicare Part A, an inpatient hospital deductible will be $1,316 per benefit period next year, which rose by $28 since 2016. This covers the cost of being hospitalized for no more than 60 days. The costs increase after the first 60 days.

Both CMS and commercial health insurance companies will likely need to improve patient education and ensure their customers choose the best health plans to meet their needs. Improving price transparency both among health plans and medical services will be imperative for reducing costs especially when patients are facing high deductibles.

Image Credit: Market Insights Group

Dig Deeper:

How Medicare, Medicaid, and CHIP Guide the Health Payer Industry

CMS Releases Final Rule for Medicare Physician Fee Schedule