Payers Continue Favoring Accountable Care Organizations

“If you look at the Affordable Care Act, you find... the Accountable Care Organization, which reverses the fee-for-service system. This is going to lower the cost of healthcare over time."

- As the health payer industry and the Centers for Medicare & Medicaid Services (CMS) continues to invest in value-based care reimbursement and tie payment to quality performance measurement, the benefits of accountable care organizations continues to shine next to fee-for-service hospitals and clinics.

Healthcare providers looking to join and partner with others in establishing accountable care organizations should be prepared for a long haul before achieving any significant cost savings. Many ACOs that have participated under the Medicare Shared Savings Program find that it takes at least three years before garnering shared savings or cutting costs.

Nonetheless, this is where the health payer industry is heading and it would behoove providers to focus on quality improvements and working with payers to develop value-based care payment strategies.

CMS introduced 121 new ACOs

Last month, CMS had announced the additional participation of 121 accountable care organizations within the Next Generation ACO Model and the Medicare Shared Savings Program. In an exclusive interview with Clif Gaus, the President and CEO of the National Association of ACOs, HealthPayerIntelligence.com uncovered ways accountable care organizations can gather more cost savings, why some have left the Medicare Shared Savings Program, and whether ACOs really do have the chops to cut healthcare costs and improve service quality.

When it comes to the CEO’s perspective on the future of the 121 new accountable care organizations joining the Medicare Shared Savings Program and the Next Generation ACO Model, Gaus predicted, “You have to segment them into a couple of different categories. 21 of them are the advanced payment ACOs under Next Generation. Like their predecessor the Pioneer that had 32 in the program whittled down to nine now, I would guess there would be dropouts from that program over the course of those five years. They will also add more applicants or awardees next year.”

“There may be another 15 or 20 added to the program next year. It may initially grow some, but as ACOs learn the difficulties of meeting all the CMS requirements and transforming healthcare, [some of them will] drop out.”

“Whether in the end, the program will have net savings; I think remains to be seen. I’m optimistic that it will. As Pioneer has done, it’s shown that they can find savings and improve quality,” he explained. “These are the most experienced organizations in our country when it comes to managing cost and quality.”

Gaus also went on to elucidate that accountable care organizations need “really good, current data on their beneficiaries” in order to gather more cost savings through reliable and efficient post-acute and hospital care services. Greater care coordination is key as well as preventing hospitalizations and readmissions. Involving home health agencies is a useful practice in order to have more effective patient management after a hospitalization.

Real-time data on patients who are hospitalized or in emergency rooms would tremendously benefit ACOs as they work to reduce medical costs, according to the President and CEO of the National Association of ACOs.

When asked why some ACOs have left the Medicare Shared Savings Program, Gaus answered, “The principle reason is that they weigh off the cost of their operation against continuing as an ACO. Those costs include an IT infrastructure so that they can process the beneficiaries’ claims, understand where their care is being received, and who are the high-risk beneficiaries and high-cost beneficiaries. There’s an operational cost there.”

“Secondly, there’s an operational cost for the care-coordinating nurses who reach out to the beneficiaries and try to help them migrate through the array of choices there are for post-acute care, when they do or don’t need a hospital admission, and help them facilitate their preventive care.”

“Those nurse navigators are expensive and an ACO has to weigh whether it’s worth continuing these costs. Is that worth the chance that they’ll be able to lower the cost and find savings? Those ACOs that have had some success stay in the program. Those that find it more challenging and have not had success, leave the program,” Gaus concluded.

The other important point that Clif Gaus brought forward is that it can take accountable care organizations three years or longer to achieve any real cost savings and meet quality improvement goals.

While ACOs do provide an efficient model for cutting healthcare costs, it can take the organizations themselves a large amount of resources and time invested in order to reach the benchmarks set out by payers and the federal government.

Healthcare providers may need to weigh the risks versus the advantages of participating in an ACO before jumping in. While there may be more risks involved than in fee-for-service payment models, it could lead to better patient health outcomes and shared savings.

“It’s a hard journey and the quality goals for achieving and keeping savings are very high relative to fee-for-service,” Gaus began. “There’s two different standards here and learning to transform care and provide efficient and better quality takes time.”

“The ACOs have shown that, in the first three years, they’re able to improve the quality. They both provide higher quality and they’re quality-improving from year to year. That’s a home run. In some respects, that’s been the real success story of ACOs,” he continued. “That’s a great story for beneficiaries. In fact, the converse of that, sadly, there’s almost 70 ACOs that will no longer be focused on that.”

“The other side of that equation is the ACOs have to invest so much of their own money that without a quick return, they run out of money to continue. I believe that the ACO concept and model is still the best we have to lower costs and increase quality, but it can take a much longer time and needs greater rewards from the government to keep the movement growing.”

Value-based care and ACO development trending among payers

Creating contracts with ACOs and pursuing value-based payments continues to grow in popularity among health payers. As such, medical providers would be wise to invest some time and money in better understanding and potentially pursuing some of these new models of reimbursement. Jeremy Earl, Associate at McDermott Will & Emory, explained in an interview how important ACOs are to the health payer industry today.

“Everybody understands that this is the way provider reimbursement is headed. If you want to be ahead of the curve and gain experience with these new payment models, I think participation in the Medicare Shared Savings Program is a good way to do that,” Earl began.

“I don’t necessarily know that from a revenue standpoint whether it’s become a significant driver of provider revenue at this point, but I do think the bigger revenue opportunity is in the contracts with private payers where providers can utilize the ACO infrastructure to manage either a Medicare advantage or a commercial population.”

Population health management remains key for ACO success

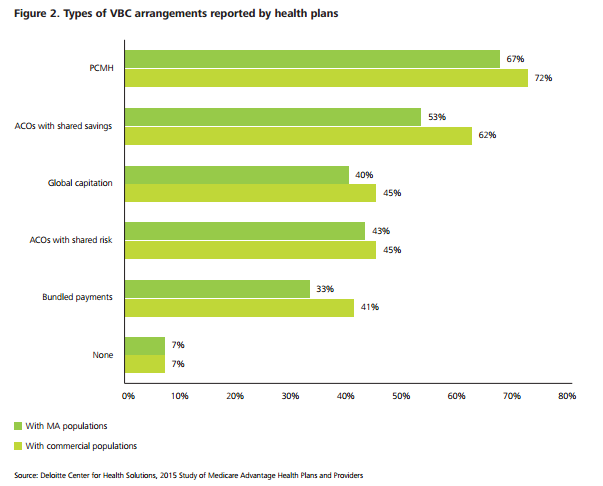

Providers and payers are targeting population health management as a key strategy for improving the success and effectiveness of accountable care organizations. Whether providers are forming patient-centered medical homes or ACOs, analytics systems for integrating clinical processes and improving population health management is being supported by more health payers, according to a study from Deloitte.

When it comes to Medicare Advantage, however, a small number of health plans interviewed for the study felt that value-based care payment contracts would not be equally effective among commercial and Medicare Advantage beneficiaries “because commercial populations do not lend themselves to investments in population health.”

Essentially, the interviewed insurance executives stated that commercial populations are more flexible in terms of coverage plans such as when an employer moves a workforce to a different health plan or members change their insurance due to a job transfer. Since the commercial populations are more heterogeneous, the executives explain, population health management tends to be more complex and difficult in this particular market when compared to Medicare Advantage beneficiaries.

The report from Deloitte provides key data about which new healthcare payment models are being implemented the most among insurers. The findings show that patient-centered medical homes and ACOs with shared savings have the highest adoption rate.

When asked about how providers and payers are working together to strengthen population health outcomes, McDermott Will & Emory’s Jeremy Earl responded, “One of the biggest focuses of private payers is managing high-risk populations – populations with co-morbidities and chronic conditions that use a lot of health resources and are ultimate drivers of additional costs in the healthcare system.”

“What I’ve seen is payers and providers having a renewed focus on the best way to holistically manage the health of high-risk populations. In many cases, this takes the form of the insurer providing care coordinators and even embedding clinical staff onsite with the providers.”

“It also takes the form of plans compensating providers through per member – per month care coordination fees and other types of compensation that incentive providers to perform this type of population health management. In the past it may not have been in the provider’s best interest to really try to manage the health of a defined population due to lack of reimbursement.”

“Inherently, moving providers towards a shared savings or shared risk compensation model incentivizes population health management because the provider knows they are financially responsible for a defined population,” Earl mentioned the benefits of programs and models of care similar to ACOs and patient-centered medical homes.

“To the extent there are any cost savings from avoiding hospital or ER readmissions, for example, the provider will see additional revenue from avoiding that type of care. This shifts the mindset that providers have from a revenue standpoint. It will allow them to be successful and is now in their best interest from both a clinical standpoint and financially,” he concluded.

End result: ACOs cut healthcare costs

At the end of the day, accountable care organizations and similar models of care delivery are moving the medical industry toward reducing wasteful spending that the fee-for-service system mostly incentivizes. Dr. John R. Patrick, author ofHealth Attitude: Unraveling and Solving the Complexities of Healthcare, told HealthPayerIntelligence.com that one of the most important things that “Congress can do is support the spread of Accountable Care Organizations.”

“If you peel back the onion and look at the elements of the Affordable Care Act, you find things that are helpful. One of them is the Accountable Care Organization, which reverses the fee-for-service system. This is going to lower the cost of healthcare over time. The most recent report I saw indicated the savings from the ACO model were $418 million,” he mentioned.

When it comes to fee-for-service payment systems, Dr. Patrick finds this a troublesome form of reimbursement throughout the healthcare industry.

“We have a big problem with the cost of administration. The other costs have to do with fraud and the lack of tort reform. The lack of tort reform is not a large part of the problem itself, but it induces defensive medicine, which is what produces unnecessary tests and procedures. The incentive system that is part of the American healthcare system encourages unnecessary tests and procedures because it compensates providers based on how many times they do something.”

“The good news is the accountable care model offers the hope that we can get this under control by paying fixed amounts per person per month rather than pay for every time somebody does something,” Patrick concluded.

Image Credits: Deloitte Center for Health Solutions