Payers, Providers Highlight the Pros of Cost-Sharing Reductions

Payers and providers share insight with policymakers on the benefits of cost-sharing reductions in the face of an uncertain future.

Source: Thinkstock

- A joint group of America’s Health Insurance Plans (AHIP) and provider organizations came together to promote the benefits of cost-sharing reductions (CSRs) on consumer and payer healthcare costs, the group announced in a joint statement.

Along with American Academy of Family Physicians, American Benefits Council, American Hospital Association, American Medical Association, Blue Cross Blue Shield Association, Federation of American Hospitals, and the United States Chamber of Commerce, AHIP issued its comments in response to recent Trump Administration remarks about CSRs.

CSRs have helped to subsidize $7 billion in healthcare costs for insurers that help lower-income beneficiaries purchase healthcare services.

“Cost-sharing reductions are used to help those who need it most—low and moderate-income consumers,” the group said. “These funds, which are built into their benefits, reduce their out-of-pocket costs such as copayments and deductibles when they receive care. Without these funds, consumers’ access to care is jeopardized, their premiums will increase dramatically, and they will be left with even fewer coverage options.

“These benefits are essential to making coverage and care affordable for American families who receive them. Clarity and commitment to this funding is needed to eliminate confusion and anxiety for consumers,” the group continued.

Source: AHIP

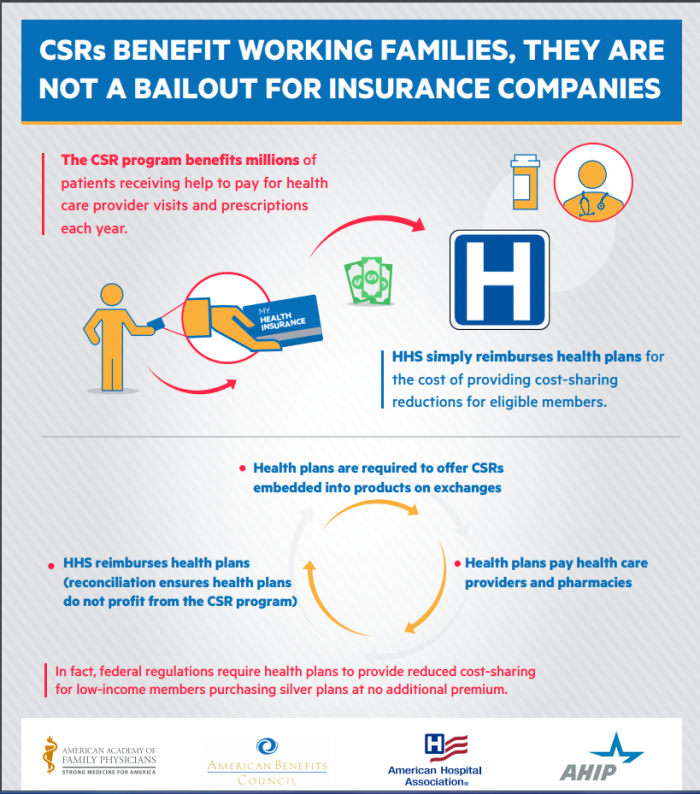

The group attached a simple infographic explaining how CSRs work wherein HHS directly pays the needed costs for a person’s provider visit or prescription drug costs. Federal regulation currently requires health plans to provide reduced cost-sharing for low-income members purchasing ACA silver plans at no additional premium.

In its statement, the group reiterated that CSRs not only benefit customers, but they also keep the healthcare market stable for payers and healthcare businesses.

“As medical professionals, insurers providing health care services and coverage to hundreds of millions of Americans, and business leaders concerned with maintaining a stable health insurance marketplace for consumers, we believe it is imperative that the Administration fund the cost-sharing reduction program,” it noted.

These remarks follow a similar letter AHIP sent to Congress, which addressed its legislative role in keeping CSRs viable. AHIP provided congressional leaders a detailed case for the retention of CSRs, which included the prevention of payer losses and possible payer withdrawal from the healthcare market.

“Eliminating the reimbursements to insurers for CSR subsidies could result in insurer losses and solvency challenges,” said Shari Westerfield, Vice President of Health Practice Council at the American Academy of Actuaries

“This could lead to insurers opting to withdraw, leading to severe market disruption and loss of coverage among individual market enrollees—both those receiving CSR subsidies and those not.”

Payers are already educating enrollees on possible increases in out-of-pocket healthcare expenses should CSRs become void.

Blue Cross Blue Shield of North Carolina raised insurance rates based solely on the future funding of CSRs. BCBS of NC communicated that they are aware beneficiaries will pay more to make up for the potential losses of not having CSRs in place.

“With no funding for the federal payments for cost-sharing reduction plans, Blue NC will need to factor the missing federal payments into our 2018 rates. That will drive more customers away from coverage and toward being uninsured,” said BCBS of NC CEO Brad Wilson.

“For some insurers, this additional pressure on premiums might lead to a decision to leave the exchange or the ACA market entirely.”

While the current administration ponders whether to remove CSRs, the Senate announced bipartisan hearings (via Bloomberg Politics) to take place in early September on stabilizing the ACA market and retaining the CSRs.

Policymakers on both sides of the Senate aisle are open to a unified discussion on how to accomplish this.