Payers with Larger Market Share Have More Negotiating Power

Payers with the largest share of local markets can negotiate lower prices for physician office visits, a new study finds.

Source: Thinkstock

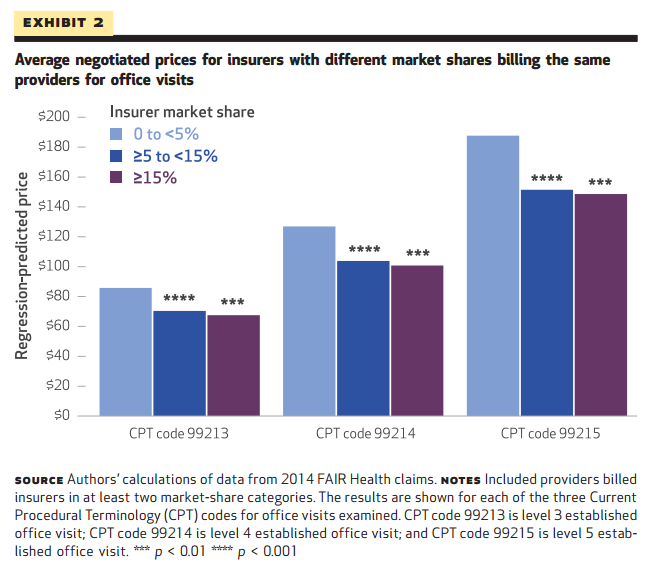

- Payers that dominate the local market are able to negotiate lower physician office visit prices than their smaller peers, found investigators from Harvard Medical School. Health insurance companies with 15 percent or more of the market share negotiated visit prices that were 21 percent lower than those established by payers making up 5 percent or less of the market.

Payers with less than 5 percent of the market ended up with negotiated prices of $88 per office visit, compared to a final price of $72 for payers with 5 to 15 percent of market share and just $70 for those with more than 15 percent of covered lives in a given region.

The study indicates that large mergers, such as those proposed by Aetna and Humana, may be able to drive down prices by increasing the bargaining power of healthcare payers, although those savings may not translate to the consumer’s wallet.

"Our findings suggest that mergers between large health insurers, such as those recently proposed, could lead to lower negotiated prices with health care providers," the researchers said. "However, mergers might not ultimately reduce the costs of care borne by consumers because the savings that insurers realize from negotiating lower prices might not accrue to consumers."

The Affordable Care Act may play a role in bringing more savings to patients, the team notes, but few researchers have yet examined data from the post-ACA era.

READ MORE: How Health Insurance Mergers Could Change the Payer Industry

“On the insurer side, the Affordable Care Act (ACA) requires insurers to spend at least 80– 85 percent of premium revenues on medical care and activities related to quality improvement. This medical loss ratio provision is intended to increase the share of price reductions obtained by insurers that are passed on to consumers.”

“However, since much of the research on insurance market structure and premiums is based on data predating the ACA, and in light of the current political uncertainty surrounding the ACA, it is not clear whether this provision will ultimately be effective in ensuring that insurers’ savings from lower negotiated prices are passed on to consumers.”

The team added that policymakers may need to address the negative influences of market power on healthcare spending.

"This study adds to a growing body of evidence that health care costs are affected by the bargaining power of providers and insurers,” the researchers said. “Our findings suggest that mergers among health insurers will likely enhance their ability to negotiate lower prices from providers.”

"Such increases in insurer market power may have a particularly strong effect on price negotiations with large provider organizations, as we found that insurers required larger market shares to negotiate substantially lower prices from provider groups with large market shares."

READ MORE: Mergers in Health Insurance Market Don’t Pose ‘Pure Monopoly’

Actions that address concern over large payer-mergers include the recent shareholder class-action lawsuit filed against Aetna. David Balto of the Coalition for Patient Choice stated that Aetna was already a large, resource-rich insurer with market clout and did not need a merger in order to be competitive in healthcare exchanges.

The Department of Justice blocked the Aetna-Humana merger because the action violated antitrust laws, showing that payers will have limits to how much they can expand in a given marketplace.

Insurers looking to pursue large mergers in order to increase their negotiating power with providers even further are likely to face similar roadblocks, but those able to strike the balance between holding sufficient market share and overwhelming the market may be able to negotiate service prices that benefit their business models.

Source: Health Affairs

The researchers analyzed a 2014 database containing large, multi-payer commercial health insurance claims generated by FAIR Health.

Claims with $0 or statistically insignificant low prices were excluded from the study sample.

READ MORE: Aetna Leaving Health Insurance Exchanges Due to DOJ Lawsuit

The average insurer market share ownership was 24.5 percent. Some insurers were reported as having as much as 85.8 percent in certain counties. The four largest insurers in the US had market shares between 5 and 15 percent ownership within 44 percent of large counties. Mergers involving major national or regional insurers increased insurer market share from below to above 15 percent market ownership in several counties.

"These results suggest that mergers of health insurers could lower the prices paid to providers, particularly providers large enough to obtain higher prices from insurers with modest market shares," the researchers said.

While the researchers developed averages and benchmarks, the study is not without limitation in other factors that affect negotiating price.

"Other factors, including the quality, specialty mix, and reputation of providers, and the narrowness of insurers’ provider networks, can affect negotiated prices. Our analyses should be viewed as measuring an important— but not exhaustive—set of determinants of health care prices."

The team concluded that increased transparency in consumer pricing helps to build consumer awareness and stifle the negative consequences of limited insurance competition.

“To protect consumers from the potential adverse consequences of weaker competition, several strategies have been pursued to strengthen competition among providers and insurers,” the team said.

“To address information problems facing consumers (that is, incomplete information about provider prices) and the limited incentives that consumers with insurance have to shop for lower-cost providers, insurers, and policy makers have introduced price transparency initiatives, reference pricing, and complementary coverage designs such as high-deductible health plans. The aim of these policies is to increase consumer cost-consciousness and to promote price competition among providers.”