Single-Employee Businesses Experience High, Burdensome Premiums

Single-employee businesses view their premiums as too high and burdensome, which leads to exits from health insurance markets.

Source: Thinkstock

- Single-employee businesses paid an average of $500 per month on premiums, experienced high premium payment growth, and experienced polarizing financial burden based on their premium payment amounts, a new report from JPMorgan & Chase reveals.

Single-employee health insurance premium payments (HIPP) grew at an average of 8.3 percent in 2016, while multiple employee-sponsored (20 or more employees) family plan HIPPs grew by only 3.4 percent.

Single-employer businesses also had to purchase individual single or family health plans on the marketplace, which ended up creating significant financial burden.

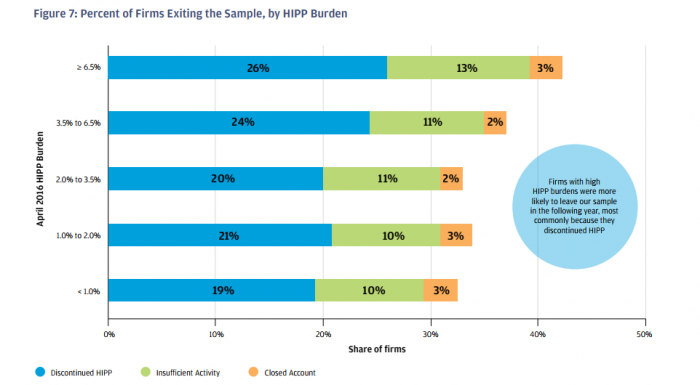

Roughly 21 percent of single-employee firms stopped their HIPPs if they accounted for 1 percent of their monthly expenses. Twenty-six percent of single-employer businesses stopped their premium payments if it accounted for 6.5 percent or more of their monthly expenses.

The team at JPMorgan & Chase said these numbers are troubling because single-employee businesses like contractors, consultants, or one-person enterprises, are a large part of the insurance market and have a high likelihood to exit participation in the market.

“Non-employer businesses are a large segment of the small business sector, and small business owners are especially likely to purchase health insurance on the individual market,” the JPMorgan & Chase researchers said.

“Four million self-employed business owners purchased health insurance on this market in 2014,” the team continued. “The economic experiences of these small business owners can inform both the well-being of the small business sector and the condition of a substantial share of the individual health insurance market.”

Source: JPMorgan & Chase

A typical single-employee business had HIPPs that accounted for 2.5 percent of their overall monthly expenses. About one-fifth of these businesses were likely to discontinue their premium payments, and these payments were sometimes less cost-effective than out-of-pocket healthcare spending that traditionally drives away developing enterprises.

“These payments may be larger than the out-of-pocket premiums business owners might have paid for employer-sponsored insurance if they were employees,” the researchers added. “These differentials are consistent with other research suggesting that business creation may be hampered by the relative costs of health insurance faced by small business owners.”

Convenience was also found as a factor that discourages single-employee businesses from purchasing health plans or paying their premiums.

Just over 40 percent of single-employee businesses with a HIPP burden of 6.5 percent or greater in 2016 exited coverage within a year, and cited the discontinuation of electronic health insurance payments as the reason.

Health insurance premium growth rates and premium payments only provide a limited perspective on the financial struggles single-employee businesses continually face in the health insurance market.

The smallest business owners tend to be financially vulnerable, and have less than one month’s worth of cash to keep their enterprises afloat, according to JPMorgan & Chase estimates. These business owners also tend to exit the health insurance market because of further fiscal vulnerabilities of large and unexpected healthcare expenditures.

The JPMorgan & Chase team also found that HIPP levels also varied by the industries in which single-employee businesses participated in.

Single-employee businesses in the high-tech services industry had a median HIPP level of $715 per month in 2017, which was $400 more per month than the personal services industry. However, premium payments by industry did not always reflect financial burden, indicating that higher-earning industries may be less affected by high premiums.

Policy makers should consider the impact of health insurance market reforms to keep the four million single-employee businesses within the health insurance market.

“While health insurance premiums for non-employer firms are growing faster than premiums for employer-sponsored insurance, we find that this growth rate is decelerating,” the team concluded.

“Health policy choices that might support rather than disrupt this deceleration may help to limit the increasing economic burden that health insurance premiums otherwise impose on small business owners.”