Single Payer, Public Options Become Focus of Healthcare Debate

A flurry of polls about single payer, Medicare-for-All, and other options are offering data – but not necessarily insight – into what the public thinks about insurance reform.

Source: Thinkstock

- As the nation starts to turn its politics-weary eyes towards the 2020 election cycle, a new series of healthcare talking points are emerging, particularly from the left-hand side of the ideological spectrum.

Terms like “single payer,” “Medicare-for-All,” “public option,” and “Medicaid buy-in” are dominating headlines as prospective candidates aim to capture support for widespread insurance industry reform.

The proposals are divisive – depending on who you ask, that is…and depending how the question is worded.

In some regions of the country, Americans frustrated by rising costs and insufficient value from private payers seem more than ready to embrace a wholesale change in how to purchase insurance coverage.

New Mexico, New York City, and California are all making moves towards overhauling their insurance markets.

READ MORE: HHS Proposes Eliminating Drug Rebates to Cut Prescription Costs

And a wave of enthusiasm in other states for Medicaid expansion during the recent midterm elections indicates that many Americans are ready for a new strategy.

In other states, however, uncertainty about how such a massive shift would play out – and who would pay for it – is keeping beneficiaries generally anchored to the status quo.

Even as the current Administration continues to chip away at the ACA, new industry polls are striving to shape the next phase of the healthcare debate as Americans seesaw between blue-sky thinking and practical reflections on costs and possibilities.

Unfortunately, in such a politically-charged environment, some of the most recent surveys on what Americans think about single payer or public insurance options actually include leading language to nudge respondents in a particular direction.

Some, but not all, of the stakeholders on both sides of the issue are employing the tactic, leaving industry observers with the responsibility of taking the results with a grain of salt. Here are a few of the most recent benchmark surveys discussing how the market may respond to innovative proposals.

AHIP: Two-thirds of Americans are against “government-run” healthcare

READ MORE: Price of Insulin Doubles, Increasing Spending for Members, Payers

Two-thirds of Americans rarely agree on anything – but when they do, it’s probably about how inefficient and ineffective the federal government can sometimes be.

It may come as no surprise, then, that a recent AHIP survey found that “two in three Americans support the existing health care system over a government-run health care system.”

Seventy-two percent of Americans are currently “satisfied” by their health coverage, AHIP added.

The organization did not reveal how many of the 1756 respondents are members of a Medicare Advantage plan, a government-run program that simultaneously represents the fastest growing and most lucrative market for private payers at the moment.

Proponents for universal coverage say concept has hit the mainstream

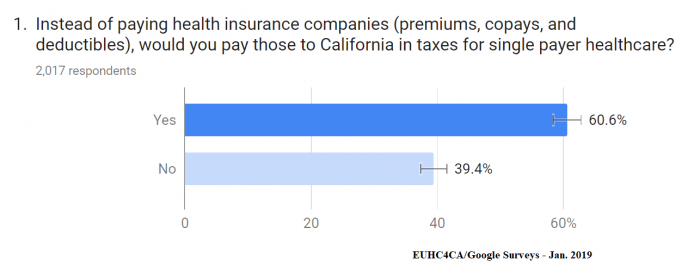

Perhaps unsurprisingly, a poll from Enact Universal Healthcare for California (EUHC4CA) has a different take on the issue.

READ MORE: Nearly 50% of Pre-Medicare Adults Worried About Healthcare Costs

On January 31, the organization said that close to two-thirds of Californians (61 percent) support paying taxes for a universal coverage system instead of paying for private coverage.

The single-question survey, fielded online, asked “instead of paying health insurance companies (premiums, copays, and deductibles), would you pay those in federal or state taxes for single payer healthcare?"

The question did not ask participants if they would support such a plan if the tax was higher than what they are currently paying for their coverage, despite assertions in the organization’s press release that the support was for tax increases to support a universal coverage system.

Source: EUHC4CA

On February 4, a second version of the same one-question poll, fielded to Americans from multiple states, found that 54 percent of respondents answered in the affirmative. However, EUHC4CA again states that the support is for higher taxes.

While technically taxes would be higher than they are at present, since Americans would be transferring their private healthcare spending into tax-based health spending, EUHC4CA’s wording appears to indicate that Americans would support a net increase in expenses for healthcare if it would mean universal coverage.

Non-partisan polling from the Public Policy Institute of California (PPIC) indicates that support for universal healthcare within California is somewhat less well-formed.

In December of 2018, PPIC asked voters and likely voters about their level of support for a universal coverage system. Sixty percent of adults and 57 percent of likely voters said universal healthcare should be a “very high” or “high” priority for the state, but the survey did not delve into what that would entail.

Medicaid buy-in receives more clear-cut support, says United States of Care

The ability to buy in to the Medicaid system appears to have a stronger mandate, says recently-formed advocacy group the United States of Care.

Supported by former CMS Acting Administrator Andy Slavitt and prominent politicians from both sides of the aisle, US of Care states that 78 percent of registered voters nationwide believe a Medicaid buy-in option would be a positive step forward for the insurance landscape.

Allowing individuals who cannot afford private coverage to purchase a plan similar to Medicaid could help to close gaps in access created by the existing ACA subsidy structure and rising premiums on the state and federal exchanges.

In New Mexico, where Medicaid buy-in is currently seeing traction in the state legislature, support hovered at 74 percent.

However, favorability was relatively evenly spread across Democrats, Independents, and Republicans, indicating that support is not driven wholly by enthusiasm on the left.

Splitting the differences with more detailed data

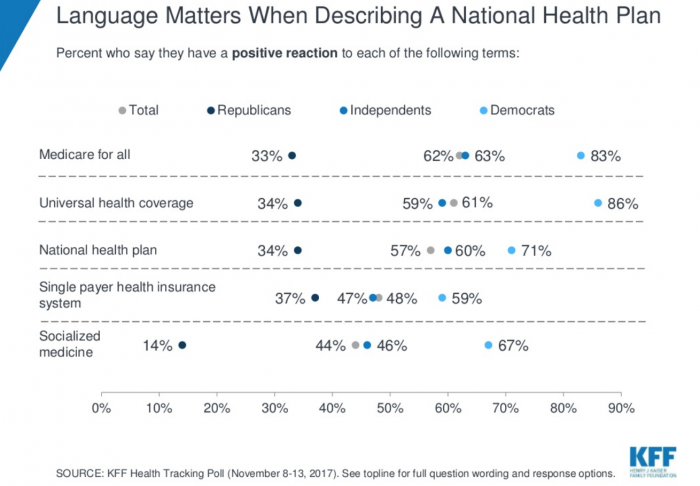

The Kaiser Family Foundation (KFF) offers a much more comprehensive look into what the public is thinking about the myriad proposals that fall under the universal coverage and public option umbrellas.

A January 2019 update to ongoing polling on the subject reveals a slight increase in support over time for a single-payer healthcare system. In February of 2016, 50 percent of Americans expressed support for such a system. In January of 2019, that support has increased to 56 percent.

KFF specifically breaks down the differences in responses when different terms are used.

Public opinion on “Medicare-for-all” or “universal health coverage” is significantly more favorable than for “socialized medicine” or “a single-payer health insurance system.”

Sixty-two percent of participants expressed a positive reaction to “Medicare-for-all,” compared to just 44 percent who view “socialized medicine” in a positive light.

Both Republicans and Democrats balked at the term “socialized medicine.”

Source: Kaiser Family Foundation

In contrast, when the proposals are broken down into concrete examples of who would benefit, support remained strong on both ends of the spectrum.

Seventy-seven percent of Americans, including 85 percent of Democrats and 69 percent of GOP voters, favored the idea of “allowing people between the ages of 50 and 65 to buy insurance through the Medicare program.”

Support for a similar incremental system in the Medicaid environment was also strong, with 85 percent of Democrats and 64 percent of Republicans favoring the notion of allowing people who do not receive coverage from their employer to buy in to a Medicaid program.

The same percentage of Republicans disagreed with the two statements – in the Medicaid poll, five percent more of the GOP voters were uncertain rather than opposed.

Optional Medicare-for-All also received cautious approval, with individuals likely to agree that people should be able to buy into Medicare or keep their existing private insurance if they wish to.

However, 77 percent of people think that any Medicare-for-All proposal would likely result in higher taxes.

As Americans well know by now, polls don’t always indicate what happens on election days, and they certainly don’t dictate what politicians will actually end up doing.

But they can offer influential data points for shaping debates, regardless of whether the methodology behind the numbers truly pans out.

For healthcare stakeholders, one of the lessons from the most recent crop of consumer polls is to be cautious about making decisions based on opaque or overly broad data.

While Americans may seem to be clambering for change, they are also incredibly sensitive to how those changes will impact their own wallets and their ability to secure coverage for their families.

Implementing clear, frequent, and comprehensive two-way communication in this time of uncertainty and widespread change will help payers understand what their members are asking for and how to best deliver value and affordability to beneficiaries.