Top 3 Difficulties Facing State Health Insurance Exchanges

A variety of challenges such as complex reimbursement models and legal actions have troubled state and federal health insurance marketplaces.

- Once the Patient Protection and Affordable Care Act was passed into law, a tide of legal challenges came crashing against the legislation. In particular, the state and federal health insurance exchanges faced several differing lawsuits.

Legal challenges

For example, the King v. Burwell case dealt with whether the premium tax subsidies offered due to the Affordable Care Act could be legally distributed through the federal program versus the individual state health insurance exchanges. The issue at hand was the language within the legislation, which states that individuals eligible to receive the premium subsidies must be enrolled in a health insurance exchange developed by the states, according to a report from the Congressional Research Service.

Since many states decided not to establish their own health insurance exchange and left their constituents free to sign up for a healthcare coverage plan through the federal exchange, the court case argued that the Internal Revenue Service was in the wrong when creating regulations that offered subsidies through both the federal and state health insurance marketplaces.

However, the Supreme Court ruled in favor of ensuring subsidies are offered through the federal health insurance exchange on June 25. The Supreme Court agreed with the other side of the argument stating that the subsidies were meant to be provided to individuals through the federal as well as the state health insurance exchanges.

If the King v. Burwell case went the other way and any individuals that should have been guaranteed subsidies were not provided the premium credits, the individual mandate would have been at risk because requiring health coverage for all would have been prohibitively expensive for some low-income Americans.

“The government further argues that to limit premium tax credits to state-run exchanges is in stark contrast to the act’s goal of expanding access to affordable health insurance and maintaining stable insurance markets,” the report from the Congressional Research Service stated.

“It is asserted that if premium tax credits were unavailable in federally facilitated exchanges, core provisions of ACA would not function properly. In addition, it is claimed that millions of individuals would no longer be able to afford health insurance, and the loss of these consumers would have an extremely detrimental impact on the insurance markets in the affected states. This result, it is claimed, would defeat the main purpose of establishing exchanges and credits in the first place.”

How value-based insurance affects exchanges

The Robert Wood Johnson Foundation also found that state insurance marketplaces are facing real competition in offering health plan choices among value-based insurance platforms. Value-based insurance consists of developing health plans that allow for copayments and other consumer financial responsibilities to be lowered for any clinical care that is of higher quality while services with uncertain benefits or outcomes would require greater consumer cost sharing.

These value-based plans are much more complicated than the options available on the state exchanges. Regardless, several health payers working through the state health insurance exchanges are creating plans that both boost a streamlined, user-friendly purchasing system as well as a more complex design revolved around healthcare quality and value.

When it comes to supporting consumers in health plan decision-making, it is vital to have greater cost sharing transparency and easy-to-find benefit information. States like Vermont and Oregon are looking for additional opportunities to offer value-based insurance plans along with the standard set of options through their marketplaces.

Financial obstacles

A variety of other challenges besides complex reimbursement models and legal actions have troubled state and federal health insurance marketplaces. For example, some state exchanges are facing financial obstacles due to elevated costs and low enrollment.

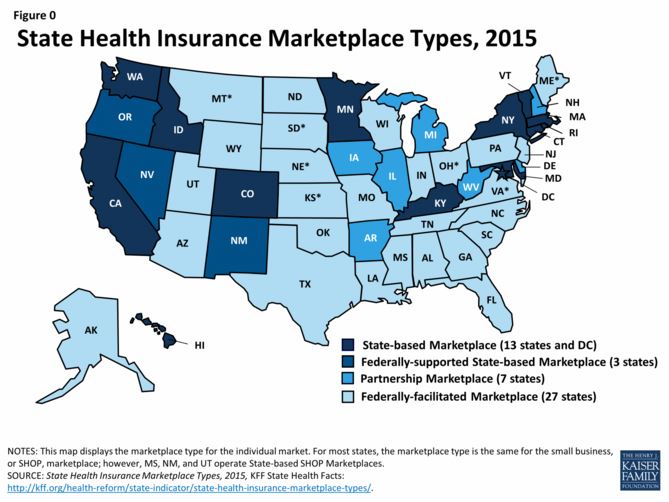

Hawaii was one such state that could not continue running its own health insurance marketplace and was forced to turn over the management of an exchange to the federal government for the 2016 fiscal year. There are estimates showing that approximately one out of two exchanges is having financial difficulties in operating the programs. The graphic below shows the states with their own exchanges versus others that rely on the federal marketplace.

Bloomberg reported that there remains a question as to whether health payers providing plans through the exchanges will be profitable. For instance, UnitedHealth Group has stated previously that it will look to move away from the state and federal marketplaces in 2017.

Another major issue is whether four of the top health insurers will consolidate and merge into two payers, which could affect competition on the health insurance exchanges. The ongoing rise in the cost of premiums through the individual marketplaces is also troubling and changes may need to be made to stabilize the prices of premiums.

The Department of Health and Human Services (HHS) has also discovered that not as many people as previously predicted are joining the health insurance exchanges and obtaining coverage, as they would rather take the tax penalty of the individual mandate and rely on remaining healthy. This is especially true among younger Americans.

“They've discovered that not as many young invincibles are ready to jump into the insurance market,” Paul Keckley, a Managing Director of Navigant Consulting Inc.'s healthcare practice, told the news source. “It's the cost. If you're not getting a tax credit to pay 75 percent of the premium it's going to cost you a couple of hundred dollars a month at the cheapest and most of these kids think they can just take their chances.”

There are still serious uncertainties about the state health insurance exchanges and the health payer industry as a whole as the nation moves into 2016. Time will tell whether the Affordable Care Act and the state health insurance exchanges will be able to manage and solve the challenges associated with running these marketplaces.