Why a Competitive Health Insurance Plan Matters to Employees

A Harris Poll survey shows that 86 percent of those polled and on an employer-sponsored health insurance plan stated that competitive benefits would be a major advantage when it comes to choosing a particular job.

- It seems that benefits and a health insurance plan majorly influence employment decisions of many Americans. An online survey completed by Harris Poll on behalf of the software company Collective Health shows that more than 75 percent of US citizens view health benefits as the main drivers of their career decisions, according to a company press release.

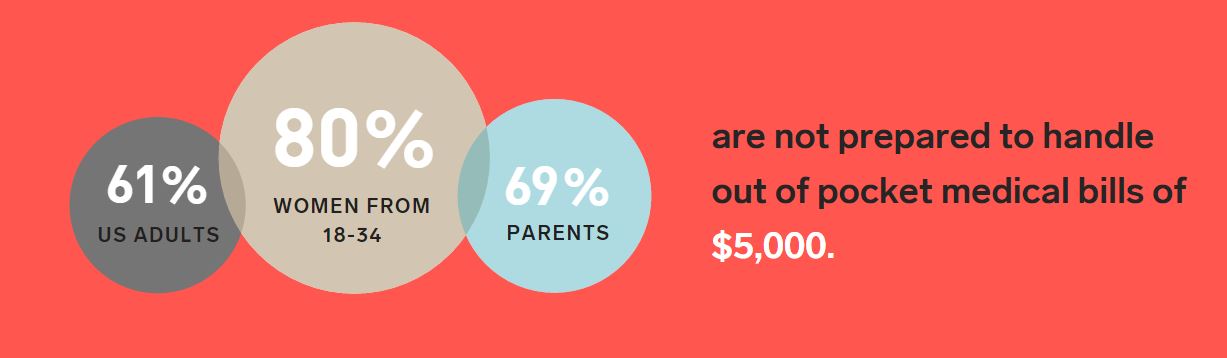

In fact, 86 percent of those polled and on an employer-sponsored health insurance plan stated that competitive benefits would be a major advantage when it comes to choosing a particular job. The survey also illustrated that up to 60 percent of people are not prepared for out-of-pocket medical bills of as much as $5,000. Also, 63 percent stated being relatively confused on some health benefit opportunities and options.

Both parents and millenials seem to have the greatest confusion among those surveyed. Up to 80 percent of women ages 18 to 34 as well as parents with children under 18 years of age stated that they were not equipped to handle an out-of-pocket medical bill as high as $5,000.

Another interesting finding from the survey is that “gym memberships, free food, or standing desks” are not more important than a competitive health insurance plan for 67 percent of polled participants. The results also show that 59 percent of consumers are confused by medical bills they’ve gotten from a clinician or medical facility.

The majority of millenials (71 percent) “are not prepared to handle an out-of-pocket medical expense of $5,000.” Additionally, most Americans are in favor of having higher monthly premiums if that means more of their medical costs are covered.

This study is further supplemented by the survey from the Henry J. Kaiser Family Foundation and The New York Times that found 20 percent of Americans with health insurance are still struggling with paying their out-of-pocket medical bills.

Additionally, more and more people are now looking toward virtual methods of contacting their primary care provider such as through email. Kaiser Permanente conducted a study finding that 85 percent of people with higher co-pays prefer email as their initial method of communicating with their doctor.

“Outside of the Kaiser Permanente setting, there’s quite a bit of consideration among payers about how to reimburse for and account for non-visit-based care. Integrated delivery systems such as Kaiser Permanente don’t have that same struggle, but rather can focus on offering comprehensive services to the patient,” Dr. Mary E. Reed, DrPH, Research Scientist with the Kaiser Permanente Division of Research, told HealthPayerIntelligence.com.

“Outside of the Kaiser Permanente setting, there’s quite a bit of consideration among payers about how to reimburse for and account for non-visit-based care. Integrated delivery systems such as Kaiser Permanente don’t have that same struggle, but rather can focus on offering comprehensive services to the patient,” Dr. Mary E. Reed, DrPH, Research Scientist with the Kaiser Permanente Division of Research, told HealthPayerIntelligence.com.

“Our findings show that patients perceive a significant value in being able to email their providers. As external settings work out their payment systems, they may be able to recoup some of that value as well.”

The survey conducted by Harris Poll asked 2,000 participants about how a health insurance plan and benefits affect their employment decisions, their overall understanding of the options and benefits within their health insurance plan, and whether they can manage a high out-of-pocket medical cost.

More than half of those polled (57 percent) stated that they would not take a job that did not offer competitive healthcare benefits while 78 percent would strongly consider healthcare benefits when deciding on a job offer. If the polled participants have dependents, these statistics only become more significant with regard to a health insurance plan and medical benefits.

More than four out of five of those surveyed with a child less than 18 years of age stated that “healthcare benefits would strongly factor into their decision of where to work.” This clearly shows how vital it is for employers to offer strong healthcare coverage plans if they wish to retain their workers.

Out of all millenials surveyed, 72 percent stated being confused about each and every benefit option open to them. Additionally, 70 percent of those with children stated being confused about their health plan options and benefits.

“These findings are particularly relevant at this time as 150 million Americans are once again starting a new employer-based healthcare plan,” Rajaie Batniji, Chief Medical Officer and Co-founder of Collective Health, said in a public statement. “While Americans increasingly demand competitive healthcare benefits in the workplace, a significant majority of them still don’t understand the options available to them, which can inadvertently expose them or their dependents to increased financial risk.”

“These findings are particularly relevant at this time as 150 million Americans are once again starting a new employer-based healthcare plan,” Rajaie Batniji, Chief Medical Officer and Co-founder of Collective Health, said in a public statement. “While Americans increasingly demand competitive healthcare benefits in the workplace, a significant majority of them still don’t understand the options available to them, which can inadvertently expose them or their dependents to increased financial risk.”

Due to all of this confusion, it may stand to reason that employers as well as health payers could move toward providing greater education among their workforce with regard to health insurance options in order to solve this important issue.

Employers are paying attention to these types of findings and more than 90 percent of private health insurance plans are being covered by employer sponsorship, Collective Health reports. With more Americans choosing jobs based on competitive health benefits, employers and payers will need to work together to ensure that consumers are satisfied with their health coverage options.

Image Credit: Collective Health