25% of Texans Lack Knowledge about Health Insurance Plans

Polled Texans answered questions about seven key terms related to health insurance plans in a survey to show their overall understanding of the insurance industry.

- New research shows that consumer education in terms of health insurance plans and healthcare access is becoming a necessity since many are unaware of some typical health insurance terms. Rice University’s Baker Institute for Public Policy and the Episcopal Health Foundation (EHF) released a new report showing that as many as one out of four Texans lack confidence in defining various basic terms regarding health insurance plans.

With 25 percent of Texans unable to define terminology such as ‘copayment,’ ‘premium,’ or ‘provider network,’ the researchers from Rice University’s Baker Institute and EHF found that the low-income, uninsured population of Latino descent was more likely to fall into this group, according to a press release from Rice University.

These surveys are meant to monitor the outcomes of implementing the Affordable Care Act as well as report on any health insurance coverage changes. Originally, the Health Reform Monitoring Survey reports were created by the Urban Institute, the Ford Foundation, and the Robert Wood Johnson Foundation.

Polled Texans answered questions about seven key terms related to health insurance plans in a survey to show their overall understanding of the insurance industry. The researchers uncovered some important differences among the different groups in the Texas population studied.

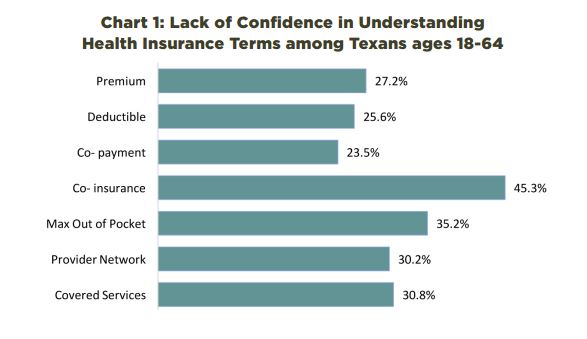

For example, those without coverage had little idea on what five of the seven terms about health insurance plans meant. A “lack of confidence” in the terminology was twice as high among the uninsured respondents.

Out of those who are uninsured, 70.3 percent are unaware of the term “co-insurance” and 62.1 percent are unsure of what the concepts “provider network” and “covered services” mean.

Population groups that were more likely to lack healthcare coverage were continually found to have difficulty understanding some typical health insurance terminology. The Caucasian and African-American populations were less likely than the Hispanic groups to have trouble identifying the definition of specifications about health insurance plans.

For example, while only 15.1 percent of Caucasians were unable to identify what a “premium” is, as many as 43.6 percent of Hispanics did not know what the term meant. This could very well be related to the fact that many of Latino descent are bilingual or may not speak English.

“As Hispanics make up an increasingly larger share of the Texas population, it’s critical that we consider their needs when developing and implementing policies about health insurance,” Vivian Ho, the chair in health economics at Rice’s Baker Institute and director of the institute’s Center for Health and Biosciences, a professor of economics at Rice and a professor of medicine at Baylor College of Medicine, stated in the release.

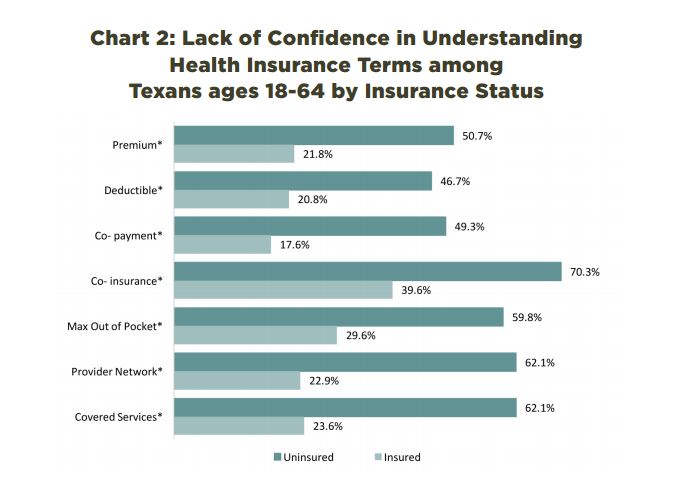

Low-income Texans also found it more challenging to define certain health insurance concepts. The researchers discovered in the report that more than 35 percent of polled Texans were unable to define “maximum out-of-pocket expenses” while at least 45 percent had difficulty understanding term “coinsurance.”

Almost one-third of those polled – 30 percent – had trouble understanding the concepts “provider network” and “covered services.” Ever since the Patient Protection and Affordable Care Act became operational through the health insurance exchange, Elena Marks, EHF’s President and CEO and a Nonresident Health Policy Fellow at the Baker Institute, alongside of Vivian Ho of Rice’s Baker Institute partnered to put out the Health Reform Monitoring Survey (HRMS) every quarter starting in 2013.

“This research shows that understanding the key parts of a health insurance plan can be tough, especially for the uninsured,” Elena Marks said in a public statement. “These numbers illustrate the continuing need to offer education and outreach targeting the uninsured so they can better understand their health insurance options.”

“Even among those with insurance, many lacked confidence in aspects of employer-provided insurance that have changed dramatically over the past several years,” Marks continued. “Workers are paying larger portions of premiums, deductibles and copays. They need to fully understand how these changes can influence their out-of-pocket spending on health care.”

The Baker Institute and the Episcopal Health Foundation are working together to report on any major changes ever since the Affordable Care Act expanded medical coverage among the citizens of Texas due to tax subsidies offered through the health insurance exchange along with other key provisions of Obamacare. For example, young adults under 26 years of age are allowed to remain on their parents’ health insurance plans.

The surveys focus on defining healthcare access, affordability of medical spending, self-reported health outcomes, and healthcare coverage issues. This particular survey shows that 23.5 percent of those polled are unaware of what the term “co-payment” means while 27.2 percent lack understanding of the word “premium.”

Obamacare brought a tidal wave of changes to the health insurance industry, which led to as many as 20 million more Americans to enter the market and purchase medical coverage. This was done through Medicaid expansion, employer-sponsored health plans, and the insurance marketplace. With the healthcare coverage increasing in Texas to include an additional 5 percent of people, it grows more important than ever before for insured individuals to understand the terminology of the health insurance field.

Since 1.3 million Texans purchased coverage through the federal health insurance exchange, it is important to educate consumers on the definitions of terminology in order to ensure they are making the right financial decisions for their medical care and insurance purchasing.

Health insurance companies along with state and federal agencies will need to work further to educate consumers on important medical coverage terms and ensure these individuals are making the best decision regarding their healthcare spending.

Image Credits: Rice University's Baker Institute and Episcopal Health Foundation