The History of Medicare Advantage: From Inception to Growing Popularity

Medicare Advantage offers beneficiaries supplemental benefits and out-of-pocket spending limits, two factors that may contribute to its growing popularity.

Source: Getty Images

- Medicare Advantage’s popularity continues to grow in 2023 as enrollment figures and plan options increase. The private program has received mixed reviews from healthcare stakeholders, with members generally reporting high plan satisfaction and government agencies calling for increased oversight due to overpayment and marketing discrepancies.

Understanding how Medicare Advantage came to be and how it differs from traditional Medicare could perhaps shed some light on where the program is headed. In the following article, HealthPayerIntelligence breaks down Medicare Advantage’s history, enrollment trends, and how stakeholders view the program.

Where it began

Private plans have been a part of the Medicare program since its inception in 1966. In the early years, health maintenance organizations (HMOs) contracted with Medicare to allow retirees with employer-sponsored insurance to maintain patient-provider relationships. Payment methods evolved from a reasonable-cost basis to risk-based contracts over time.

The Balanced Budget Act of 1997 (BBA) created Medicare Part C, known then as the Medicare+Choice program. The BBA reduced payment rates to plans, established new risk-adjustment measures based on health status, and created an annual enrollment period.

The BBA also authorized new private plan options, including preferred provider organizations (PPOs), provider-sponsored organizations, private fee-for-service plans, and high deductible health plans with medical savings accounts.

Under the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA), Medicare+Choice was renamed Medicare Advantage. The MMA established Medicare Part D and raised payment rates. The legislation also created the system under which plans must submit a bid with its estimated costs of providing Medicare benefits to beneficiaries for the upcoming year.

The MMA allowed beneficiaries to enroll in Medicare Advantage with regional PPOs and special needs plans tailored to meet vulnerable populations’ care needs.

Medicare Advantage vs. Traditional Medicare

What is the difference between Medicare Advantage and traditional Medicare? In simple terms, Medicare is the public, government-run healthcare option for seniors and people with disabilities, while Medicare Advantage is the private plan alternative for these populations.

Healthcare coverage, monthly premiums, out-of-pocket costs, and provider networks differ between the two programs. These differences may help beneficiaries decide which program to enroll in.

Traditional Medicare includes Part A coverage for inpatient services and Part B coverage for outpatient services. Medicare Advantage covers all services that Medicare covers in addition to extra benefits that may vary by plan, such as dental, vision, hearing, and prescription drug services.

Known as supplemental benefits, these services can include health-related benefits, such as home-based palliative care, in-home support services, caregiver support, and over-the-counter (OTC) benefits. Some supplemental benefits are optional for beneficiaries to purchase, while others are covered for everyone enrolled in a Medicare Advantage plan.

Plans can also offer special supplemental benefits for the chronically ill (SSBCI), including meal benefits, pest control, and service dog support.

Care access is different under the two programs. Traditional Medicare beneficiaries can visit any doctor or hospital in the country that accepts Medicare and do not need a referral to see a specialist. Meanwhile, Medicare Advantage beneficiaries can generally only see non-emergency care providers in their plan’s network and service area. Medicare Advantage plans may also require individuals to receive a referral for a specialist.

Additionally, Medicare Advantage plans frequently require prior authorization for certain services, while traditional Medicare usually does not.

Another area where these plans differ is healthcare costs. In traditional Medicare, beneficiaries must pay a monthly premium for Part B coverage and a separate premium for Medicare drug coverage if they choose to join a Part D plan.

In Medicare Advantage, individuals pay the monthly Part B premium and may also have to pay the plan’s premium. However, some plans offer zero-dollar premiums and cover some or all of the Part B costs. In addition, most Medicare Advantage plans include Part D coverage.

Traditional Medicare beneficiaries must pay a 20 percent coinsurance for Medicare-covered services after meeting their deductible and there is no out-of-pocket limit in the public program.

Out-of-pocket costs can vary in Medicare Advantage plans. Beneficiaries typically must pay a copayment for in-network care, but plans have yearly limits on out-of-pocket expenses for Part A and Part B services.

Enrollment trends

Medicare Advantage enrollment started booming back in 2010 when payment provisions in the Affordable Care Act created incentives for improved care quality. Standard rebates were reduced but set higher for plans receiving more than 3.5 stars. Plans receiving more than four stars received an add-on to their benchmarks.

Additionally, the provisions reduced Medicare Advantage rates and brought plan payments closer to traditional Medicare spending levels.

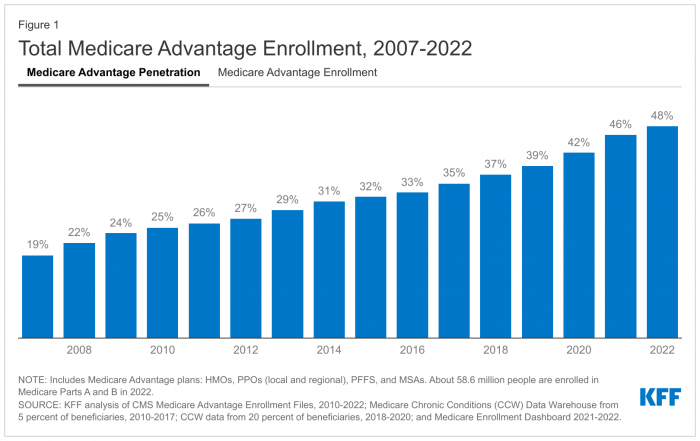

Between 2009 and 2017, enrollment in Medicare Advantage increased by more than 80 percent, accounting for 33 percent of Medicare beneficiaries, the Commonwealth Fund found.

From 2018 to 2022, the share of beneficiaries enrolled in the private program grew from 37 percent to 48 percent, according to data from KFF.

Source: KFF analysis of CMS Medicare Advantage Enrollment Files, 2010-2022; Medicare Chronic Conditions (CCW) Data Warehouse from 5 percent of beneficiaries, 2010-2017; CCW data from 20 percent of beneficiaries, 2018-2020; and Medicare Enrollment Dashboard 2021-20

In 2022, two-thirds of Medicare Advantage beneficiaries (18.7 million) were enrolled in individual plans that are open for general enrollment, while 18 percent (5.1 million) had employer- or union-sponsored group plans, and 16 percent (4.6 million) were enrolled in special needs plans.

In terms of Medicare Advantage plan providers, UnitedHealthcare and Humana were the dominant payers in 2022. UnitedHealthcare accounted for 28 percent or 7.9 million Medicare Advantage beneficiaries, while Humana accounted for 18 percent or 5.0 million beneficiaries.

The Congressional Budget Office (CBO) has projected that the share of all Medicare beneficiaries enrolled in Medicare Advantage plans will reach 61 percent by 2032. This figure has already grown to 50 percent as of January 2023, CMS data revealed.

According to the Commonwealth Fund’s 2022 Biennial Health Insurance Survey, almost a quarter of Medicare Advantage beneficiaries chose the private program for its supplemental benefits, while one in five beneficiaries enrolled because of the out-of-pocket spending limits.

Stakeholder perceptions

Medicare Advantage’s significant enrollment growth may be attributed to its high member satisfaction rates.

JD Power’s 2022 US Medicare Advantage Study found that overall customer satisfaction with Medicare Advantage plans was 809 on a 1,000-point scale, up three points from 2021. Furthermore, data from eHealth indicated that almost 90 percent of surveyed Medicare Advantage beneficiaries were satisfied with their health plan coverage.

However, the program has its downfalls, too. For example, some members have reported that their plans do not offer enough coverage for mental health treatment or substance use disorder services.

Policymakers and other stakeholders have also pointed to the program’s structural issues that lead to overpayment. According to the Urban Institute, the program’s bidding benchmarks, risk adjustment, and quality rating systems contribute to overpayments.

Medicare Advantage has faced scrutiny surrounding its marketing policies and prior authorization requirements. The Senate Finance Committee highlighted misleading advertisements and aggressive in-person tactics employed by health plans, brokers, and third-party marketers.

Prior authorization has been associated with patient care delays and increased administrative burden. Medicare Advantage plans received 35 million prior authorization requests in 2021, 2 million of which were denied.

CMS and HHS introduced several rules in 2023 that aim to address the program’s controversies.

In January 2023, CMS released the Risk Adjustment Data Validation (RADV) rule to increase oversight of Medicare Advantage RADV and payment processes.

CMS has generally used extrapolation—the act of estimating a value based on a valid sample of units—to audit Medicare Advantage plans. Under the final rule, CMS will not extrapolate audit findings for payment years 2011 through 2017 and will instead collect non-extrapolated overpayments for those years. Extrapolation will start with 2018 risk adjustment data validation audits, the agency said.

CMS also finalized a rule to increase marketing oversight and streamline prior authorization requirements. The 2024 Medicare Advantage and Part D Final Rule prohibited advertisements that do not mention specific plan names, use confusing words and imagery, and use Medicare logos in a misleading way.

In addition, the final rule requires Medicare Advantage plans to annually review utilization management policies and says healthcare professionals with relevant expertise must review potential coverage denials.

As Medicare Advantage enrollment continues to grow, payments are set to increase by 3.32 percent or $13.8 billion in 2024.