Top Predictions for Health Insurers, Employers in the New Year

Experts’ top predictions indicate that insurers and employers will face high costs and other challenges but will also find opportunities in places like specialty pharmacy.

Source: Getty Images

- Health insurers and employers face a challenging landscape in 2023, but these obstacles are accompanied by opportunities for growth, according to experts’ top predictions.

Three years after the first wave of the coronavirus pandemic hit the US, the American healthcare system is still feeling the effects. In 2023, the anticipated unwinding of the public health emergency will send shockwaves through the health insurance industry, impacting health insurers and employers alike.

Out-of-control healthcare prices will continue to pressure employers and health insurers to take cost-cutting measures. They will double down on practices that have proven to lower costs while maintaining high quality of care.

In particular, payers will target pharmaceutical price increases and specialty pharmacy costs with outcomes-based contracts. Additionally, they will defend Medicare Advantage plans’ efficacy in improving quality and costs for the senior population.

Experts from Blue Cross Blue Shield Association (BCBSA), Business Group on Health, Humana, and Manatt Health broke down these and other trends that payers should anticipate in 2023 with HealthPayerIntelligence.

Medicare Advantage plans will grow, respond to price increases

The 2022 plan year proved that seniors are not immune to healthcare affordability challenges. As early in the year as February 2022, researchers found that Medicare beneficiaries were struggling to afford care. At the time, one in five seniors said that covering healthcare costs was “very difficult” and a fifth of seniors reported that half of their monthly income went toward healthcare.

Alex Ding, MD, associate vice president of physician strategy and medical affairs at Humana

Source: HumanaIn 2023, seniors will continue to feel that cost pressure, projected Alex Ding, MD, associate vice president of physician strategy and medical affairs at Humana. As the pressure rises, more of this population will turn to Medicare Advantage plans.

“A macro trend in Medicare is that we will continue to see more Americans moving to Medicare Advantage benefits over original Medicare,” Ding said.

Medicare Advantage plans’ supplemental benefits, particularly cash benefits, will become even more valuable and attractive to members. The 2023 Medicare open enrollment data reinforced Ding’s point.

In the last five years, the average number of Medicare Advantage plans available to beneficiaries has more than doubled from an average of 20 health plans per beneficiary in 2018 to 43 plans per beneficiary in 2023. Major payers including Aetna, UnitedHealthcare, and Elevance Health offered benefits cards that Medicare beneficiaries could use to cover transportation, groceries, and other needs.

Medicare Advantage plans came under scrutiny in 2022 due to overcharging—which payers have decried—and marketing practices. Ding indicated that these developments did not nullify the positive outcomes that Medicare Advantage plans have demonstrated.

Sean Robbins, executive vice president of external affairs for BCBSA, concurred and pointed to the plans’ high member satisfaction.

“Blue Cross and Blue Shield companies are committed to strengthening the successful program and we will continue to work with policymakers to ensure MA agents, brokers and any advertisements put consumers first,” Robbins told HealthPayerIntelligence.

Sean Robbins, executive vice president of external affairs for BCBSA

Source: Blue Cross Blue Shield AssociationChronic disease, price increases will fuel payers’ value-based care efforts

While cost increases are a resounding theme across experts’ expectations, it is certainly not the only challenge that payers anticipate. Ding pointed out that chronic disease care is becoming more common and more complex.

Policy and healthcare leaders also attest that chronic disease care is expensive. The Consolidated Appropriations Act of 2023 allotted over $1 billion in spending on chronic disease prevention and health promotion. The Centers for Disease Control and Prevention has stated that 90 percent of annual healthcare spending goes toward patients with chronic diseases.

Moreover, more individuals are living with multiple chronic diseases, a health status that can negatively impact care complexity. Between 2020 and 2021, the share of Americans with multiple chronic conditions rose five percent from 9.1 percent to 9.6 percent.

Payers and providers alike are feeling the pressure from an increasing prevalence of complex conditions. Ding expected that this would drive stakeholders toward value-based care agreements.

“Studies have shown—our data included—that in value-based care arrangements, there's greater financial stability because there is a regular revenue stream that isn't volume dependent. There's greater reliability and stability of revenue. And so the practice is more readily available to budget, to invest, and to be able to fund their operations,” Ding said.

“We hope as practices recognize that positive aspect of value-based care that, in an economic downturn, they will take another look and take a stronger consideration of transitioning to a value-based care practice.”

Robbins agreed that financial pressures would drive higher adoption of value-based care in 2023. However, he added that payers’ and providers’ definitions of value-based care will determine the industry’s progress.

“Sometimes what people call ‘value-based’ is really just a bonus program to do what should already be done versus true value-based where you're sharing risk between the provider and the payer for the outcome of that individual,” Robbins explained.

“What I mean by ‘value-based care’ is not upside only. It's a true up-and-downside risk-sharing agreement between payers and providers. The extent to which we can accelerate that in the marketplace, patient outcomes will be better.”

As providers gravitate toward value-based care, payers will play a significant role in supporting their advancement from low-risk value-based care agreements to higher risk contracts.

“Our goal is to come in and help a provider at the stage that they're at and really assess what they're ready for and not throw them into the deep end, but really to kind of provide them the tools, the data, the resources, the assistance, the guidance that's needed to move along that continuum as they're ready to do so,” Ding explained.

Payers can offer financial and technical support to provider partners in order to fuel their transition to value-based care, research on value-based care’s progress in Medicare Advantage has indicated. Payers can also advocate for primary care transformation by instituting strong metrics and emphasizing patient-centered care.

Ding also pointed to the positive evidence driving the shift into value-based care. Humana’s data showed, along with other research, that Medicare Advantage value-based care programs can decrease low-value care spending, hospital stays, emergency department admissions, readmissions, and acute care.

COVID-19, technology will influence payer dealmaking

Health insurers’ merger and acquisition decisions will be shaped by both a departure from past trends and the emergence of new influences from the present in 2023, according to Robert Belfort, partner at Manatt Health.

“A number of years ago it became apparent that the megamergers of the major health insurers were pretty much at the end of that process for antitrust reasons, and that it wasn't going to be possible, at least under the current interpretation of the antitrust laws for those types of consolidations to continue,” Belfort told HealthPayerIntelligence.

In lieu of megamergers, several different types of transactions arose in recent years that will continue to characterize deals in 2023.

First, health insurers will try to use acquisitions and mergers to fortify product lines that their companies might not be as adept at offering. They might also acquire smaller, niche health plans to improve existing service lines.

Robert Belfort, partner at Manatt Health

Source: Manatt HealthAs an example, Belfort referenced small Medicare Advantage plans that received venture capital money. Insurtech companies that have started Medicare Advantage plans raked in venture capital funding in recent years, driving many to go public.

However, these small plans could not stay small for long. The nature of the health insurance industry would not allow it.

“Fundamentally, health insurance is a business that requires scale, so you don't get a lot of small players that remain in the market for a long time,” Belfort explained.

“They build up a certain amount of capacity of enrollment or technology or whatever it is that is appealing a license or contracts. And then they end up being acquired by a bigger platform that can reduce the administrative costs of running the plan because they're spreading those costs over a much larger enrollment base.”

Additionally, acquisitions of and mergers among small Medicare Advantage health plans will continue into 2023, but they will not form the bulk of the dealmaking in the new year. Payers are more likely to seek out providers or vendors to acquire, instead of horizontal mergers.

Third, technology vendor acquisitions will dominate the payer dealmaking landscape. These deals may emerge from existing service arrangements between payers and vendors or providers which evolve into an acquisition.

Belfort anticipated that acquisitions related to improving telehealth options—or “tech-enabled care management models,” as Belfort called them—for the senior population would be paramount. Additionally, payers will continue to acquire technologies that collect and analyze data. They may also seek to acquire digital solutions that bridge traditional medical services and innovative care management or social determinants of health supports.

Fourth, provider acquisitions will be prevalent. Payers will use these acquisitions to expand their services and become well-rounded in their offerings, instating or reinforcing their home healthcare products, expanding medical services, and overall moving toward vertical integration.

“When I started practicing law many years ago, there were staff model HMOs where the physicians were basically working for the health insurer, and then the market really moved away from that model and moved toward broad networks of loosely-connected physicians,” Belfort shared.

“Some of the limitations of that model from a cost control, and quality monitoring standpoint have become apparent.”

Fifth, Belfort anticipated that payers would use mergers and acquisitions to inflate their identities as convenient and flexible sources of coverage that offer care when and where consumers want it. This identity formed due to the telehealth boom during the initial waves of the coronavirus pandemic.

However, the flurry of telehealth utilization that the pandemic prompted was largely attributable to the public health emergency flexibilities. Payers have been advocating since 2020 for Congress to solidify telehealth flexibilities so that they will continue even after the public emergency ends. So far, the House of Representatives has extended telehealth flexibilities to the end of 2024, but the bill has been awaiting the Senate’s attention since late July 2022.

If the public health emergency ends without policymakers making telehealth flexibilities permanent, then it could influence payers’ telehealth-driven models and, as a result, payers’ dealmaking decisions.

Lastly, Belfort added that greater adoption of Medicaid expansion could also impact payers’ deals. If Medicaid expansion is more widely accepted, Medicaid managed care will become more attractive. But some states remain sharply divided over the issue.

Payer strategies: focus on specialty pharmacies, outcomes-based contracts

Some trends in 2023 were clear, like the overall upward trajectory in healthcare spending and healthcare costs. But other trends have yet to solidify. One question on Robbins’s mind was: how will drug list prices respond to the post-COVID—or nearly post-COVID—era? He projected that list prices will return to pre-COVID levels.

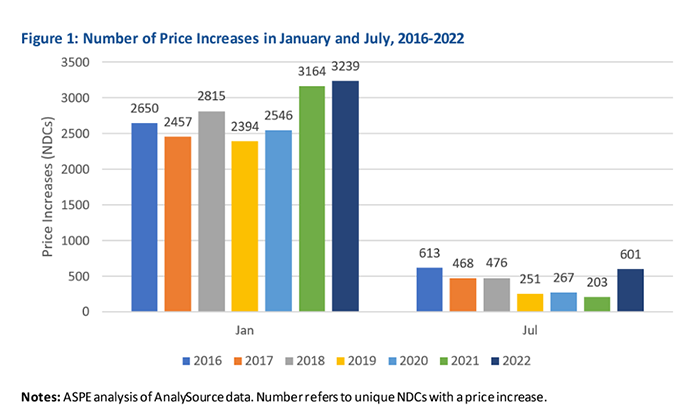

The drug price trend from 2022 was heading in that direction. More than 1,200 drug products saw price hikes that outpaced inflation between July 2021 and July 2022, with an average increase of 31.6 percent, according to the Department of Health and Human Services (HHS). Some pharmaceutical companies increased a drug’s list price by over 500 percent. The number of price increases in January 2022 set the record on increases in that month since before 2016.

Robbins predicted that payers will respond to these increases by aiming their cost control efforts at specialty pharmacies.

“A tremendous amount of the cost growth exists today in specialty pharmacy and specialty medications,” Robbins said. “There’s a real market opportunity there. I'd be surprised in 2023 if we don't see payers make bold and aggressive moves to try to figure out how exactly that will work in the market.”

It is a particularly challenging space in which to control costs. Specialty pharmacies deliver life-saving medications. But the price tags for these therapies often amount to millions of dollars.

Outcomes-based agreements will be a dominant strategy among payers as they intensify efforts in this area of the industry.

“The fee-for-service, ‘use it and bill it’ approach is simply not sustainable when a drug is $1 million, $2 million, or more per course of treatment. And so how that will work and how that builds in the marketplace is going to be—not just a 2023 trend, but a 2023 and forward trend,” Robbins said.

Source: "Price Increases for Prescription Drugs, 2016-2022" by ASPE, 2022 (https://aspe.hhs.gov/reports/prescription-drug-price-increases).

Labor shortages will fuel employer affordability challenges

Affordability is the top concern on most employers’ minds, a concern they share with healthcare leaders across the industry. The challenge of rising healthcare prices is not new, but the pressures of 2023 are adding a layer of urgency, Ellen Kelsay, president and chief executive officer of Business Group on Health, told HealthPayerIntelligence.

Ellen Kelsay, president and chief executive officer of Business Group on Health

Source: Business Group on Health“Certainly, healthcare spending trends have been a long-time concern for employers but, as we look to the year ahead, affordability is really of significant concern because of the foundational baseline already being costly to begin with and we're seeing the highest trends that we've ever seen in recent years forecasted for 2023 and 2024,” said Kelsay.

According to recent surveys, Kelsay’s assessment may come as no surprise to most companies’ executives.

Seven out of ten employers reported that they anticipate moderate to significant cost increases in healthcare over the next three years with many projecting a six percent increase in 2023, according to a Willis Towers Watson survey. In 2022, many employers expected their healthcare spending to surpass budgeted amounts.

Provider shortages will fuel the affordability problem in the new year.

Labor shortages and labor costs will be main drivers of the anticipated $370 billion increase in healthcare spending by 2027, a McKinsey report found. The nursing workforce alone may see 200,000 to 450,000 registered nurses leave the industry by 2025.

As a result, employers and their payer partners will not have the upper hand in contract negotiations. Health systems may drive hard bargains in 2023 which would impact healthcare spending. Employers will have to lean into available resources to determine a fair price.

Policy changes will affect employer health plan enrollment

Tara Straw, senior advisor at Manatt Health, emphasized the effects that policy changes could have on employer-sponsored health plan enrollment.

Tara Straw, senior advisor at Manatt Health

Source: Manatt HealthFirst, the public health emergency unwinding will change employees’ eligibility for Medicaid. Researchers have found that as many as 18 million people could lose coverage under Medicaid in the 14 months after the public health emergency ends if it expires in April 2023. The largest share of those individuals (9.5 million) is expected to transition into employer-sponsored health plans.

Employers who have low-wage workforces are likely to see an influx of employees joining their health plans from Medicaid coverage.

“The special enrollment periods are also different for people coming out of Medicaid or CHIP coverage,” Straw noted.

Typically, employees have 30 days to join a new health plan during a special enrollment period. However, Medicaid beneficiaries have 60 days to enroll in new plans after losing their Medicaid coverage.

“Employers may not know that because it isn't as common today as it will be at the time they start the Medicaid unwinding,” Straw said.

Another key policy change that could impact enrollment is the family glitch solution. The “family glitch” refers to a policy issue in which some employees found employer-sponsored health plan coverage unaffordable when they added their families, but they were ineligible for Medicaid coverage.

In October 2022, HHS finalized a rule that aimed to resolve this problem through the Affordable Care Act marketplace. The rule allows families without access to affordable employer-sponsored health plans to purchase coverage on the Affordable Care Act marketplace using premium tax credits.

The law may result in employees’ family members and some employees abandoning their employer-sponsored marketplace plans in order to join more affordable plans on the Affordable Care Act.

However, this population is likely to be very small, Straw projected. The influx from Medicaid due to the public health emergency unwinding will be more significant.

“Even if employees' family members move into the marketplace, that doesn't increase the penalty that large employers could pay for not offering affordable coverage to their workers,” Straw added.

“That might be a concern of some employers who might be less familiar with the rules, thinking that the loss of those family members is going to somehow escalate their potential penalties under the ACA, but that just isn't the case.”

Employers will retain health equity, mental health focus

While affordability may dominate the conversation around 2023, Kelsay highlighted that employers will continue to prioritize mental health benefits and health equity endeavors in the new year.

“In this economic environment where affordability is a concern, I think some people are saying, ‘Oh, well maybe employers won't prioritize those as much anymore,’” she said.

But those projections did not align with Kelsay’s predictions.

“[Mental health and health equity] become even more important in an era where affordability is going to be more challenging for individuals,” Kelsay said.

Robbins observed the same emphasis on mental health benefits among employers from the payer perspective.

“There is consistent feedback from the business community on mental health within their benefits packages: what are the tools and approaches that drive better mental health outcomes for their populations? And that is something that I think every payer is working earnestly to try to—not just solve in terms of offering solutions, but offering solutions that have high impact and efficacy,” Robbins said.

“There is no magic solution there yet. The country has a supply and demand challenge in general. And then we're trying to figure out how to find the solutions that actually make an impact, not just drive supply for the sake of driving supply.”

“Mental health and health equity become even more important in an era where affordability is going to be more challenging for individuals.”

Employer strategies: pursue APMs, reassess partnerships

Kelsay expected employers to pursue a couple of proven strategies to contain costs.

She predicted that employers would revisit their partnerships to reassess their quality—particularly partnerships they forged during the pandemic.

“They're going to be looking hard at their partnerships to ensure that the vendors that they have in place are actually delivering proven outcomes, that they're improving patient experience, and that they are high-quality solutions,” Kelsay emphasized.

Employers may apply a special level of scrutiny to their virtual care vendors. They will re-examine the price of the interventions, in addition to assessing the patient outcomes and patient care. The new year will bring a renewed focus on outcome measurements and quality of care.

Kelsay projected that employers will continue to blend independent contract negotiations—or “direct contracts”—and contracts made through their health plans and intermediaries. They will maintain their activist mentality and continue to hold their health plans accountable for costs and value-based care progress.

Direct contracting remains the road less traveled among employers: less than 10 percent of large employers have direct contracts in primary care, according to Business Group on Health’s 2021 Large Employers Health Care Strategy and Plan Design Survey.

However, the overall trajectory of employer negotiations is driving toward more direct contracting, Kelsay said. Interest is swelling and 17% of large employers reported that they were considering the approach for 2022 through 2023.

Kelsay also anticipated that employers would explore alternative payment models in order to control costs. In particular, she expected that employers would rely on centers of excellence and advanced primary care alternative payment models. They will also revisit their virtual care and telehealth arrangements to pursue alternative payment models.

“If all these new solutions and virtual modalities are delivered in a fee-for-service environment, that's a step in the wrong direction. So employers will be increasingly looking at APMs within their virtual and telehealth solutions as well,” Kelsay said.

As employers and payers enter 2023, they face strong financial pressures and uncertainty over the fate of pandemic policies. But they also can look forward to new opportunities to improve specialty pharmacy offerings, pursue identity-refining deals, and reassess partnerships.