2018 ACA Open Enrollment Totaled 8.82M Beneficiaries in Last Week

The 2018 ACA open enrollment totaled 8.82 million beneficiaries during a shortened enrollment period.

Source: Thinkstock

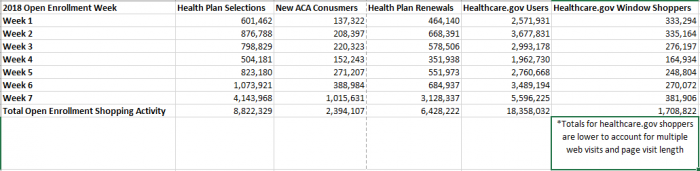

- Approximately 8.82 million beneficiaries enrolled in a health plan during the seven week 2018 ACA open enrollment period, which experienced surges in health plan purchasing activity during the final two weeks.

The opening week of 2018 open enrollment was met with underwhelming activity as only 600,000 individuals nationwide signed up for a health plan on the federal health exchange. During week six 1.07 million beneficiaries enrolled in an ACA health plan and 388,984 new ACA enrollees signed up for a health plan.

Week seven of the open enrollment period highlighted drastic increases of consumers that shopped for an ACA health plan. Over 4.1 million beneficiaries signed up for a health plan during week seven and 1.01 million health plan enrollments were from new ACA enrollees.

Enrollment activity such as new health plan enrollments, health plan renewals, and engagement with the healthcare.gov shopping platform grew significantly from the first two weeks to the final two weeks with some stagnation between weeks four and six.

Source: Xtelligent Media - CMS Weekly Enrollment Snapshot Data

2018 ACA enrollment totals were expected to decrease from last year because of policy changes that impacted open enrollment resources. The numbers from this year’s open enrollment period reflect previous analyses of ACA consumer behaviors and showcase a relatively high demand for ACA health plan regardless of policy implications.

ACA enrollment activity indicated that most consumers using federally facilitated health exchanges to purchase insurance tend to wait near the deadline to make a health plan purchase. ACA consumers have a high likelihood of making cost-conscious enrollment decisions which may have slowed down purchasing decisions.

Market stability or “flattened enrollment” may have also played a role in tamer enrollment numbers than prior years. The people who need ACA health plans are leveling off because more individuals have had health insurance access in the past five years, which would explain enrollment plateaus during the middle enrollment weeks.

A Standard and Poor’s analysis suggests that open expected enrollment (OEE) was higher in previous years because there was a much higher need for health insurance because of the individual mandate and easier health insurance access.

Factors that lead to market destablization could have also played a major role in enrollment totals as large commercial payers including Anthem, Aetna, and BCBS of Kansas City exited the sale of individual health plans through the exchanges. These payers shared general perceptions of poor ACA individual health plan financial solvency.

Additionally, market instability concerns have led state governments to do more in order to stabilize individual health plan markets for their citizens.

The Washington State Office of the Insurance Commissioner has implemented an highly detailed plan to stabilize individual insurance markets through reinsurance, new public plan options, and high-risk pools. The Office found that only two insurers offered individual health plans, which could create negative effects on affordability and access.

Policy decisions from President Trump and HHS may have also played a part in enrollment engagement. HHS reduced the ACA Navigator program by 90 percent, which could have lowered outreach, advertising, and enrollment guidance from past enrollment periods.

The President issued an executive order which cut the ACA’s cost-sharing subsidies and created a significant financial impact on premiums for individual health plans.

The CSRs were expected to offset catastrophic costs claims for certain ACA enrollees, and lower premiums, but losing the CSRs caused payers to spike premium amounts by 20 percent for ACA plans. Higher premiums and less payers in the ACA market may have dissuaded consumers from purchasing health plans outright.

2018 ACA enrollment totals may determine if the country’s insured population is stable in the short term, as policy debate in the House and Senate could drastically influence access to individual health insurance.

Policy debate has already led to a repeal of the ACA’s individual mandate which could drastically alter the individual health plan market as well as an executive order that could disrupt ACA health plan market stability through longer-duration association health plans.

Even with the future of the ACA in question, the 2018 individual health plan market remained stable and did not experience crippling effects of policy decisions or commerical insurer exits.