Healthcare Payers Face Challenges with Medical Loss Ratio

The medical loss ratio surrounding fraud prevention and recovery is bring some obstacles for payers to overcome.

- Under the Patient Protection and Affordable Care Act’s medical loss ratio, health payers are required to spend a minimum of 80 percent of their premium revenue on paying claims and boosting quality while the rest (20 percent) can be spent on administrative fees, marketing, and profit. According to a press release from the Aite Group, health insurance companies are facing challenges in meeting the calculations of the medical loss ratio due to treating fraud prevention and recovery differently.

Fraud recoveries, which are essentially a decline in fraud loss, are part of quality improvement processes under the medical loss ratio provision. This means that fraud recovery is counted as part of the 80 percent part of the premium revenue. However, fraud prevention programs that include predictive data analytics systems are actually considered part of the administrative fees or the 20 percent section of the medical loss ratio.

Also, factors like salary, benefits, and product investment are also considered part of administrative spending. This method of putting fraud prevention into the 20 percent threshold doesn’t put as much value on advanced predictive analytics, said Aite Group senior analyst Michael Trilli.

“This divergence of ‘fraud benefits’ creates two unintended short-term consequences for health plans looking to reduce risk of fraudulent and abusive billing practices: It undervalues advanced predictive analytics as a prepayment asset and it undermines the mission-critical SIU function,” Trilli explained.

“However, in the long term, the medical loss ratio is beneficial as it should push health plans to think differently about payment integrity. Instead of health plans viewing payment integrity as an operational metric across different functional groups, it should be seen as a strategic enterprise core competency that leverages analytics to drive key business imperatives.”

A report from the Robert Wood Johnson Foundation discusses how the medical loss ratio was created to protect the consumers. The provision was set up to ensure payers spend a minimum amount of premium revenue on provider claims and quality improvement.

Another part of the ACA provision requires payers to pay premium rebates to members when their medical loss ratio falls below 80 percent. As such, almost $1.1 billion in rebates were sent to consumers in 2011. Throughout the next year, however, insurers aligned more closely with the medical loss ratio and the premium rebate value fell to $504 million in 2012, the report states.

There are multiple pathways that payers may have taken to increase the medical loss ratio closer to 80 percent. Payers may have experienced more growth in claims spending or may have reduced administrative spend by improving efficiency and operating at a lower margin.

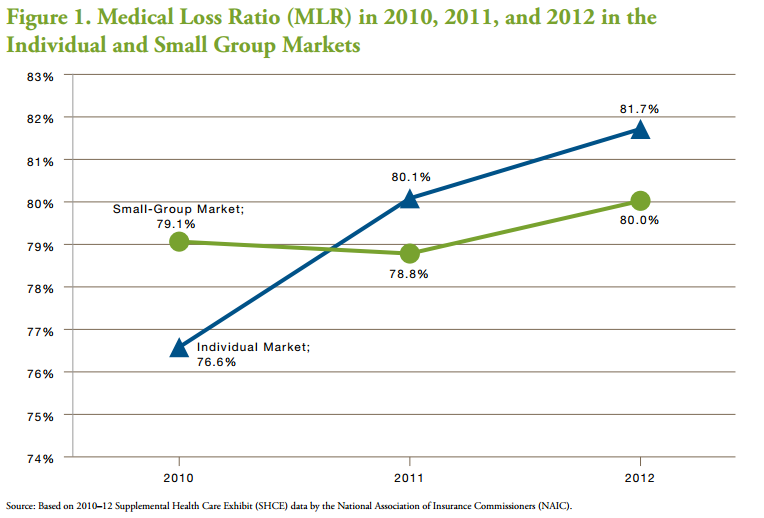

There may also be other reasons for the change and increase of the ratio such as insurers staying in or entering and exiting the individual market or the small employer group market. Using information from the National Association of Insurance Commissioners, the researchers looked at data from 2010, 2011, and 2012 to find that the medical loss ratio increased from 2010 to 2012 in both individual and small group markets.

The medical loss ratio was originally significantly below 80 percent but grew 3.5 percent from 2010 to 2011 and then another 1.6 percent from 2011 to 2012. This growth may be partially due to insurers remaining in the individual market for all three years of the analysis.

“Mean health claims increased by 8.9 percent from 2010 to 2011 on a per-member per-year (PMPY) basis in the individual market, followed by a 5.1 percent increase from 2011 to 2012,” the study stated. “ Those growth rates are approximately twice the rates of growth in national health spending per capita for 2011 and 2012.”

Due to the medical loss ratio, the health insurance industry has likely seen an increase in claims, the study states. This shows that this particular provision of the Affordable Care Act may not have worked to contain rising healthcare costs. However, other aspects of the healthcare legislation did make an impact on reducing medical spending such as the creation of accountable care organizations and the Medicare Shared Savings Program.

“Our research in the earlier period from 2011 to 2012 suggests that claims appear to have increased in response to the MLR rule. That finding casts doubt on the cost-containment aspect of the MLR rules, at least in the short term,” the Robert Wood Johnson report stated.

Payers will need to work with their provider network to further reduce spending by focusing more on alternative payment models and moving away from fee-for-service payment systems, which incentivize providers to offer more care and pursue wasteful spending practices.

Dig Deeper:

The Progress and Challenges of the Affordable Care Act

How Health Insurance Mergers Could Change the Payer Industry