More Choices for Federal Health Plans Doesn’t Spread Market Share

Expanding federal health plan choices hasn’t taken much market share away from a few dominant payers.

Source: Thinkstock

- The federal health plan market contracted under the Office of Personnel Management (OPM) has remained heavily concentrated over the last decade, despite OPM’s efforts to improve health plan choice for employees enrolled in the Federal Employees Health Benefits Program (FEHBP), a new GAO report found.

OPM has attempted to increase the number of HMO and fee-for-service (FFS) plans over the last decade, but the organization has not been able to disrupt the lead of a handful of dominant payers.

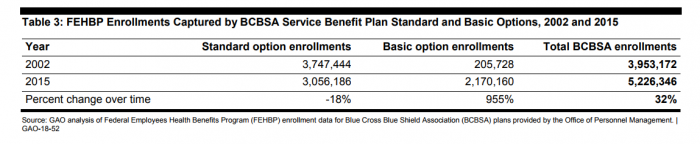

Blue Cross Blue Shield (BCBS) is currently the largest provider of federal health plans. In 2000, BCBS was the largest participating plan in 93 percent of FEHBP countries. By 2015, it had become the biggest payer in 98 percent of counties.

Officials from FEBHP said that BCBS was able to acquire and maintain such significant control over federal health plan market share because the payer offered competitive premiums while enrolling individuals at lower administrative costs.

Source: GAO

GAO also found that the average market share of the largest payer (in instances when BCBS didn’t have the majority of market share) participating in a state’s FEHBP market increased in 90 percent of all counties.

Consumers do not lack for choices, OPM stresses. The number of health plan options has increased even as the market consolidates.

From 2007 to 2012, federal employees in 99 percent of counties were offered a higher number health plan options. The average number of employee health plan options increased from 19 available plans to 24 available plans. Nineteen plans were fee-for-service (FFS) plans and the remaining five were HMO plans.

Federal employees enrolled in the FEHBP had significantly more options for FFS plans than HMO plans, as FFS plans were available in every county participating in the FEHBP.

“Nationwide FFS plans’ combined median county market share accounted for almost all FEHBP enrollment and showed a slight increase from 97 percent in 2000 to 99 percent in 2015, although variation existed in some counties. Comparatively, the combined median county market share held by HMO plans decreased from 6 percent to 2 percent,” GAO said.

Additionally, FEHBP enrollees sometimes only had FFS plans available in their respective counties.

“In each year since 2000, 16 to 30 percent of counties had all of their FEHBP enrollment in FFS plans, and, in years for which we had HMO plan availability data, almost all of these counties offered at least one HMO plan offering,” GAO added.

OPM said that many health plans attempting to enter the federal health plan market have a tendency to drop out of the FEHBP, as their payers cite economic or business-related losses and inefficiencies.

Even though increasing federal health plan choice hasn’t decreased market concentration, OPM believes that with more authority to expand competition they can create lower federal employee premiums and better health plan affordability.

GAO interviewed 11 FEHBP stakeholders, the Association of Federal Health Organizations, two federal employee and retiree organizations, six FEHBP carriers, two FEHBP experts, and found that there was not a clear consensus on the potential benefits of OPM increase plan choice.

Five of the seven FEHBP experts said that increased oversight would de-concentrate the market, as OPM has authority to increase transparency around benefits, create initiatives to foster health plan participation, and lower federal employee costs for health plans.

Conversely, a separate stakeholder said that increasing the amount of plans contracted through OPM would increase OPM’s administrative costs. GAO added that five of six interviewed carriers said an effect of expanding regional PPO plans would be higher consumer premiums and market instability.

The findings from GAO indicate that the federal health plan market remains highly concentrated without a steady opinion from stakeholders on how to effectively de-concentrate it. The agency concluded their report by asking OPM for additional comments on the subject matter.