Only 30% of Employers Get Pharmacy Benefit Manager Contracts

Employers only have a minimal understanding of their current pharmacy benefit manager contracts.

Source: Thinkstock

- Only 30 percent of employers have a complete understanding of their pharmacy benefit manager (PBM) contracts, according to a new survey from the National Pharmaceutical Council (NPC).

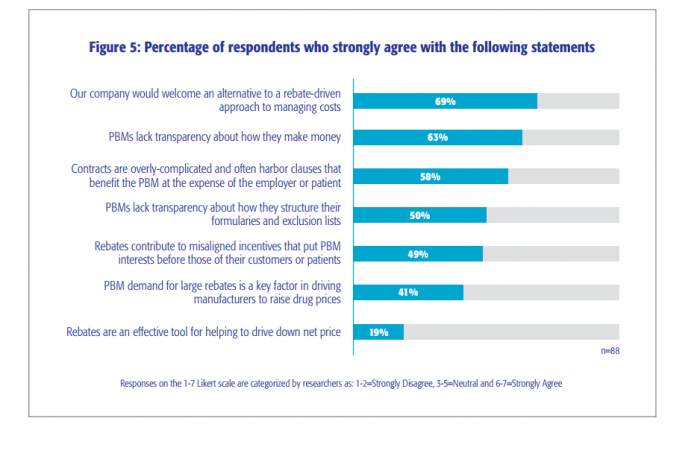

Just 40 percent of the 88 employers participating in the survey said they understand the performance guarantees included in their PBM contracts, while 63 percent added that PBMs are not transparent enough about the financial workings of these arrangements.

"Employers want to provide the best health benefits for their employees while getting strong value in return for the money they spend on prescription drug benefits," said Dan Leonard, NPC president in a press release.

“We wanted to understand employers' perspectives on PBMs and benefit design with the intention of beginning a constructive and educational conversation among healthcare stakeholders.”

Fifty-eight percent of employers also believe that contracts are too complex, ambiguously worded, and often benefit PBMs at the expense of employers.

In addition, 50 percent of employers surveyed think PBMs lack transparency about the basis for those decisions regarding formulary and exclusionary list decisions, such as the clinical, financial and economic impacts of contracts

“The problem faced by most employers is that, while they are concerned about a lack of transparency, they are confused and intimidated by the sheer complexity of the prevailing PBM models and ambiguously worded contracts that are common,” NPC added.

Source: National Pharmaceutical Council

The survey also found that 69 percent of employers would welcome an alternative to rebates including discounts, point-of-sale rebates where patient payments reflect a post-rebate price.

Forty-nine percent of employers said the rebates contribute to misaligned incentives that put the interests of the PBM before patients and customers. Additionally, 41 percent of employers believe that PMB demand for large rebates on drug purchases is a key factor in driving up the cost of prescription drugs.

Employers acknowledged that rebate-heavy PBM agreements influenced an employer’s operational focus on rebates as a revenue stream. Furthermore, employers said their focus shifted to making sure rebates were earning positive revenues from other business operations such as reducing employee co-insurance, lowering deductible payments, and providing access to the most effective medicines.

NPC provided three solutions for employers to help bring transparency and understanding to their contracts with PBMs, which are available on the NPC website.

Employers can access a PBM relationship segmentation tool that offers a quick self-assessment to show employers where their levels of trust, satisfaction, and engagement with PBMs. This tool also provides strategic guidance for improving engagement and trust with their PBM.

Employers also have access to a prescription drug benefit consulting guide that evaluates the level of engagement a PBM or external consultant is with an organization and their pharmacy benefit issues.

NPC hopes that the findings in their report and related research can increase employer and stakeholder awareness of prescription drug benefits, as well as the relationship between suppliers and employers when determining these benefits.

“NPC’s purpose in conducting this research and disseminating its findings is to contribute to a constructive discussion among employers and supply chain stakeholders about how to improve the value returned for money spent on prescription drug benefits,” the report concluded. “The findings and conclusions developed through the research and reviewed in this report have supplied key elements for a constructive, solutions-oriented conversation.”