7% of Counties Retain One Payer on Health Insurance Exchanges

A new study finds that more and more consumers purchasing coverage on the health insurance exchanges are facing only one or two health plan options.

- With more health payers such as UnitedHealthcare, Humana, and Aetna dropping out of a number of state health insurance exchanges, it is useful to analyze the differences of healthcare coverage between different regions and states around the country. A policy brief from the University of Minnesota Rural Health Research Center outlines how few healthcare coverage options are available to residents living in certain counties on the health insurance exchanges.

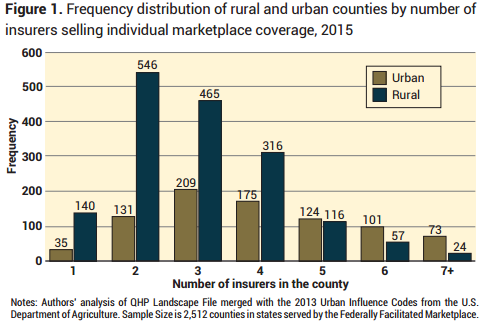

Out of 2,512 counties studied, 175 counties or 7 percent showed access to only one health insurer, which means the payer had a monopoly on the market within these particular regions. This type of monopoly could very well lead to higher premiums and expensive out-of-pocket costs with fewer benefits for consumers.

Additionally, the report shows that 677 counties or 27 percent of the analyzed regions had only two health payers available to the public on the health insurance exchanges. This would be called a duopoly and could be straining on consumer interests as well.

Along with these findings, the brief analyzes what type of health payers are offering healthcare coverage through the exchanges in which states. Greater attention is given to which regions still have insurance options from UnitedHealthcare, Cigna, Humana, Aetna, and Blue Cross Blue Shield.

The public health insurance exchanges are expected to cover as many as 26 million Americans by the year 2024. This marketplace was created by the Patient Protection and Affordable Care Act in order to give Americans the option to purchase healthcare coverage when finding affordable care an obstacle and lacking employer-sponsored medical insurance.

The policy brief outlines that the premium costs in regions that have a higher number of payers participating on the health insurance exchanges tend to be lower than in states and locales that have fewer payers monopolizing the market. Additionally, the research shows that payers’ decision to participate in these markets plays a direct role in patient access to certain hospitals and specialists.

“Robust insurer participation in the Marketplace is essential for achieving the overarching policy objective of increasing access to affordable health insurance for lower income Americans,” the report stated.

“Policymakers who support the Affordable Care Act have raised concerns about ensuring consumer choice in the Federally Facilitated Marketplace, an issue which has recently garnered attention in the media.17-20 The decisions by insurers to enter local markets directly affects the set of choices available to a potential enrollee, the price of coverage resulting from market competition between insurers, and the set of providers from which an enrollee is able to seek care vis-à-vis their selected plan’s provider network.”

The analysts from the University of Minnesota Rural Health Research Center took information from the Healthcare.gov website on the Qualified Health Plan Landscape, which included data about which payers participated on the health insurance exchanges in 34 states last year.

The results from the study also include the fact that Blue Cross Blue Shield is the most typical payer found in markets that have only one health insurer available. Blue Cross Blue Shield serves 80 percent of urban counties and 99 percent of rural counties that have only one healthcare coverage option available.

While there are clearly certain issues that have stemmed from the healthcare reform established by the ACA, a brief from the Department of Health & Human Services Office of the Assistant Secretary for Planning and Evaluation stresses how the uninsured rate in the United States is at the lowest ever recorded. Only 9.1 percent of Americans still lack healthcare coverage.

Among individuals living in rural regions, the insurance rate has grown tremendously with an 8 percent rise from the beginning of open enrollment in 2015. Among 88 percent of rural consumers on the health insurance exchanges who have tax credits for their premium costs, the average monthly premium increased by only $5 or 4 percent between 2015 and 2016, the HHS brief stated. Additionally, research shows that healthcare access has improved among rural residents as well.

“The Health Insurance Marketplace and Medicaid expansion provisions of the Affordable Care Act have contributed to large reductions in the uninsured rate in both rural and urban areas. According to an analysis of data from 2012 through the first quarter of 2015 from the Gallup Healthways Well-Being Index, coverage rates among non-elderly adult increased similarly in urban and rural areas, rising by 8.0 percentage points in rural areas and 7.9 percentage points in urban areas,” according to the HHS brief.

While the Affordable Care Act and the health insurance exchanges have brought a significant benefit to patient care and reducing the rates of the uninsured, more modifications to the legislation may be needed to satisfy health payer concerns and consumer interests while reducing the potential for insurers to monopolize the market.

Image Credits: University of Minnesota Rural Health Research Center

Dig Deeper:

How Payers Could Succeed in ACA Health Insurance Exchanges

Risk Pool Gains on Horizon for Health Insurance Marketplace