80% of Payers Aim to Address Social Determinants of Health

Payers are focusing on addressing the social determinants of health, expanding value-based reimbursement, and improving consumer engagement in the near future.

Source: Thinkstock

- Eighty percent of payers believe that addressing the social determinants of health (SDOH) of their beneficiary populations will be a key way to improve their population health programs, according to a new Change Healthcare survey.

The findings in the 8th Annual Industry Pulse Report, commissioned by the HealthCare Executive Group, indicate that payers are taking action to address SDOH through community programs and screenings as a way to support value-based care initiatives.

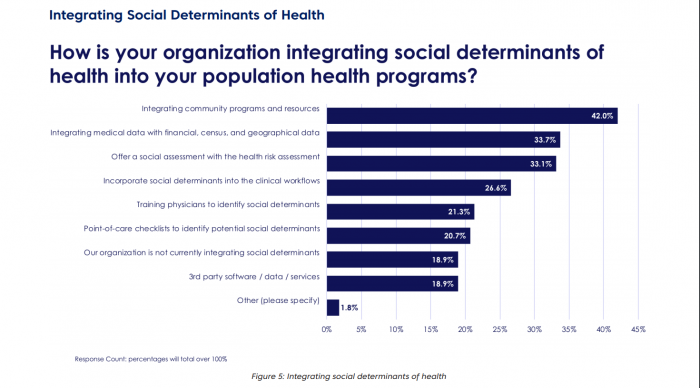

Forty-two percent of payers are integrating community programs and resources into their population health programs. Thirty-four percent of payers said they are integrating census and socioeconomic data with clinical data to develop new insights.

Payers are starting to realize the organizational benefits and long-term returns for actively addressing SDOH, according to the authors of the survey.

“The issue of social determinants of health has become part of every conversation around improving care quality while lowering costs,” the survey says.

READ MORE: How Payer Philanthropy Can Address Social Determinants of Health

“This concept recognizes that not every healthcare problem can be addressed with a prescription pad or a hospital procedure. For example, an elderly patient’s health might suffer because they lack access to transportation. This leads to missed doctor’s appointments, an inability to get to therapy or the pharmacy for prescriptions, and so on.”

Source: Change Healthcare

Over a third of payers are adding SDOH assessments to their health risk assessments and 26.6 percent are adding SDOH into clinical workflows.

Only 18.9 percent of payer organizations are not integrating SDOH in any form into population health programs.

The survey also found that payers are increasing adoption of value-based reimbursement models like risk-sharing and bundled payment models.

The four most common value-based reimbursement models include risk-sharing (15.4 percent of respondents), pay-for-performance (14.81 percent), full capitation models (12.04 percent), and bundled payments (11.34 percent).

READ MORE: How All-Payer Claims Databases Can Identify Wasteful Spending

Risk-sharing, pay-for-performance, and full capitation models are predicted to be more impactful over a long term period, the survey found.

The top barriers to implementing value-based reimbursement models included changing physician behavior (38.5 percent), resistance to change (37.8 percent), and confusion surrounding payment models and risk management (35.6 percent).

The payer industry still faces significant barriers to value-based reimbursement but commercial payers have been able to break into the value-based environment.

“The commercial markets appear to be forging ahead, with several new value-based reimbursement initiatives and progress reports announced by major health plans of late,” the report said.

“In particular, the data analysis technologies required for effective value-based reimbursement programs at scale, especially related to bundled payment and care episodes, are starting to have a significant impact.”

READ MORE: High Care Costs Driving Employer-Sponsored Insurance Spending

Consumer engagement opportunities for payers have grown with subtle increases in the use of innovative engagement solutions. However, payers continue to rely on traditional methods with potential engagement shortcomings.

Seventy-one percent of payer organizations use either digital or mail surveys to engage with their members. Fifty-six percent use focus groups and 51 percent leverage social media to engage members.

“Note that many of these approaches are opt-in, which can be problematic,” the study added. “For example, a survey is lost in the mail, discarded or ignored; is poorly designed; reaches consumers in the wrong context or at the wrong time (e.g., arrives right after the consumer receives a large medical bill); or only those most-pleased or most displeased respond, etc.”

Emerging engagement techniques that payers currently use include using wellness coaches (48 percent), telehealth (36 percent), patient navigators (26.9 percent), and instant messaging (11.9 percent).

Additionally, 25.4 percent of payers offer incentives to members for healthy behavior and 23.7 percent have established provider-patient partner programs to boost engagement.

Payers believe that high-deductible health plans (HDHPs) are less likely than incentives to improve healthcare utilization. Respondents added that incentives are a stronger engagement method than providing members with high deductibles.

“While HDHPs seek to make consumers feel the pain of failing to control healthcare costs, incentives reward them for demonstrating they are making progress toward improving their health,” the report authors said. “Incentives can take many forms, including lower premiums or other bonuses for behaviors such as participating in an exercise program.”

Survey respondents cited challenges surrounding uncertain policy implications and regulatory chaos resulting from political uncertainty around the ACA. Payers are now taking a more active role to address industry concerns by supporting value-based reimbursement and holistic approaches to addressing healthcare costs.

“While Washington played a central and early role in stimulating value-based reimbursement interest and activity, the transition from volume to value in care delivery now has its own momentum,” the report concluded.

“Still, given the lack of consensus in DC, healthcare leaders who continue to see value-based reimbursement as an opportunity must take leadership roles in terms of innovating new payment programs.”