Medicare Hospital Insurance Trust Fund Depleted by 2029

The Medicare Board of Trustees say that expected cost increases in all Medicare programs will deplete the Hospital Insurance Trust Fund by 2029.

Source: Thinkstock

- A statement released by HHS and CMS’s Medicare Board of Trustees (MBT) indicates that the Medicare Hospital Insurance Trust Fund is likely to be depleted by the year 2029.

The report suggests that the difference between Medicare income and expenditures ($710 billion versus $679 billion), as well as projected cost and spending increases, are the largest drivers in the probable depletion of the trust.

“For 51 years, Medicare has played a crucial role in providing healthcare for America’s senior citizens,” said HHS Secretary Tom Price, MD. “Unfortunately, on its current trajectory, Medicare’s hospital insurance trust fund will be depleted in just over a decade, while spending on the other elements of the program continues to grow much faster than our economy.”

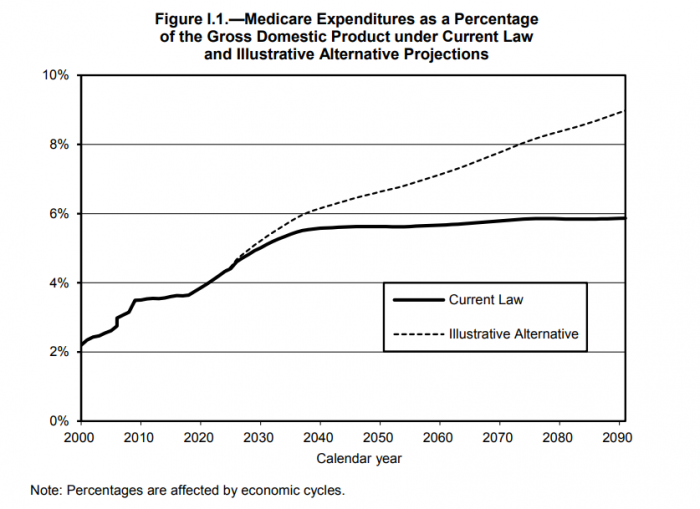

Source: Medicare Board of Trustees

Even though the report shows a year improvement over last year's expected depletion of the trust, many of the same factors, such as an increase in expenditures and a lack of outside financing, remain major causes of concern. The future of the trust and its financial insecurity poses a detriment to the care of the US’s rising geriatric population.

As the populous baby-boomer generation enrolled into Medicare over the years, expenditures across Medicare have gone up drastically over the last few years. Advances in care have increased expected life spans, increasing anticipated costs for beneficiaries to record levels.

To make sure that the nation’s elderly citizens continue to have access to Medicare, the trustees and government leaders believe financing reform is critical.

“At HHS, we take seriously our responsibility to protect Medicare for this generation and those to come, and we are pursuing all available avenues to improve Medicare’s sustainability in ways that put patients first,” said Price.

Even though the MBT is confident in their analysis, there are other factors that can cause uncertainty when it comes to per-beneficiary costs that affect the Hospital Trust Fund.

New developments in healthcare delivery, technology, and similar innovative approaches to healthcare cloud some estimates when it comes to Medicare costs. The MBT believes that these uncertainties, compounded with rising physician and pharmaceutical rates, promotes increases in Medicare expenditures.

Policy and legislation passed by Congress in 2016 also has played a role in expenditures, according to the MBT. The Comprehensive Addiction and Recovery Act of 2016 and the 21st Century Cures Act have put necessary limits on medication prescriptions and reduced payments inpatient hospital services. These may seem like small adjustments, but less purchases in medication and generally lower payment rates for a large Medicare population adds up financially.

As the trustees attempt to tackle issues that have detrimental impact on the trust, CMS still aims to provide more affordable, better healthcare options for vulnerable geriatric populations.

“Millions of Americans rely on the healthcare they receive from Medicare,” said CMS Administrator Seema Verma. “As stewards of this program, CMS will continue to do all we can to reduce out-of-pocket costs for beneficiaries and increase the quality of and access to healthcare for our seniors.”